← Back to Trade Talk Blog

I was amused by the recent flurry of media releases proclaiming the adoption of algorithmic trading in derivatives markets. Pay no attention to the man behind the curtain, could this be important new information that somehow leads us to enlightened trading? Or is it the case there is nothing more deceptive than an obvious fact? The latter are the words of one well-known sleuth, whose Watson would likely retort, “No kidding, Sherlock,” or something roughly comparable.

|

| The infamous Sherlock Holmes |

Avoiding the temptation to offer my own breaking insights, such as The Internet is here to stay! and Mobile communications expected to take off!, I will instead stay the high road, eschewing mirthful gratification for the sake of propriety. As our sleuth would advise, if you eliminate all other factors, the one which remains must be the truth: while other vendors are merely talking about algo trading in derivatives, Trading Technologies has been delivering for several years. I am therefore tickled pink that other vendors are now “discovering” this space. The algos are not missing, they are here. In production. Today.

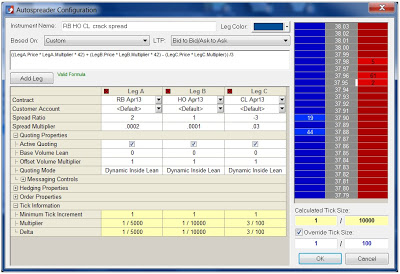

One of TT’s first algorithmic solutions was our hosted Autospreader® Strategy Engine (SE), which is a very-low-latency computational server for executing synthetic spread algorithms such as calendar rolls, synthetic strips, butterflies and condors. Recent enhancements to this system include intuitive rule building for customized handling of pre- and post-trade hedging, as well as conditional participation and synthetic sniper spreads.

The Autospreader SE product is complemented by TT’s Synthetic Strategy Engine, another proximity-hosted server that provides a suite of algorithmic order types, including synthetic icebergs, TWAP, POV and triggered algos such as stops and if-touched orders.

Continue Reading →

Tags: Algos & Spread Trading, APIs, Trade Execution

|

| Sweden celebrates National Day each year on June 6.* |

Somewhat unique among monarchies, instead of a family motto upon accession to the throne, the sovereign of Sweden will adopt a personal motto. This often serves as a national motto as well, and is printed on their 1 krona coins.

Upon taking the throne in 1973, the current Swedish monarch, King Carl XVI Gustaf, adopted the motto For Sweden—with the times. This motto reflected his desire for both himself and his country to constantly evolve to adapt to the modern world. When it comes to navigating the recent eurozone crisis, though, in many ways Sweden, along with the other Nordic countries, was ahead of its time.

Nordic countries were largely spared the crisis that unfolded in the eurozone over the last few years. In part, that is likely because the Nordic countries had already been through their own version a couple decades earlier, and had already made structural changes to their economies that allowed them to weather the recent storm. As the eurozone shows signs of stabilizing, the Nordic countries, and Sweden chief among them, are poised to see growth accelerate.\

Continue Reading →

Tags: Market Access, Trade Execution

With a few blogs already posted on using Autospreader, I thought it would be good to take a step back, look at the basic functionality of TT’s Autospreader and provide some insight on how it works.

In my former life as a market maker at the Chicago Board Options Exchange (CBOE), it was instilled in me very early on that no trade should occur without knowing ahead of time how that trade would be offset or hedged with another trade. I won’t get into the details of options trading and all the potential strategies here, but there are numerous ways to hedge trades and create a position that could make a profit or incur a loss based on many different factors.

Every trade that involves another trade against it in another contract to create a position could be referred to as a spread. At the most basic level, spread trading involves buying one contract and selling another contract at the same time. The basic premise behind spread trading is that you can profit from the changes in the pricing relationships of two or more contracts or products.

The mindset and habits I learned from trading options and taking advantage of price discrepancies involving multiple products carried over to the futures world, where spread trading has been around since the inception of futures products and contracts.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

Global capital markets have been in flux over the past few months, to say the least. In early April, Japanese Prime Minister Shinzo Abe launched the second arrow of “Abenomics.” After 15 years of chronic deflation, the Bank of Japan set an inflation target of 2 percent and announced a plan to buy $75 billion a month of Japanese government bonds. This led to the Nikkei index to run up by roughly 30 percent through mid-May.

