Critical Updates

Eurex/EEX/NODAL: T7 14.0 Upgrade

November 10

Deutsche Börse will release T7 14.0 to Production on November 10, 2025 across Eurex, EEX and Nodal. Simulation access for T7 Release 14.0 is available for testing in the TT UAT environment.

Additional information from the exchange (including System documentation, circulars and timelines) is available on the T7 14.0 initiative page via the following link: www.eurex.com > Support > Initiatives & Releases > T7 Release 14.0

The following are the anticipated milestones for this project:

| Milestone | Expected Date | Delivered Date |

| Exchange Upgrade Announcement | 6/13/2025 | 5/5/2025 |

| Exchange Preliminary Release Notes | 7/13/2025 | 7/01/2025 |

| Exchange Preliminary Specifications | 7/28/2025 | 7/01/2025 |

| Exchange Simulation Available | 9/01/2025 | 9/01/2025 |

| TT Deployment to UAT | 9/05/2025 | 9/08/2025 |

| TT Impact Analysis | 9/19/2025 | 9/19/2025 |

| TT Delivery of Go-Live Plan | 9/19/2025 | 9/19/2025 |

| Customer UAT Completion Target | 10/25/2025 | 10/25/2025 |

| Exchange Connectivity Test | 11/08/2025 | |

| Exchange Go-Live | 11/10/2025 |

TT Impact Analysis and Go-Live Plan:

No customer action is required for this release. TT will perform required upgrades the weekend before November 10th and participate in exchange connection testing during the go-live weekend. We will closely monitor all services at startup on Monday, November 10th, and address any issues that may arise.

TT has submitted the Readiness Statement to Eurex as required.

FMX and FMX_USTF: Optional order fields for Clearing Firm and Position Account

November 17

FMX has added support for specifying the Clearing Firm and Position Account on orders sent to the exchange. TT will add support for these fields in Production on November 17.

These values are now configurable within Account settings in TT User Setup. FIX users can use FIX party blocks with party role 4 for Clearing Firm and 38 for Position Account.

This functionality is currently available in the TT UAT environment for customer testing.

Eurex/EEX: Self Match Prevention (SMP) and Other Enhancements

December 2025

TT will provide support for the following Eurex/EEX exchange functionality.

Enhancement to Self Match Prevention:

On December 1, Eurex and EEX are enhancing the Self Match Prevention (SMP) feature to add 3 new types in addition to the current offering. These new SMP types will be configurable via a new drop down at the Account level in TTUS, and the following values will be allowed:

- Cancel Aggressive and Passive (Netting , existing model)

- Cancel Passive (resting order will be cancelled)

- Cancel Aggressive (Incoming order will be cancelled)

Order Entry Rejection Based on Eurex Trading Capacity Requirements:

Eurex requires that, for Agency orders, the Client ID field must be populated, otherwise they will be rejected.

For Proprietary or Market Making orders, the Client ID field may remain empty.

TT will now reject orders prior to submission to the exchange under these conditions:

- Trading Capacity = Any other capacity (Agency)

- Account Type = A1 – A9 (Required when Trading Capacity is Any other capacity / Agency)

- Client ID = Blank

This change is being made to address reporting concerns from customers when orders are sent to the exchange and are rejected because they do not meet these conditions.

TT will deploy these changes for testing in UAT in late November.

NZX : Dress Rehearsal / Streetwide tests

November 10 – 15

During the week of November 10 – 15, NZX will conduct a Dress Rehearsal for customers in the UAT environment in preparation for the launch of the NZX20 Index Derivatives next year.

During this test, customers may:

- Test their connectivity to the exchange

- Place orders and view execution reports for the NZX20 Index Futures contract (TT Contract Code: KIW)

The timing for this test will be from 8:00 AM – 05:00 PM NZT.

Customers who would like to participate in this testing should contact their TT Onboarding representative.

MIAX: API Upgrade and Minneapolis Hard Red Spring Wheat Options Support

November 16

MIAX Futures has published updated Interface Specifications for the MIAX Futures Onyx trading platform to support enhancements expected to be implemented into production from the calendar date of November 16 (for a trade date of November 17).

TT plans to support the options contracts on Minneapolis Hard Red Spring Wheat Futures along with this upgrade. Changes are expected to be available in TT UAT for customer testing by November 10.

JPX : Tick Change for Nikkei Options

November 17

The tick size table for the Nikkei Options on JPX will be updated on November 17.

| Current | To Be |

| Tick Size = 1, for prices 0 to 100Tick Size = 5, for prices above 100 | Tick Size = 1, for prices 0 to 300Tick Size = 5, for prices above 300 |

This change will be applicable for both – regular Nikkei 225 Options (Product Symbol = 225), as well as Nikkei 225 Mini Options (Product Symbol = 225M).

