[Update] CME: DR Datacenter Migration and Test Postponed

March 2023

The mock disaster recovery test previously scheduled for September 10 has been postponed to early March 2023. Additional details, test scripts, and registration information will be announced in future CME Globex Notices.

CME: Listing Cycle Expansion for E-Mini S&P 500 Monday, Wednesday and Specific Friday Weekly Options

September 11

Effective Sunday, September 11 (trade date Monday, September 12) the listing cycle for the following options will be expanded:

| Product | Symbol | Current Listing Schedule | New Listing Schedule |

| Monday Weekly Options on E-Mini S&P 500 Stock Price Index Futures | E1A-E5A | Weekly contracts listed for 4 consecutive weeks | Weekly contracts listed for 5 consecutive weeks |

| Wednesday Weekly Options on E-Mini S&P 500 Stock Price Index Futures | E1C-E5C | Weekly contracts listed for 4 consecutive weeks | Weekly contracts listed for 5 consecutive weeks |

| Weekly Options on E-Mini S&P 500 Stock Price Index Futures | EW1, EW2, EW4 | 4 weekly contracts listed for week 1, week 2 and week 4; 9 weekly contracts listed for week 3 | 6 weekly contracts listed for week 1, week 2 and week 4; 9 weekly contracts listed for week 3 |

These options are currently available for testing in UAT.

CME: Sunsetting Eurodollar Options

September 11

Effective Sunday, September 11 (trade date Monday, September 12) Eurodollar and Mid Curve option quarterlies will be sunset. No additional Weekly Mid-Curve, Term Mid-Curve, Mid-Curve, and Calendar Spread Options contracts will be listed after Monday, September 12, 2022.

Please note: All currently listed expirations will remain listed including the April and May 2023 contracts.

Additional Resources

Globex Notices, August 22, 2022

CME: Changes to Bursa Malaysia Derivatives (BMD) Gold Futures

September 18

Effective Sunday, September 18 (trade date Monday, September 19), and pending final regulatory approval, the Bursa Malaysia Derivatives (BMD) Gold futures security definition message will be amended as follows:

- Change to tag996-UnitOfMeasure

- Change to tag1147-UnitOfMeasureQty

- Change to tag969-MinPriceIncrement

- Afternoon Trading Session Hours

Additional Resources

Globex Notices, August 22, 2022

JPX: Introduction of Holiday Trading

September 20

JPX has announced the introduction of Holiday Trading with a launch date of September 20, 2022. This new exchange initiative will allow trading during Japan public holidays for Index Futures and Options and all Commodity Futures and Options (including TOCOM products). Securities Options, JGB Futures and Options on JGB Futures will not be tradable during holidays.

For correct support of order management and trading during holidays, and correct display of trading status during holidays, Holiday Trading ready versions of TT Order Connector (OC) and TT Market Data Server (MDS) have been deployed to UAT and are now available for testing.

The completed J-GATE3.0_Holiday_Trading_Checklist・ConfirmationForm.xlsx document is also available now for all customers to submit to the exchange. Please contact your TT Onboarding representative to obtain the document.

For detailed information about JPX Holiday Trading on the TT platform, please refer to the JPX Holiday Trading document. This document will be kept up to date with the latest information as it becomes available, so customers are encouraged to check periodically to get the newest updates. Note that several important updates were added on August 4 and August 18.

JPX: System Reboot

September 20

JPX has announced the introduction of Recovery by system reboot with a launch date of September 20, 2022. This new exchange initiative is to allow the exchange to resume trading following certain failure scenarios. JPX is rolling this out as a response to Arrowhead failures experienced by the exchange during the 2021 Calendar year.

The TT platform will fully support all elements of the System Reboot process including all sequence number changes, settlement price updates and post-reboot order workflow. TT’s Business and Engineering teams will coordinate efforts to verify correct platform response during the pre-scheduled test environment weekday test events.

For additional information about JPX Holiday Trading on the TT platform, please refer to the JPX System Reboot TT Factsheet.

SGX: Cobalt and Lithium Contracts

September 26

SGX has announced the introduction of SGX FM Cobalt and Lithium Contracts with a launch date of September 26, 2022. The products are available for testing in UAT now. Please note the following two points for UAT testing: (1) TTW traders testing Cobalt and Lithium Contracts will see incorrect Profit and Loss calculations in the TTW Positions Widget. (2) The Product Names will not appear in TTW Widgets or in Product/Instrument downloads of other applications. These two issues will be corrected during the week of September 19 or earlier. These two issues are specific to UAT testing only and will never impact Production.

MX: API Upgrade (SAIL B3, HSVF D7)

UAT September 30 / Prod November 14

The Montreal Exchange is upgrading its Order Entry (B3), Market data (D7) and Drop copy protocols.

