Transaction cost analysis (TCA) is well established in equity and fixed income markets. Following TT’s acquisition of Abel Noser Solutions in 2023, a big part of our data and analytics strategy has been to bring TCA to other asset classes, including futures. In April of this year, Bowmoor Capital was among the first clients to deploy TT Futures TCA to inform their trade execution and algorithmic trading strategies and ensure they are achieving best execution. I recently spoke with Brendan Mulvany, Head of Trading at Bowmoor Capital, about his career in futures trading and the value of TCA.

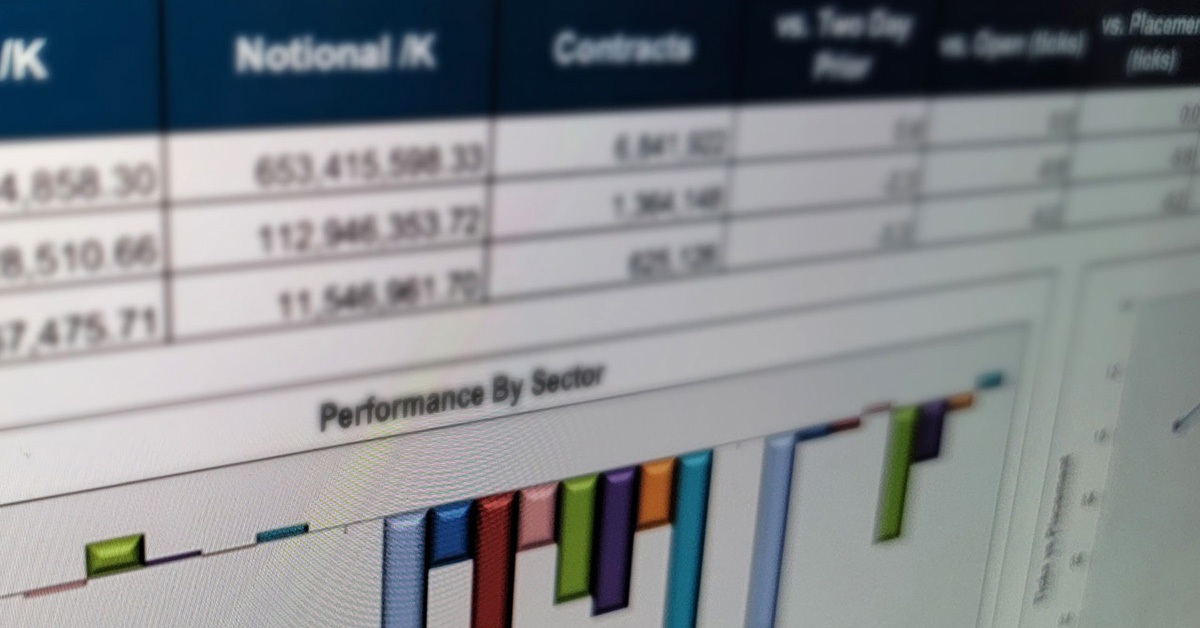

Continue Reading → Data and analytics is an important part of the TT strategy–TT acquired Abel Noser Solutions, the leader in multi-asset transaction cost analysis (TCA) solutions, in 2023. As other TCA providers exit the space, we are doubling down and increasing innovation while expanding our technology platform.

Continue Reading → As trading has become increasingly complex and markets have evolved, transaction cost analysis (TCA) has shifted from a compliance function primarily for equities trading to one that actively drives front-office decision-making across all asset classes. Today, multi-asset TCA is an essential tool for both buy-side and sell-side firms in optimizing trade execution, managing risk and meeting regulatory requirements.

Continue Reading → Regulators in both the UK and EU are taking steps to make it easier for asset managers to charge clients for research without their consent (which was required under MiFID II). While the re-bundling creates complexities, it brings huge opportunities for asset managers. Neil Scarth, Principal at Frost Consulting, addressed these changes at our TT Connect: Unlocking Profit with Data & Analytics event last September. We’ve since caught up with Scarth about what the changes mean for asset managers and how they can capitalize on the opportunities.

Continue Reading → As the electronification of markets has led to greater transparency in global markets, so too has the power of trade analytics been enhanced to produce more comprehensive, accurate and actionable trading recommendations.

Continue Reading →