This change is available in the TT UAT environment for customer testing.

B3: Upcoming B3 FIX Order Entry Gateway Migration – Action Required

November 7 – December 12

B3 has announced a phased reduction of FIX Order Entry Gateways starting in November 2025, affecting certain Derivatives connections. Similar changes in the Equities segment will follow in early 2026. Clients may have already received a notice directly from B3 with the full schedule.

Customers who have received notice that their FIX order entry sessions are affected must ensure the new IPs, Ports, and Target Comp IDs are updated by the date listed in the notice they received from B3.

Customers who would prefer to make these changes before the exchange deadline can contact B3 to have their session IDs migrated to the new destination gateway and would then need to ensure the corresponding TT connections are updated.

NOTE: Customers who have received this notice must complete the required changes by the exchange deadline, otherwise connections will fail to login.

It is strongly recommended that clients perform these updates after the trading session ends and before the next session begins

For questions, contact B3 at +55 11 2565-5021, [email protected]

Coinbase Derivatives Exchange (CDE) 24/7 Support

December 6, 2025

Effective December 6, TT will support the CDE market for 24 by 7 trading. This enhancement will enable support of continuous trading across weekends for eligible products.

Customers who would like to trade 24/7 products on CDE must have their FCM Administrator enable “24 * 7 Trading” on the CDE admin portal, at the executing firm level.

Once enabled, all sessions under the firm will be permissioned for weekend trading. No additional configuration is required by clients.

24 by 5 products: LC, BCH, DOG, GOL, NOL, DOT, SHB, AVA, LNK, XLM, SLR, HED, NGS, ADA

24 by 7 products: BIP, ETP, BTI, BIT, ETI, ET, SOL, SLC, XRP, XRL, SLP, XPP

Note the following:

- Clients enabled for 24 by 7 products can submit GTC/GTdate orders on all products

- Clients not enabled for 24 by 7 cannot submit GTC/GTDate orders 24 by 7 products

- CDE market on TT will follow TT’s standard Crypto maintenance window

CME: NYMEX and COMEX Market Segment Product Migration

December 7, 2025

CME has announced a market segment migration for NYMEX and COMEX products to improve trading and instrument management. This change is effective Sunday, December 7, 2025.

| Product Group | Current Segment ID | New Segment ID |

| Futures All NYMEX Metals, Softs and Alternative Markets Futures and COMEX Futures | 76 | 78 |

| Options All COMEX Options and NYMEX Metals, Softs and Alternative Markets Options | 56 | 76 |

Additional Resources

Updated: B3: Binary Protocol

March 2026

B3 has rolled out new low latency binary protocols for market data via the Binary Unified Market Data Feed (UMDF) and for Order entry (Simple Binary Encoding (SBE).

TT has already migrated its Market Data to the binary UMDF protocol and, for order entry, currently supports both the legacy FIX API and the new binary API.

Please note that B3 continues to support the legacy protocols in parallel with the new Binary offering, and the TT migration will follow a phased approach:

- Phase 1- Completed: TT upgraded its Market Data feed to use the new Binary UMDF protocol.

- Phase 2- In Progress: Customers can continue using their existing FIX order connections while also having the option to configure new binary API connections.

- Phase 3- Future: TT will discontinue support for the legacy FIX order entry API, requiring all customers to use the Binary Order Entry API connections. Any GTC/GTDate orders resting on legacy FIX connections will be canceled when the cut-off occurs.

NOTE: B3 has set the length of the “Entering Trader” value to five on the Binary Order Entry API.

TT will discontinue support for the FIX Order Entry API at the end of Q1, 2026. Customers that have not yet moved to the Binary Order Entry API are strongly encouraged to begin planning for this migration.

WSE: API Upgrade

TBD

WSE has an upcoming upgrade to their trading system APIs for both market data and order entry. On the Go Live date of this new API, the current API will be decommissioned and the market will be fully migrated to the new versions.

- No functional changes are being implemented on the market data feed for display on TT

- New OTDs of Account Type and Trading Capacity will be introduced, which can be appropriately configured on TT

- TT will support the Self Match Prevention feature introduced along with this upgrade

- Customers are strongly advised to cancel any pending GTC/GTD/GTT orders before close of trading on the last day of the old API

While this upgrade in production was earlier planned for 10 Nov, this date has now been postponed by the exchange, and the announcement on the new date is awaited.

Further details regarding availability of testing in the TT UAT environment will be provided in the near future.

WSE conducted a connectivity test in the production environment on October 4, and TT participated successfully.