- GTE (Test environment) availability – August 18, 2022

- The exchange go-live date for the new protocol is November 14, 2022. TT will launch shortly after. TT will continue to support trading using the old protocol until then.

Current API will be active in GTE1 so UAT will still be available.

Our current target date is September 30 for UAT, but we aim to implement new changes and upgrade UAT as soon as possible.

FIX: Logon Tag Validation

September 30

TT FIX has introduced a new feature that will enable FIX sessions in UAT and Production to be routed to a specific host in the environment rather than being randomly assigned a host by the HA Proxy load balancer during Logon. The new feature will give customers and TT greater flexibility in routing sessions for the purposes of testing, diagnosis, early access to new features or roll-back to older versions of the TT FIX servers.

When the new feature is enabled, HA Proxy performs tag validation on the FIX Logon (35=A) message to ensure that the FIX message is well formed. The Logon message may only contain standard tags for that FIX Version, or custom tags in the range 10,000 to 19,999. If the logon contains tags that are outside the permitted range for that version (for example, a FIX 4.2 logon containing FIX 4.4 tags 553 and 554), that logon will be rejected.

The TT FIX Integration team has performed an analysis of current production Logon messages and is contacting customers directly to request removal of any non-standard tags from their FIX 4.2 or 4.4 logons. Customers that connect to dedicated FIX servers bypass the HA Proxy load balancer and are not impacted.

The new feature is currently enabled in UAT only. Production deployment will begin on September 30 and take 3 to 4 weeks to fully deploy to production. Customers must remove any non-standard FIX tags from their Logon messages prior to September 30.

For questions regarding FIX Logon, please contact TT FIX Integration at [email protected]. For information on configuring the new feature in TT Setup, please contact TT Onboading at [email protected].

CME: E-Mini Nasdaq-100 Tuesday and Thursday Options

October 2

Effective Sunday, October 2 (trade date Monday, October 3) pending completion of all regulatory review periods, E-Mini Nasdaq-100 Tuesday and Thursday options will be listed for trading on CME.

| Product | Symbol |

| Tuesday Weekly Options on E-mini Nasdaq-100 Index Futures – Week 1 – 5 | Q1B-Q5B |

| Thursday Weekly Options on E-mini Nasdaq-100 Index Futures – Week 1 – 5 | Q1D-Q5D |

ICE: Mandatory Requirement of Manual Order Indicator (“Tag 1028”)

October 3

From the exchange:

In March 2022, ICE Futures U.S. (“IFUS” or the “Exchange”) issued a notice detailing the mandatory inclusion of a Manual Order Indicator on order messages in FIX Tag 1028 effective October 3, 2022. This is a reminder that ICE Futures U.S. will require the inclusion of the Manual Order Indicator on all order messages for IFUS markets starting on October 3, 2022. The Manual Order Indicator is assigned a “Y” value to indicate manual order entry and “N” to represent automated order entry.

TT currently supports the sending of tag 1028 for ICE and ICE_L.

TFEX: SET BCP Exercise

October 8

TFEX is conducting a SET Business Continuity Planning Exercise scheduled for Saturday, October 8, 2022. All Members are required to participate in this test to ensure that the backup trading system can function immediately and continuously in any case where the main trading system is unable to function.

Additional details about connecting to TT for participation will be provided in due course.

The exchange is planning to distribute the test details and additional documentation during the month of September 2022.

FIA: Industry-Wide Testing

October 15

The Futures Industry Association will sponsor its annual Industry-Wide Disaster Recovery Testing (IWT) on Saturday, October 15. We will facilitate customer participation for registered TT platform customers.

Testing is available on the following exchanges:

- CFE

- CME

- Eurex

- Euronext

- ICE

- Montréal Exchange

- Nodal

Customers who plan to participate in the FIA IWT should contact their Onboarding Manager to register for testing and provide exchanges that will be tested along with Connection_IDs that will be used during the test.

Ping/telnet tests for CFE, CME and ICE exchanges will be completed by TT staff as required.

TFEX: New Trading System IWT

Ongoing until November 16

TFEX has announced the start of IWT for their next generation trading system. IWT for the TFEX Derivatives market started on August 8, and ends on November 16, 2022. Participation is mandatory for all brokers.

Access to the IWT Testing system is available via the TT UAT test environment. Details about how to prepare for IWT and access the environment are provided in the TFEX Trading System Upgrade Migration Guide.

All customers participating in IWT should contact the exchange Member Readiness Team ([email protected]) directly to make arrangements.

Eurex: T7 11.0 Upgrade

November 21

Eurex will be upgrading T7 to version 11.0 on November 21, 2022. More details will be provided in upcoming System News and Updates. Eurex will upgrade the simulation environment on September 12. TT’s UAT environment will be available shortly after the 12th, date TBC.

