← Back to Trade Talk Blog

Global capital markets have been in flux over the past few months, to say the least. In early April, Japanese Prime Minister Shinzo Abe launched the second arrow of “Abenomics.” After 15 years of chronic deflation, the Bank of Japan set an inflation target of 2 percent and announced a plan to buy $75 billion a month of Japanese government bonds. This led to the Nikkei index to run up by roughly 30 percent through mid-May.

Much of the money that flooded into Japan was pulled out of emerging markets. Brazil in particular reacted to try and lure foreign capital back into the country. Years ago, while the U.S. and European economies were mired in recession, Brazil put in place capital controls in the form of the IOF tax to prevent hot money inflows from strengthening the real against the dollar. Since then, the Brazilian economy has stalled, and in mid-June the Brazilian government removed most of the IOF taxes, including the 1 percent tax on derivatives.

Thus far, we have only received hints of the biggest development yet to come. Starting in April, the U.S. Federal Reserve began hinting that it would likely wind down QE3 and begin tapering its purchase of bonds later this year. Although the talk of tapering being imminent has been put to rest for now, it is only a matter of time until the Fed begins to wind down its $85 billion a month purchase of bonds. In a preview of the eventual effect tapering will have, yields on benchmark 10-year U.S. Treasuries were up more than 80 basis points from the beginning of May through the end of June.

|

10-Year U.S. Treasury Yield

Source: Yahoo! Finance |

Taking a View Using the Swap Spread

The swap spread is a useful tool to speculate or hedge against changes in the supply and demand of the U.S. Treasury market, changes in the federal government deficit or responses to the expectation of increasing interest rates. A swap spread consists of a Treasury bond leg and an interest rate swap leg, with each leg acting as a proxy for the perceived riskiness of government debt and bank debt respectively.

When concerns arise regarding the creditworthiness of the banking system, the resulting flight to quality in Treasuries leads to a rise in the yield of interest rate swaps relative to government debt, and a widening swap spread. Conversely, if investors and credit rating agencies become concerned about the creditworthiness of government debt (not that that would ever happen…), people may pull money out of Treasuries, leading to a rise in the yield of government debt relative to bank debt and a narrowing swap spread.

Supply and demand mechanics of the Treasury market can also influence the swap spread. When a persistent federal deficit is expected, and with it the expectation of an ample supply of Treasuries, Treasury yields rise relative to swap yields and the swap spread narrows. When deficit projections decrease, expectations of a shrinking supply of Treasuries will cause spreads to widen.

|

U.S. Dollar 10-Year Swap Spread

Source: Bloomberg |

Perhaps one of the biggest influences on the swap spread is mortgage convexity hedging. When interest rates rise, the likelihood of homeowners refinancing decreases and the duration of outstanding loans increases. In response to the increase in duration and an increase in the amount of interest they can expect to earn from mortgages, investors will look to sell long-dated assets. The effects of this hedging are more pronounced in the swaps market than the Treasury market, usually leading to a widening of swap spreads. When interest rates fall, investors will look to buy swaps, often leading to a narrowing of the swap spread.

The Invoice Spread

A swap spread trade is typically constructed by buying (or selling) a Treasury bond and paying (or receiving) the fixed rate of an interest rate swap with an identical maturity. The same trade, known as an invoice spread, can be built using Treasury futures and Eris Exchange interest rate swap futures. Using an invoice spread can result in significant margin savings of up to 75 percent compared to a swap spread using the cash products.

Eris Exchange actually lists a flex contract specifically designed to lend itself to constructing an invoice spread. The Eris invoice spread leg contract has the same maturity as the cheapest to deliver Treasury underlying the 10-year U.S. Treasury future available on either the Chicago Board of Trade (CBOT) or NYSE Liffe U.S.

Even though Eris contracts are futures, they match the cash flows of a typical over-the-counter (OTC) interest rate swap. As a result, an Eris product offers the best of both worlds: like an OTC swap, it can serve as a proxy for corporate credit risk, while also offering the capital efficiencies of a futures product.