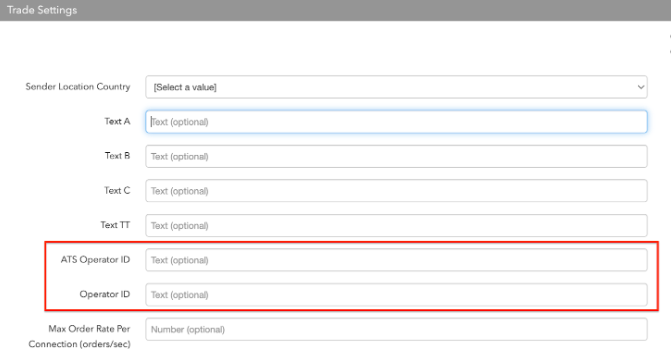

CFE: Upcoming ATS Operator ID Enforcement

December 5, 2025

To ensure compliance with CFE Rules 403(b) and 303A, TT will update system behavior related to the handling of Operator IDs (OEOID – FIX Tag 25004) for manual and automated orders.

As part of this update, TT will:

- No longer substitute the Manual Operator ID when the ATS Operator ID is not configured

- Omit Tag 25004 if the applicable Operator ID is missing, which will result in order rejection by CFE

TT intends to deploy this change to production at the end of the trading session on December 5, 2025. The update will take effect starting with the following trading session, December 7 (Sunday 5.00 pm).

To ensure compliance with CFE rules, and to avoid order rejections once software changes are implemented later this year, customers should review the User configuration in TT Setup and verify that the following fields are populated as needed:

- Manual Operator ID: Used for manual order entry

- ATS Operator ID: Used for orders submitted via automated trading systems

These are separate fields and must be configured independently.

Order behavior is as follows, based on the TT Setup configuration:

- If only the Manual Operator ID is configured:

- Manual orders will be accepted

- Automated orders will be rejected by CFE (Tag 25004 not sent)

- If only the ATS Operator ID is configured:

- Manual orders will be rejected by CFE (Tag 25004 not sent)

- Automated orders will be accepted

- If both Manual and ATS Operator IDs are configured:

- Manual orders will be accepted

- Automated orders will be accepted

- If neither field is configured:

- All orders (manual and automated) will be rejected by CFE

If you are unsure of your current Operator ID configuration or need assistance updating Setup, please contact your TT Onboarding representative or TT Support.

Additional Resources

CFE ATS Operator ID Reporting and Configuration FAQ

HKEX: Derivatives After Hours Trading (AHT) Enhancements

Q4, 2025

HKEX plans to introduce the below enhancements to their After Hours Trading (AHT) session in Q4 of 2025 –

- Equity index derivative product coverage expansion for US and UK Holidays

- Currently, on Memorial Day (US) and Spring Bank Holiday (UK), in the AHT session on HKEX, only the Currency and Metals AHT products are enabled for trading. This will be modified to include all AHT eligible products for trading on these US/UK holidays.

- On Christmas day, currently, only the Currency products are eligible for AHT session. This will be modified to include all MSCI and Currency products for trading on Christmas day.

- There is no change to the products that will be available for trading during the Day session on any of the holidays.

- Shortening of the market break between the Day and AHT session

- Currently, the market break between the Day and AHT session is of 45 mins. HKEX plans to start the AHT session 15 mins earlier, by reducing the market break to 30 mins.

- Widening of AHT Price Limits

- Currently, the price limits on all futures contracts traded in the AHT session is + or – 5%, and orders outside these price limits are rejected.

- The stock index futures traded on HKEX will be categorized into 2 baskets – flagship and non-flagship futures. While the initial price limits will be set at + or – 5% for both, those for the flagship products will be subject to a quarterly review, and can be periodically modified by HKEX.

- Index Option – Trade Resumption

- For the options contracts that are halted due to HKEX’s Trade Halt Mechanism, trading will be automatically resumed based on a deterministic model built by HKEX.

- Enhancement to the reference price determination methodology

- HKEX will modify their methodology used for determining the reference prices.

- Orders outside price limit boundary

- For orders entered during the Day session, and which may be outside the AHT price limits (price limits apply only to AHT session) and are carried over to the AHT session, such orders will not be rejected or canceled and can get traded outside the AHT price limits.

None of these proposed changes by HKEX have any direct impact on TT, and will be supported on TT without requiring any additional changes on TT.

SGX : Liquidity Switch from PV to PW Contracts

January 16 , 2026

Singapore Exchange (“SGX”) will carry out a liquidity switch service (“Liquidity Switch”) to migrate all open interest in the SGX Baltic Panamax Time Charter Average (4 Routes) Futures (“PV Contracts”) to SGX Baltic Panamax Time Charter Average (5 Routes) Futures (“PW Contracts”).

All open positions in PV Contracts on Friday, January 16, 2026 after the end of the T session, which are not netted off in post-trade activities will be automatically migrated by SGX to PW Contracts with clearing date 19 January 2026, Monday.