TT will be supporting the following functional enhancements:

- Monday and Wednesday Weekly Option Contracts will be introduced to supplement the existing Friday Weekly Options contracts introduced by the Next Generation ETD Contracts Initiative.

- Tag 1031 ‘custOrderHandlingInst’ will become mandatory for all agency trading. Order entries and modifications without a submitted ‘custOrderHandlingInst’ when the Trading Capacity Agency is used will be rejected.

Euronext: Change of format for Trading Venue Transaction ID (TVTIC) for Euronext Markets

November 21

A new field, Trade Unique Identifier (TUI) will be disseminated within the Order Entry Gateway, Market Data Gateway and Drop Copy and will be used as the new TVTIC (Trading Venue Transaction Identification Code) across all Euronext markets to uniquely identify a trade. TVTIC used for TRS22 purposes will have a new format. TT will implement the new field/format on November 21, 2022. More details to follow in upcoming System Updates.

CME: Change to Bursa Malaysia Derivatives (BMD) Extended Night Trading Session

December 2022

In December 2022 and pending final regulatory approval, Bursa Malaysia Derivatives (BMD) will extend its night trading session for selected products on CME. Due to the time difference between Malaysian Time and Central Time, the extended night trading session activities will begin the business day prior to actual trade date in Malaysian time. The new extended night trading session will be open for trading Monday – Thursday.

There will be no Friday night trading session. There is no impact to the current Monday – Friday day trading sessions.

| Current Time | New Time |

| 21:00:00 – 23:30:00 (Malaysia Time) | 21:00:00 – 02:30:00 (Malaysia Time) |

| Product | Symbol |

| FTSE Kuala Lumpur Composite Index Futures | FKLI |

| Gold Futures | FGLD |

| MINI FTSE BURSE MALAYSIA MID 70 IDX | FM70 |

| FTSE Kuala Lumpur Composite Index Options | OKLI |

| BMD Tin Futures | FTIN |

| 3 Month Kuala Lumpur Interbank Offered Rate Futures | FKB3 |

ICE: Mandatory Migration from LMA to IM-SMA

December 31

ICE has started the process of phasing out Locally Managed Accounts (LMAs) by introducing a new set-up feature, called Independently-Managed System Managed Account (IM SMA) in the ICE Clearing Admin tool which is designed to replace LMAs. The timeline for the migration has been set to year-end.

The new ICE IM SMA feature is available within the SMA functionality and is replacing the legacy LMA, which will be phased out completely by December 31, 2022. The new IM SMA feature offers Clearing Members more control over accounts than is available with LMA.

With IM SMA set-up, it is mandatory to send in tags 439 (Clearing Firm) and 440 (Clearing Account) to the exchange. The customer could continue using tag 9207 (CustAccountRefID field) as an optional field to distinguish the customer business. ICE is targeting December 31, 2022, as the end date for LMA access. In line with this milestone, ICE will not support the creation of any new LMA access starting August 1, 2022.

The TT platform already supports the required tags for IM SMA as required by ICE. Below are the mappings between the required tags and the respective fields in the TT user setup.

- Tag Tag 439 – Clearing Firm ID

- Tag 440 – Exchange Account

Customers are requested to get in touch with TT onboarding team in case any assistance is needed for setup.

KRX: Market Data System Upgrade

January 23, 2023

KRX has announced the launch of a new Market Data System (“New MDDS”) scheduled to go into production on January 23, 2023. Updated information will be provided in System News and Updates as it becomes available.

TT Platform Impact

For Users of the TT Platform there will be no observable impact to trading. All users can expect a seamless transition from the current system to the KRX “New MDDS” with no interruptions.

[Updated] Eurex: Next Generation ETD Contracts

February 6, 2023

Eurex is aiming to introduce a more flexible set-up of Exchange Traded Derivatives (ETD) products by implementing an enhanced contract identification concept in February 2023 allowing more than one expiration per month on product level (sub-monthly contracts).

New features, changes and improvements:

- Integration of Weekly Expiring Instruments on Product Level

- Volatility Strategies in Single Stock Options

- Market-On-Close Futures T+X (Basis Trading in Equity Index Futures)

Weekly contracts will follow the new format of DDMMYYYY (current format: MMYYY), and will be listed under the same Product symbol as the Monthly contracts.

Example: OES1, OES2, OES4, OEB4 will be listed under the OESB Product Symbol, and will be sequentially integrated.

Monthly Option: OESB Sep22

Sub-monthly Options, Week 1-5): OESB Sep22-W1Fr, OESB Sep22-W2Fr, OESB Sep22-W3Fr, OESB Sep22-W4Fr, OESB Sep22-W5Fr

Market on Close T+X will be eligible for MSCI Futures. An example is the following:

On T, Client trades the calendar between the daily future (T+1) and the standard future. After the T+1 session, the index close of T+1 is published by MSCI. On T+2, the T+1 index close is entered as the Final Settlement Price for the daily future. At the end, the Client has paid basis + index close for the standard future.