|

| Trade the Eris Exchange invoice spread with TT’s X_TRADER®. |

The Right Tools Make All the Difference

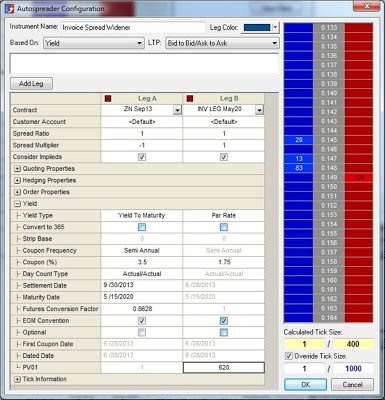

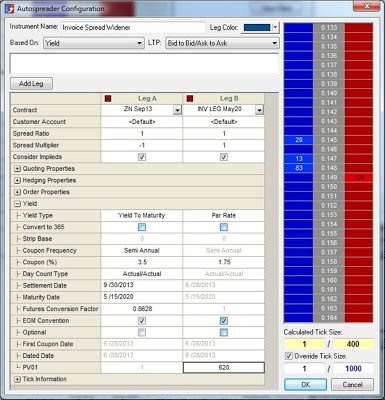

X_TRADER® 7.17 adds functionality that will make it easy to trade the invoice spread. X_TRADER and Autospreader® have long allowed the trader to convert quotes for fixed income products—whether they be Eurodollars, Treasury futures or cash Treasuries—to an implied yield.

The Eris invoice spread leg contract has a fixed coupon, and is quoted in net present value (NPV) terms. X_TRADER 7.17 will allow you to convert this NPV-quoted price to an implied yield. The only parameter the trader needs to supply is the PV01 value for the swap, or the price sensitivity of the swap to a one-basis-point change in yield. The PV01 value for a given swap is available through many market data services.

|

| Configuring the Eris Exchange invoice spread in TT’s Autospreader®. |

Both the CBOT Treasury futures leg and the Eris swap futures leg can be converted to an implied yield, making it simple to set up the spread between the two contracts. Additional information regarding how to set up an invoice spread is available on our website. With our new functionality and our newly available access to Eris Exchange, traders looking to stay ahead of the Fed have yet another tool in their arsenal.

Tags: Algos & Spread Trading, Market Access, Trade Execution

For the past few years, coverage of Mexico in the U.S. media has largely been dominated by stories of violence stemming from the country’s drug cartels. Lately though, the media have increasingly been turning their attention to the story of Mexico’s booming economy, and new president Enrique Peña Nieto’s bold moves to radically reshape it. This robust growth in Mexico looks set to continue for some time, which has led the Financial Times to label Mexico as the “Aztec Tiger.”1

MexDer, the nation’s only futures exchange, has been taking steps to ensure that it grows apace with the nation’s economy by making substantial upgrades to its matching engine, while continuing to make it easier for foreign investors to access the market. As a result of these changes, as of yesterday, April 14, north-to-south routing to MexDer via CME Group’s Globex® platform is available on TT. You can read the details in the news release that we published today.

The Aztec Tiger

A perfect storm of positive influences is coming together to make Mexico one of the world’s emerging economic powerhouses. Mexico has a young and growing population, low levels of government debt and low inflation. The country is developing into a leading exporter due in part to widespread implementation of new manufacturing processes, but also due to the fact that Mexico has free trade pacts with 44 countries—more than any other nation on earth.

These forces have combined to make Mexico’s economy one of the few bright spots in a global economy still working off the hangover resulting from the credit bubble. Mexico’s economy grew at around four percent in 2012, quadruple the growth rate of Latin America’s largest economy, Brazil.2 The Mexican peso hit a 19-month high against the U.S. dollar in March, and has outpaced 16 other major world currencies over the last month.3

With its growth track record and favorable conditions for growth to continue, a Nomura Equity Research report in July 2012 predicted that Mexico would overtake Brazil to become the largest Latin American economy within the next decade.4 In addition, Standard & Poor’s and Fitch have indicated that in the near future, they are likely to upgrade Mexico’s debt, which is already investment grade.5

A Pact for Mexico, An Open Door for Growth

Much of the optimism for Mexico’s future can be traced back to its new president, Enrique Peña Nieto. He hails from the Institutional Revolutionary Party (PRI), which ruled Mexico uninterrupted for 71 years and was identified with corruption and inefficient bureaucracy. That being said, President Nieto is quickly making himself known as a risk taker, willing to take on fights in which none of his predecessors seemed willing to engage.

