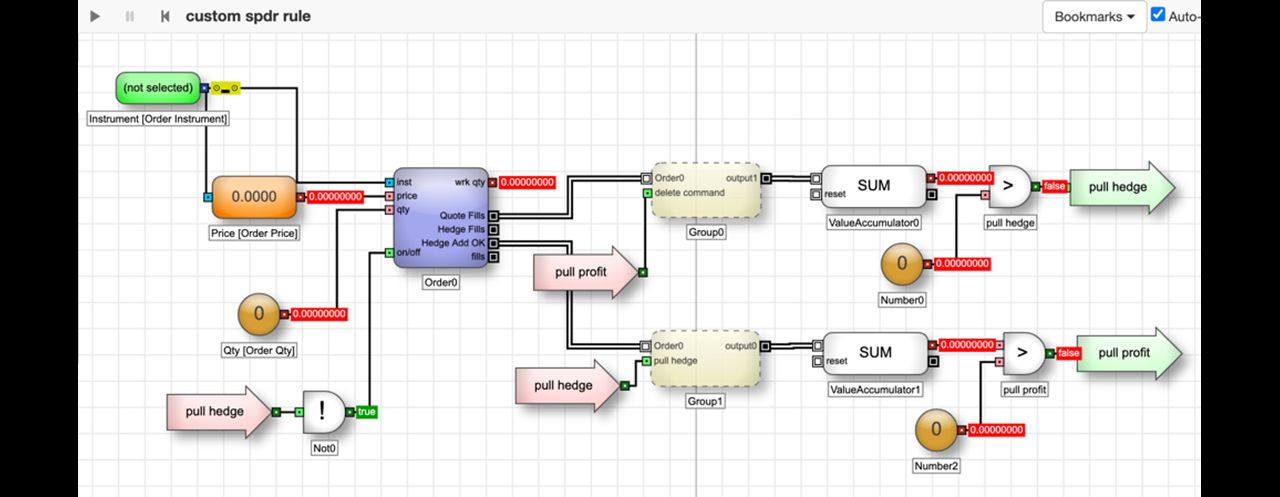

TT’s Autospreader has long been a favorite tool among the proprietary trading and order desk communities. Automating hedge leg execution opens the door for superior hedge price execution and adds to the bottom line. The paradox we see now is why use a client—a front-end that can never compete with the execution speed and efficiency of server-side logic—for the quote-side execution? When striving for optional spread execution, why not automate the entire process? This is where the TT platform’s ADL DIY algo design tool comes in to improve your performance.

Continue Reading →Trade Talk Blog

Trade Talk has been retired. For current content, visit the TT Connect blog.

Despite the feeling that we’re all suffering from Zoom fatigue after more than a year of virtual meetings, happy hours and events, a record number of people attended our recent webinar focused on TT Score. This trade surveillance and compliance solution is fully integrated with the TT platform, but can also ingest data in FIX format from exchanges or other front-end trading systems.

Continue Reading →One of TT’s key differentiators is the ease with which we can connect new markets to the platform. In fact, we have added more than 10 exchanges to TT over the last 18 months. The most recent addition to our expanding portfolio of market connectivity offerings is the Athens Stock Exchange, or ATHEX, which is the national exchange of Greece. On the heels of announcing the availability of ATHEX Derivatives Market on TT, we invited Michael Andreadis, Chief Markets Operation and Business Development Officer of ATHEX, to tell us more about the exchange and share his perspectives on some of the issues facing that region. We hope you enjoy this conversation with Michael. For more information, please visit the ATHEX website.

Continue Reading →As the Sales Specialist for TT’s surveillance software TT® Score, I am frequently asked by customers and prospects what the “hot topics” are in the compliance world and what the regulators will be focused on next. While I am always happy to provide my opinions on such matters, we at TT thought that it would also be valuable to provide a periodic blog series that includes insights and perspectives about legal and compliance topics from several different industry experts.

Continue Reading →

Bill Baruch is a frequent contributor to CNBC, Bloomberg and The Wall Street Journal. He recently elected to use the TT platform as part of his CTA offering, and we’re taking this opportunity to learn more about how Bill got to where he is today.

Continue Reading →