Position Transfer

Internally match trades with no added latency.

Avoid Orders That Cross

Improve trade executions across your entire firm.

Avoid Fines

Avoid regulatory violations and fines resulting from crossing or self matching.

Eliminate Rejects

Eliminate orders getting rejected because of other internal orders at your desired price.

Simplify Algo Logic

Prevent algos from handling rejects resulting from crossed orders.

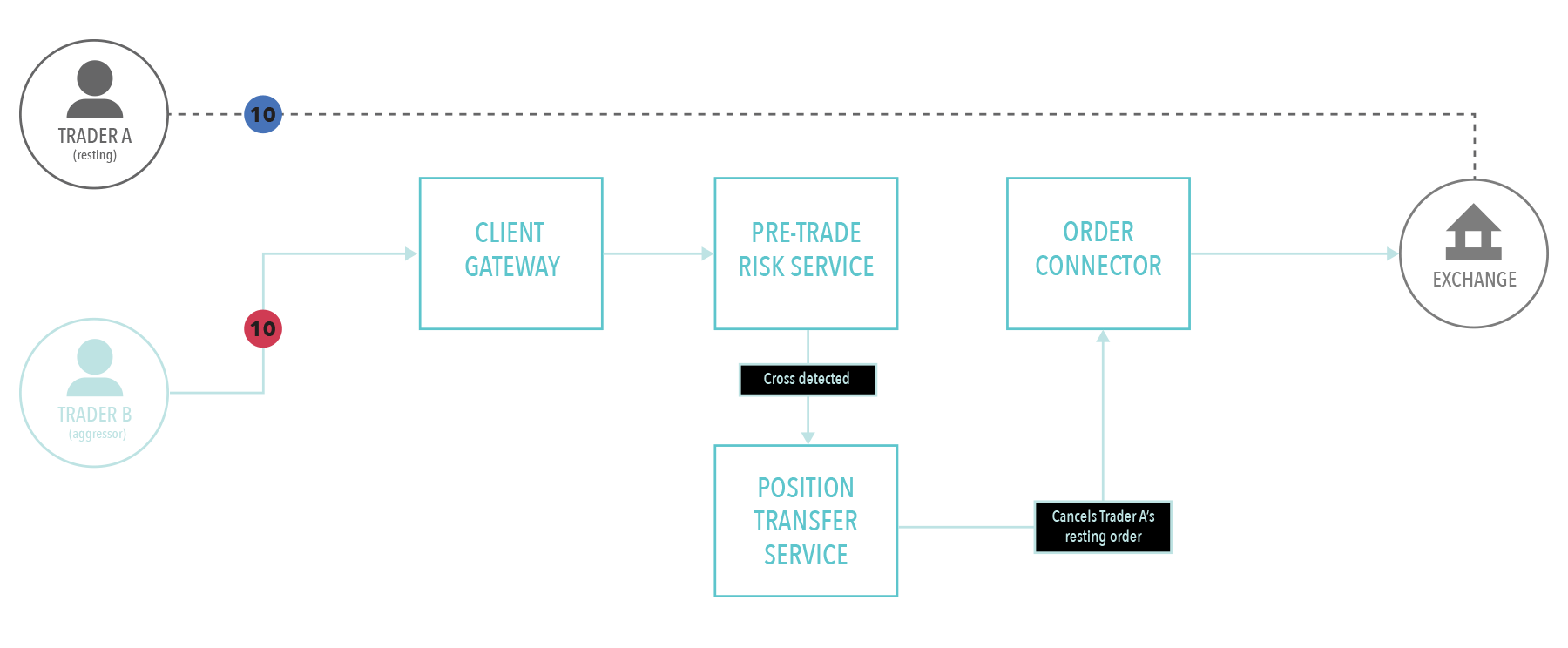

How does Position Transfer work?

How It Works

- When a potential match is detected, the aggressive order is held.

- The resting order is cancelled or reduced.

- Upon receiving order confirmations, virtual fills are created for both parties.

- Any quantity imbalances remain working or are sent into the market.