Within two days of his swearing-in last December, Nieto’s PRI signed a “Pact for Mexico”6 with the opposition National Action Party (PAN). This pact outlines 95 proposals to modernize and liberalize Mexico’s economy. Nieto began by taking on the richest man in the world, Carlos Slim, by announcing plans to foster competition in the telecommunication and television industries, which are currently dominated by monopolies. Later this year, Nieto is expected to propose his most significant change, opening up Mexico’s energy market and allowing the state-run oil concern Pemex to work with the world’s largest oil companies. It’s expected that these reforms, once enacted, will increase Mexico’s GDP growth from four percent to six percent a year.7

Making MoNeT

In parallel, MexDer and the Mexican government have done quite a bit to attract foreign investors, and to make it easy for them to access the market. Perhaps one of the most significant changes has been the development of the MoNeT matching engine, which went live on Bolsa Mexicana de Valores (BMV), the equities segment, last fall.

The MoNeT matching engine was designed to attract high-frequency traders, mainly from the U.S. and Europe. It boasts internal latencies of 90 microseconds, which is faster than the 110 microseconds of NASDAQ or 125 microseconds at the London Stock Exchange.8 BMV volumes have increased 30 percent to 40 percent since the launch of the new matching engine.9

For international traders and investors, accessing MexDer is straightforward. The north-to-south routing available via CME Globex allows any TT customer with an existing CME infrastructure to route orders to MexDer’s matching engine. MexDer is also accessible now in TT’s MultiBroker environment, which is currently available in beta. Additional information regarding how CME users can access MexDer is posted on the CME website.

There are a number of other reasons why doing business in Mexico is easier than most other Latin American countries. Unlike Brazil, there is no withholding tax of any kind on foreign investment. The Mexican peso is a freely traded and easily convertible currency, and MexDer’s clearing house, Asigna, accepts U.S. dollar-denominated collateral.

La Oportunidad Está En Todas Partes

Owing to the fact that the U.S. does $1.5 billion per day in trade with Mexico,10 the Mexican markets are, predictably, highly correlated with America’s. North-to-south customers trading MexDer via Globex have access to a number of financial futures that allow for arbitrage opportunities against their American counterparts.

MexDer lists the IPC index of the BMV, which in general tracks closely to the S&P 500. The full Mexican yield curve is available on MexDer, from one-month bills to 30-year bonds, and it converges with the U.S. yield curve. Finally, MexDer lists a Mexican peso/U.S. dollar FX future, one of the 20 biggest FX futures contracts in the world by volume, which sets up arbitrage opportunities with the CME’s equally liquid peso/U.S. dollar future. In a recent MarketsWiki interview, MexDer CEO Jorge Alegria indicated that going forward, the exchange would likely look to list commodity futures linked to similar contracts listed on CME Group.

The ascent of the Aztec Tiger is no sure thing. There is always the danger of President Nieto’s PRI party losing its appetite for reform and returning to its old ways. There’s the chance that the hiccups in the U.S. economic recovery may impact Mexico, given that 30 percent of the Mexican economy is tied to U.S. exports. There may even be signs that Mexico’s economy is stalling already, which led the central bank to reduce interest rates for the first time since March 2009. Either way, TT users now have the ability to participate in one of today’s most interesting markets.

1 Thomson, Adam. “Mexico: Aztec tiger.” Financial Times. January 30, 2013.

2 Rathbone, John-Paul. “Mexico’s reform plan lifts hopes for greater prosperity.” Financial Times. March 20, 2013

3 Kwan Yuk, Pan. “Mexican peso hits 19 month high”. Financial Times. March 14, 2013.

4 “Mexico could pass Brazil as top LatAm economy in 10 years-Nomura.” Reuters. August 8, 2012.

5 Bases, Daniel. “S&P revises Mexico sovereign credit outlook to positive.” March 12, 2013

6 “With a little help from my friends.” The Economist. December 8, 2012.

7 Thomson, Adam. “Mexico: next stop, a rating upgrade?” Financial Times. March 12, 2013.

8 Thomson, Adam. “Homegrown software fuels Mexican exchange’s efficiency.” Financial Times. October 3, 2012.

9 Kledaris, George. “Down Mexico way.” Advanced Trading. February 26, 2013.

10 Friedman, Thomas. “How Mexico got back in the game.” New York Times. February 23, 2013.

Tags: Market Access

The country of Brazil derives its name from the Portuguese word for the trees that once grew up and down its coast. In the 16th century, the timber from these trees was the first main export to Europe from what was then known as Terra da Santa Cruz (“The Land of the Holy Cross”). The wood from these trees produced a deep red dye, resulting in a name derived from the Latin word “brasa”, meaning “ember”. Over time, European merchants began to use the colloquial term for the county and its most valuable commodity: “Brasil” or “red like an ember”.