Much of the money that flooded into Japan was pulled out of emerging markets. Brazil in particular reacted to try and lure foreign capital back into the country. Years ago, while the U.S. and European economies were mired in recession, Brazil put in place capital controls in the form of the IOF tax to prevent hot money inflows from strengthening the real against the dollar. Since then, the Brazilian economy has stalled, and in mid-June the Brazilian government removed most of the IOF taxes, including the 1 percent tax on derivatives.

Thus far, we have only received hints of the biggest development yet to come. Starting in April, the U.S. Federal Reserve began hinting that it would likely wind down QE3 and begin tapering its purchase of bonds later this year. Although the talk of tapering being imminent has been put to rest for now, it is only a matter of time until the Fed begins to wind down its $85 billion a month purchase of bonds. In a preview of the eventual effect tapering will have, yields on benchmark 10-year U.S. Treasuries were up more than 80 basis points from the beginning of May through the end of June.

|

10-Year U.S. Treasury Yield

Source: Yahoo! Finance |

Taking a View Using the Swap Spread

The swap spread is a useful tool to speculate or hedge against changes in the supply and demand of the U.S. Treasury market, changes in the federal government deficit or responses to the expectation of increasing interest rates. A swap spread consists of a Treasury bond leg and an interest rate swap leg, with each leg acting as a proxy for the perceived riskiness of government debt and bank debt respectively.

When concerns arise regarding the creditworthiness of the banking system, the resulting flight to quality in Treasuries leads to a rise in the yield of interest rate swaps relative to government debt, and a widening swap spread. Conversely, if investors and credit rating agencies become concerned about the creditworthiness of government debt (not that that would ever happen…), people may pull money out of Treasuries, leading to a rise in the yield of government debt relative to bank debt and a narrowing swap spread.

Supply and demand mechanics of the Treasury market can also influence the swap spread. When a persistent federal deficit is expected, and with it the expectation of an ample supply of Treasuries, Treasury yields rise relative to swap yields and the swap spread narrows. When deficit projections decrease, expectations of a shrinking supply of Treasuries will cause spreads to widen.

|

U.S. Dollar 10-Year Swap Spread

Source: Bloomberg |

Perhaps one of the biggest influences on the swap spread is mortgage convexity hedging. When interest rates rise, the likelihood of homeowners refinancing decreases and the duration of outstanding loans increases. In response to the increase in duration and an increase in the amount of interest they can expect to earn from mortgages, investors will look to sell long-dated assets. The effects of this hedging are more pronounced in the swaps market than the Treasury market, usually leading to a widening of swap spreads. When interest rates fall, investors will look to buy swaps, often leading to a narrowing of the swap spread.

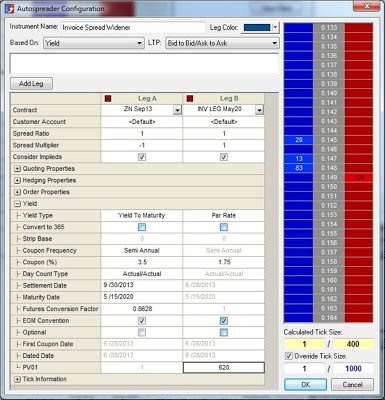

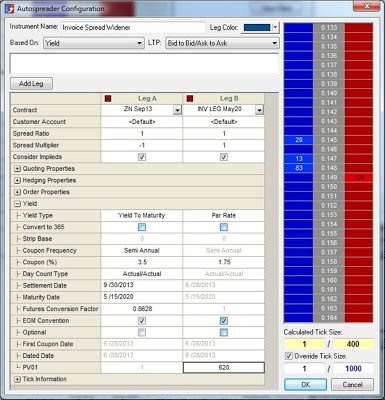

The Invoice Spread

A swap spread trade is typically constructed by buying (or selling) a Treasury bond and paying (or receiving) the fixed rate of an interest rate swap with an identical maturity. The same trade, known as an invoice spread, can be built using Treasury futures and Eris Exchange interest rate swap futures. Using an invoice spread can result in significant margin savings of up to 75 percent compared to a swap spread using the cash products.

Eris Exchange actually lists a flex contract specifically designed to lend itself to constructing an invoice spread. The Eris invoice spread leg contract has the same maturity as the cheapest to deliver Treasury underlying the 10-year U.S. Treasury future available on either the Chicago Board of Trade (CBOT) or NYSE Liffe U.S.