Eurex Next Generation ETD contracts are now available in UAT for customer testing. The following products are now available, please see the product symbols below and use those for testing purposes:

Active as of July 2022:

T+X MSCI Futures and Spreads (FMEA, FMWN)

Integration of sub-monthly options (NOA3, OGBL, AXA, BAY, CSGN, ROG, ODAX (including end of month contracts), OSMI)

Daily expiring single stock futures (AXAP, BAYP, NO3P, ROGP)

Activation Date: September 23, 2022 (integration period until October 18, 2022):

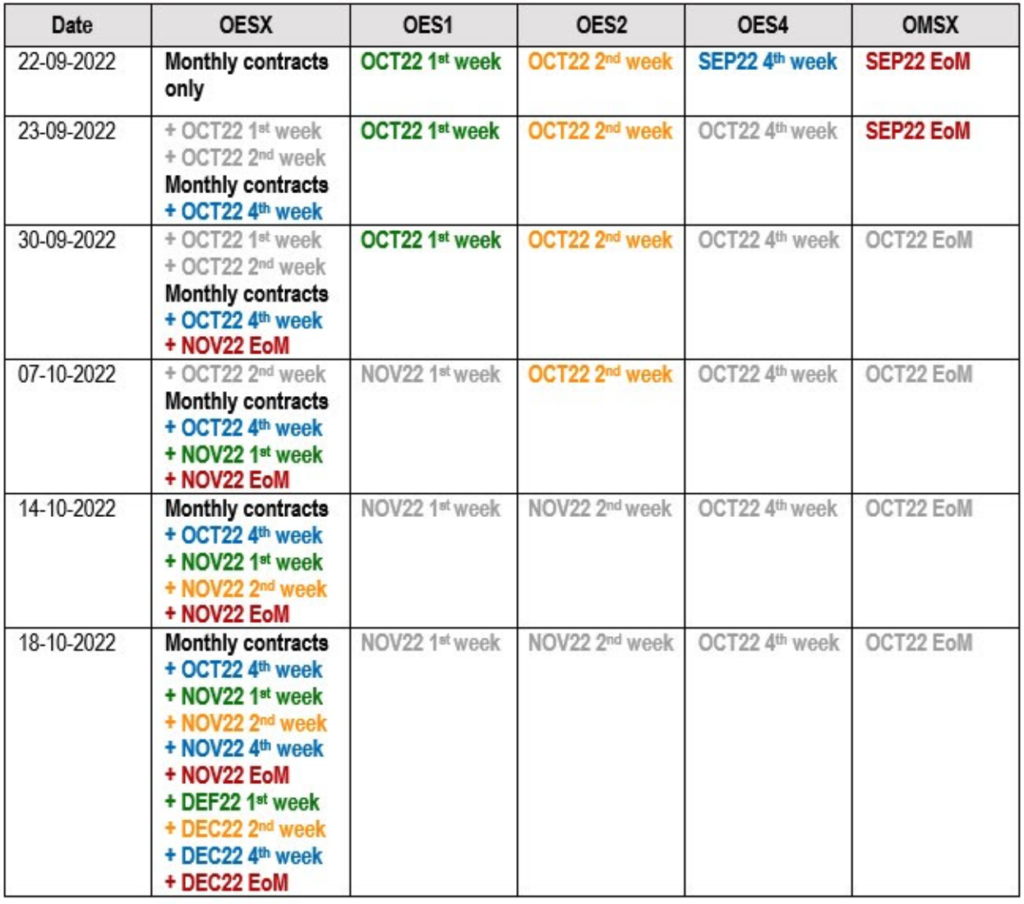

Integration of all weekly expiring contracts OES1/OES2/OES4/OMSX in option OESX. See the detailed migration schedule below:

Activation Date September 30, 2022:

Daily expiring contracts in MSCI Futures FMWO, FMJP, FMEF

Activation Date October 6, 2022:

Daily expiring contracts in single stock futures in ADSP, BMWP, UBSP

Please refer to the attached Eurex Simulation Calendar, as the 3-day rolling contracts will follow the Business Day rather than Calendar day.

Additional Resources

TFX: Three-month TONA Futures & Options

March 2023

TFX has announced the introduction of Three-month TONA Futures & Options with a launch date in late March 2023. The new products will be available for testing in UAT now prior to product launch. Updated information will be relayed here in System News and Updates whenever it becomes available from the exchange.

Additional Resources

IDEM: Migration to Euronext

End of Q2/2023

IDEM products will be migrating to Euronext at the end of Q2/2023. Further details will be provided as the date approaches.