TT’s Autospreader has long been a favorite tool among the proprietary trading and order desk communities. Automating hedge leg execution opens the door for superior hedge price execution and adds to the bottom line. The paradox we see now is why use a client—a front-end that can never compete with the execution speed and efficiency of server-side logic—for the quote-side execution? When striving for optional spread execution, why not automate the entire process? This is where the TT platform’s ADL DIY algo design tool comes in to improve your performance.

We asked Andrew Renalds from TT’s automated trading team to share thoughts on how ADL can be used to optimize your spread trading experiences. His feedback centered on two key areas. Through the use of ADL logic, traders may attain even greater execution speed and efficiency. Let’s take a look at how ADL will improve your overall performance when executing Autospreader logic.

Execution speed

Naturally, Autospreader has always provided better execution speed on a hedge leg. When a quote leg is filled or partially filled, Autospreader begins to run and manage logic to hedge or offset the trader’s risk. But what about the move to enter the synthetic spread position in the first place? What’s driving that decision? Does the decision to enter the order involve monitoring other markets? Are you waiting for a particular market event? Regardless, you’ll never react as quickly as an algo will. Using ADL to start Autospreader gets your quote leg to market faster.

Execution risk

Ever fat-finger a trade and enter the wrong quantity? How about executing at the wrong price? Wrong contract? Maybe execute at the wrong time? All of this goes away with automated order entry.

Set it and forget it

How valuable is your time? Valuable enough that you’re willing to spend it all watching a market in hopes of getting a trade signal that may not evolve? Let’s face it, we’ve all had days where we’ve sat there all day and done nothing but stare at trading screens and waited for that perfect setup. Why not let an algo do that for you? Configure ADL to watch for your setup and execute when the market is right for your strategy? This gives you time to work on other algos and attend to other business.

Added structure

How do you get out of a spread position that’s gone bad? With outrights, you can have stop orders managing your risk. Autospreader doesn’t support stops on Autospreader instruments, but with ADL, you can create stop logic and get out of that losing spread automatically.

How many markets do you watch with your strategy? Are you watching stocks, bonds, energies, metals, FX, crypto and/or a myriad of other indicators? Ever hear of paralysis by analysis? Algos don’t suffer from that. With ADL, you can factor in numerous contracts as part of your trading strategy. You may take execution a step further to aggregate multiple Autospreader configurations and dictate the optimal route for execution.

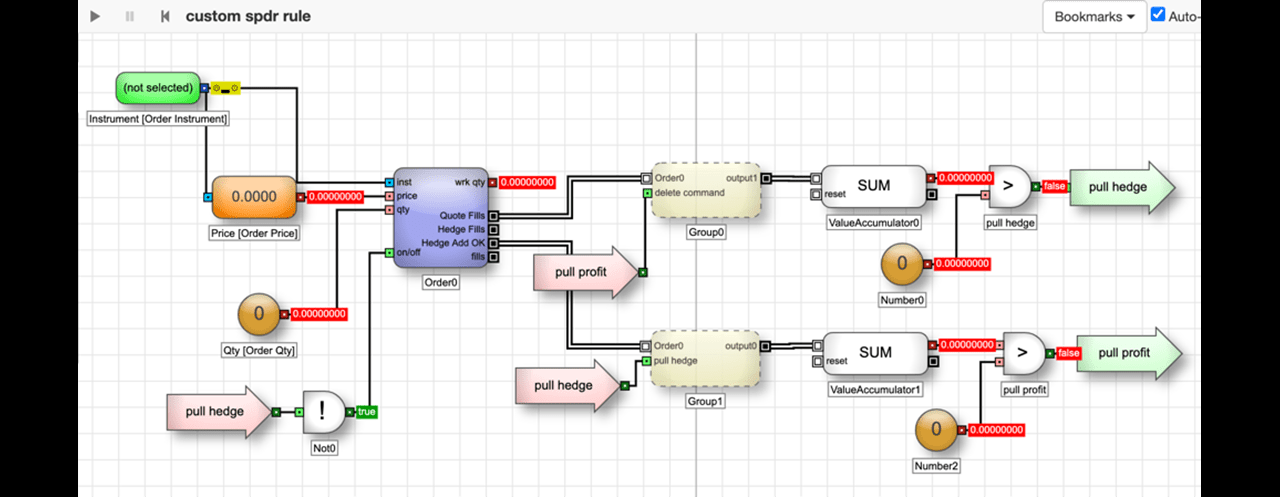

Spread execution management

What about hung orders? For spreads that you manage manually, there’s Hedge Manager, a fine tool for managing hung orders, but why not automate some of the thinking you’re likely to do when managing those hung orders? Use ADL to analyze the profitability of the filled leg and decide if it is cheaper or more profitable to cancel the working hedge orders and close the position in the open leg. You could also cancel working hedge orders in favor of initializing a new Autospreader order to convert your position into a butterfly or other strategy of your choosing.

Are you a portfolio manager who is always rolling positions? Ever get to thinking that these frequent rolls are costing you a lot of money? Use ADL to handle multiple Autospreader configurations and roll positions more cost effectively by using the liquidity of back months.

ADL is also capable of bringing in data from outside sources to use in your calculations. Need live FX or equity prices in your Autospreader analysis? With ADL, these outside sources can be considered.

The addition of ADL to Autsospreader logic brings in an additional layer with which to differentiate your spread logic. The flexibility of Autospreader is already a great differentiator, but the addition of DIY algo logic created in ADL further expands upon the world of opportunity to make your spread logic superior to what is running in the market.