Even though Eris contracts are futures, they match the cash flows of a typical over-the-counter (OTC) interest rate swap. As a result, an Eris product offers the best of both worlds: like an OTC swap, it can serve as a proxy for corporate credit risk, while also offering the capital efficiencies of a futures product.

|

| Trade the Eris Exchange invoice spread with TT’s X_TRADER®. |

The Right Tools Make All the Difference

X_TRADER® 7.17 adds functionality that will make it easy to trade the invoice spread. X_TRADER and Autospreader® have long allowed the trader to convert quotes for fixed income products—whether they be Eurodollars, Treasury futures or cash Treasuries—to an implied yield.

The Eris invoice spread leg contract has a fixed coupon, and is quoted in net present value (NPV) terms. X_TRADER 7.17 will allow you to convert this NPV-quoted price to an implied yield. The only parameter the trader needs to supply is the PV01 value for the swap, or the price sensitivity of the swap to a one-basis-point change in yield. The PV01 value for a given swap is available through many market data services.

|

| Configuring the Eris Exchange invoice spread in TT’s Autospreader®. |

Both the CBOT Treasury futures leg and the Eris swap futures leg can be converted to an implied yield, making it simple to set up the spread between the two contracts. Additional information regarding how to set up an invoice spread is available on our website. With our new functionality and our newly available access to Eris Exchange, traders looking to stay ahead of the Fed have yet another tool in their arsenal.

Tags: Algos & Spread Trading, Market Access, Trade Execution

I’m very excited about today’s announcement regarding the production release of the TT MultiBroker* solution. The MultiBroker* platform represents the fulfillment of our greatest commitment to the buy side. I wanted to dedicated this blog to that commitment in order to underscore the importance of the buy side to TT.

From the start, TT has focused on providing software for derivatives professionals, which include proprietary, sell-side and buy-side traders. Historically, TT’s pedigree is rooted in proprietary trading. From these origins, we gained our innate and steadfast commitment to uncompromising reliability, low latency and high throughput. And as a vendor whose direct customers are primarily banks and futures commission merchants (FCMs), TT also has catered very closely to the needs of the sell side, with products that include flexible user administration and advanced risk management capabilities. With multi-broker support, we now complete the circle by providing a broker-neutral platform for buy-side derivatives traders. Our TTNET™ hosting service spans five continents, eight data centers and more than three-dozen exchanges, and is unparalleled as a high-performance, reliable solution for trading listed derivatives.

|

|

Select your broker with a single click in TT’s MultiBroker.*

|

Unlike some multi-broker platforms that hand off orders to third-party/sell-side execution networks, the TT MultiBroker* solution is an end-to-end architecture that guarantees an order is never routed to another network. TT software routes the order from the end user to the exchange matching engine and back, regardless of which broker is handling execution. This optimizes performance and reliability, and eliminates hard-to-diagnose issues that can occur when orders are routed across network domains.

TT’s ongoing commitment to innovation has resulted in game-changing products such as the ADL™ visual programming platform, which allows traders and quants to develop sub-millisecond algorithms on a visual canvas, test them in simulation against live market prices and route them for proximity execution to any of our global data centers—all from a single X_TRADER® workstation and without traditional and error-prone coding. The addition of multi-broker support to the TT platform takes our technology to the next level by giving end users the ultimate flexibility of choice among their execution and clearing providers.

In my role as head of buy-side product management at TT, I am obviously very excited about TT’s deep commitment to hedge funds, asset managers, CTAs, pension funds and corporations. Since directing the TT Connected Partner Program is one of my responsibilities, I will reinforce this commitment by expanding relationships with complementary buy-side application vendors, such as commercial order management systems, portfolio management systems and a variety of middle-office and analytical applications that are geared to buy-side traders, quants and portfolio managers. If you’re with a firm that develops such complementary offerings for the buy side, I encourage you to consider joining the Connected Partner Program. You can indicate your interest by completing the Partner Program inquiry form on our website.

Along these lines, we’re also working on a powerful yet easy-to-use means of bridging FIX-based systems with our MultiBroker* platform through a user interface designed for non-programmers. Ultimately, this will empower more buy-side firms to connect FIX-enabled systems to TT’s trading platform with minimal effort and delay. Stay tuned for a future blog post that will outline this innovative new technology!

*TT’s MultiBroker solution is now know as X_TRADER ASP.

Tags: Trade Execution