Red like an ember is a good way to describe Brazil’s economy these days. As one of the world’s fastest growing economies in 2010, the Brazilian economy was white-hot. In 2011 and 2012 though, the economy slowed to a low simmer as growth slowed substantially. In 2012, the stimulative policy changes put in place by the Brazilian government and central bank resulted in a record volume year at BM&FBOVESPA, as well as a number of compelling trading and investment opportunities.

Big Year for BM&FBOVESPA

November 25, 2012 marked the one-year anniversary of TT providing native market access to BM&FBOVESPA, which coincided with the exchange’s migration of the last of their futures products to the new PUMA matching engine. While the last year has been a challenging one for the Brazilian economy in general, the country is still expected to set the pace for growth in Latin America going forward. At the same time, the exchange continues to focus on product innovation and expanding their offering for both local and foreign investors.

In a year that saw volumes declining at most major futures exchanges around the world, BM&FBOVESPA’s volumes are actually up. Through the first nine months of the year, the exchange’s futures volumes were up 5% over the same period a year earlier. The increase in volume can be traced back to two things: uncertainty in the Brazilian interest rate markets, and BM&FBOVESPA’s technology and product launch initiatives.

On the technology front, the PUMA matching engine, developed jointly with the CME Group, was built with high-frequency traders in mind. It shaved the time the matching engine takes to process a trade from 10 milliseconds to less than one. In 2013, BM&FBOVESPA will move their equities onto this platform as well.

Product-wise, this past summer, the exchange listed eight new FX contracts, including mini-dollar and mini-euro products. In June, the exchange also began cross-listing contracts with the CME Group, launching a mini-soybean product that settles to the price of the same product on the CBOT. And in October, BM&FBOVESPA similarly launched a product based on the CME’s S&P 500 future. As these markets develop in Brazil, they may offer interesting spreading opportunities against similar products in Chicago.

“North-to-South” Access

While it is still a somewhat cumbersome process for foreign investors to trade on BM&FBOVESPA, even here, both the exchange and the Brazilian government are slowly greasing the wheels. Trading by foreign participants is expected to comprise 25% of total volume this year, versus 16% in 2011.

Connectivity into São Paulo has long been costly, but slowly prices are starting to come down as more and more “north-to-south” customers enter the market. Increasingly, extranet and hosting providers, such as TTNET, are setting up shop in Brazil, making it easier and more cost-effective for the global community to access Brazil.

The Brazilian government is doing its part as well to entice foreign capital. Long fearful of inflation, Brasília put in place capital controls, such as the 6% IOF tax on inflows of foreign capital for the trading purposes, to tamp down appreciation of the Brazilian real (R$) against the U.S. dollar. As fears of a strengthening real turn into fears of a weakening currency, the government is slowly eliminating some of these controls. Last December, the IOF tax on equities trading by foreign participants was dropped, and in early December, the number of foreign loans to Brazilian firms subject to the IOF tax was reduced. While the 6% tax on foreign capital inflows related to some derivatives trading remains in place, the government will likely look to remove that, too, as long as the real continues to look weak.

Information regarding how foreign investors can access BM&FBOVESPA is available on the exchange’s website here.

Looking Ahead to 2013

Somewhat turbulent economic times in Brazil have also played a part in the uptick in the exchange’s volume in 2012. In years past, with the Brazilian benchmark Selic interest rates hovering between 10% and 20%, the carry trade has been a popular one on BM&FBOVESPA.

That has changed somewhat in the last year, though. The Brazilian economy, which grew at a 7.5% clip in 2010, will slow to about 1.5% this year. Not bad when you compare it to Japan, the U.S. and Europe, but meager by BRIC standards. In an effort to get the economy back on track, the Banco Central do Brasil has cut interest rates from 12.5% in mid-2011 to just 7.25% as of October. It was the resulting uncertainty and volatility in the interest-rate markets that led the exchange to a record volume month in May of 2012.

Low interest rates coupled with low inflation (for now) offer a number of interesting trading opportunities going forward. For local Brazilians, they can no longer ensure themselves a healthy rate of return just by sticking their cash in a savings account. For the first time in a long time, Brazilians are looking to invest in their country’s stock market. As the CEO of BM&FBOVESPA, Edemir Pinto, told the Financial Times, “For any stock exchange, high interest rates are the biggest competitor you can have so this is a big moment of great transformation for the Brazilian market.” Traders who want to gain exposure to Brazilian equities can do so via the Ibovespa index futures on BM&FBOVESPA, which track the total return of the most liquid stocks on the Brazilian stock market.

Further Selic movements by the central bank also offer opportunities for traders looking to trade the DI interest rate swap curve. With an election looming in October of 2014, President Dilma Rousseff’s government will look to get GDP growth back on track. Earlier this year, she announced a stimulus plan consisting of 955 billion reais worth of infrastructure projects. These projects, coupled with other construction related to the 2014 World Cup and the 2016 Olympics, will lead to the issuance of debt that will likely have to be hedged in the futures market.

Still, that stimulus package might not be enough. Economists had projected GDP growth north of 4% in 2013, but lately they have been revising those forecasts downwards. So, the near term question is whether the Rousseff government will continue to cut rates in an attempt to jumpstart the economy, or whether the central bank will turn its attention to preventing inflation and a further weakening of the real and will, as a result, raise rates back into the double digits.

It’s going to be an interesting new year in Brazil, with the BM&FBOVESPA futures markets offering plenty of opportunities for new and unique trading strategies for foreign investors. The embers of an emerging powerhouse economy are still there smoldering, and it’s just a question of whether the Brazilian government can find the right policies to stoke the flames.

Tags: Market Access

More than two years after the Dodd–Frank Act was passed, it’s surprising how much still remains unsettled with regard to what new regulations may be implemented and how the industry will be transformed. One of the few changes that seems certain is that over-the-counter (OTC) swaps will move to a centrally cleared model.

What remains to be seen is which model for trading and clearing interest rate swaps will ultimately win out. Will these swaps remain custom OTC contracts traded via a swap execution facility (SEF)? Or will the industry move toward an exchange model where swap-like futures are traded on a designated contract market?

Siding with Futures

It seems more and more as if the futures model will ultimately win out. Exchange-traded interest rate swap futures have margin efficiencies that the OTC model can’t match. A number of strategies that make use of OTC swaps today may no longer be profitable once these swap positions are subject to margin requirements, an issue which the substitution of swap futures for OTC contracts substantially alleviates.

The trend toward either the “swaps as futures” or “futures on swaps” model is noted by research firms such as TABB Group, but is also reinforced by moves the exchanges are making. For example, the Chicago Mercantile Exchange (CME) recently announced plans to list deliverable interest rate swap futures, and IntercontinentalExchange (ICE) is transitioning its OTC energy contracts to futures.

Making the Swap: Eris Exchange on TT

For these reasons, I was very excited last month when we announced our plans to provide connectivity to Eris Exchange. Eris has created products that capture the best of both worlds. Eris contracts are futures, which means they bring with them margin requirements substantially lower than comparable OTC contracts—up to 95 percent lower for accounts with highly correlated positions. At the same time, Eris products are designed to replicate the cash flows of OTC swaps while also allowing for custom coupons, effective dates and maturity dates to be specified, giving firms the ability to tailor the contracts precisely to their needs.

In addition to being an effective vehicle for corporations to hedge their business risks, a number of strategies based on Eris futures can be executed using TT’s suite of server-side execution tools, such as the Autospreader® Strategy Engine (Autospreader SE) or the new ADL™ visual programming platform with Algo Strategy Engine (Algo SE). These include:

- Invoice spreads between the cheapest-to-deliver Chicago Board of Trade (CBOT) or NYSE Liffe U.S. treasury future and an Eris contract with a similar maturity

- Swap spreads between an Eris future and a similar-maturity BrokerTec treasury

- Eurodollar basis trades between Eris futures and CME or NYSE Liffe U.S. Eurodollars

- Swap curve strategies between different Eris maturities, between Eris futures and BrokerTec cash treasuries or between Eris futures and CBOT or NYSE Liffe U.S. interest rate futures

We plan to roll out our support for Eris in two phases. The first phase, due out later this year, will add support for Eris’ IMM dated forward starting swaps, including Eris’ invoice spread leg contract. In phase two, we will add support for the rest of the Eris product suite, including spot starting swap futures.

Learn More

For more information, visit the Eris Exchange page on our website and read the recent news release announcing our plans to connect to Eris.

And if you’ll be attending FIA Expo later this month in Chicago, stop by our booth (#820) on Wednesday, October 31 at 3:30 p.m. to learn more about Eris futures and how you can trade Eris with TT. Free passes to the exhibit hall, compliments of TT, are available here.

Hope to see you at the show!

Tags: Market Access