The PV Contracts will be suspended from trading after the end of the T session on 16 January 2026.

LME : Introduction of Variable Tick Size

January 20 , 2026

LME is adding variable tick sizes for selected Spread instruments . Currently , the tick size for all spread instruments is 0.01 . With this change , the 3W-3M or 3W-3W spreads of 6 products will have a different tick size . The variable tick size change will apply not only to 3M–3W and 3W–3W spreads for the six base metals, but to any spread where both legs are greater than the 3M prompt, including where the first leg of carry is the 3M prompt .

This change is now available in UAT

Imp :- Please note that all GTC orders resting in the book on EOD 19 January will get cancelled if their price is not a multiple of the updated tick size as defined by exchange

Eurex: TLS Upgrade 1.3

Q1, 2026

Eurex launched support for TLS 1.3 in October 2023 and has continued to support TLS 1.2 and TLS 1.3 in parallel. Support for TLS 1.2 will be decommissioned in Q1, 2026.

Currently, TT supports TLS 1.2 and will upgrade to TLS 1.3 in advance of the decommission date.

Customer Impact: There will be no impact on the customer experience, and no action is needed from customers.

JPX: H1 2026 Changes

April 13

JPX will introduce the below changes on Apr 13, 2026 –

- Revision to the Immediately Executable Price Ranges (DCB Price Ranges) for Gold Futures and Platinum Futures – These DCB price ranges, which are currently defined in fixed JPY values, will be revised to percentages.

- Revision in rules for mini 10 yr JGB FUT – The tick size on the mini 10 yr JGB futures as well as spreads will be revised from JPY 0.005 to JPY 0.01. Please note that all remaining orders for mini 10 year JGB Futures (including those made in strategy trading) will be canceled immediately after the end of the night session for the trading day of April 13, 2026. The night session for the trading day of April 13, 2026 will begin on the previous business Day Of April 10, 2026.

Neither of these changes require any change on TT side, and will automatically take effect once the changes are made by JPX.

Disaster Recovery and Mock Testing

TAIFEX : BCP and DR test

November 16

On November 16, TAIFEX will conduct a BCP / DR test on its trading platform. This test will be applicable to both day and night trading session systems.

TT supports market data on TAIFEX , and will participate in the testing. No participation from customers is required.

New Markets

Updated: NZX: NZX 20 Index Futures Relaunch Project

Q1, 2026

In Q1 2026, NZX will move forward with its S&P/NZX 20 Index Futures Relaunch Project which will be supported on the TT platform as a new market, NZX. NZX20 index futures and spreads will be supported.

NZX is now available for testing in UAT. Interested customers should reach out to their Onboarding representative to gain access to the market.

During the week of November 10-15, NZX will conduct streetwide testing for the upcoming launch of the NZX20 Index products. This testing will be a Dress Rehearsal for their go-live in Q1, 2026. All Trading and Clearing participants are expected to participate.

TT will support this testing in our UAT environment. Interested Participants can reach out to their local TT representative for more details.

More Information about the NZX20 Index products can be found here.

For all inquiries related to NZX20, please email [email protected].

New Products

Please Note: Trading Technologies’ default approach is to support every new product listed, on the product’s first day of trading, for all markets available on the TT trading platform. If a new product listing receives high-profile attention or is of significant industry importance, TT may announce support for it below. For all other new products announced by exchanges but not listed below, users should expect that TT provides support unless otherwise noted.

CFE: Launch of Continuous Bitcoin and Ether Futures

November 10

Cboe Futures Exchange (CFE) will launch new continuous futures contracts effective November 10, 2025.

- PBT: Cboe Bitcoin Continuous Futures

- PET: Cboe Ether Continuous Futures

These contracts are long dated (10-year expiry), cash-settled, and provide continuous exposure without the need for regular rolls.

Trading of these Futures will be supported on TT, but please note that funding-related information for these products will not be supported at this time.

Additional Resources

KRX: Support for Kosdaq Weekly Options

December 5

From December 5, TT will start supporting the newly launched Kosdaq Weekly Options on KRX. This release will also involve adding support on TT for the regular Kosdaq Options, V-KOSPI Futures, Gold Futures and Single Stock Options. These products are already supported by KRX, but are not currently supported on TT.

The exchange go live for the trading on the Kosdaq Weekly options is on 27 Oct, and TT will not support these on Day1.

These contracts are expected to be available in the TT UAT environment from Nov 14.

SGX: Introduction of Perpetual Futures

Nov 24, 2025

On Nov 24 , SGX will launch perpetual futures contracts for Bitcoin and Ethereum , subject to due regulatory process. Perpetual futures differ from regular futures in that they do not have an expiration date.

These products are not available in the SGX simulation environment currently . TT is running tests internally on these products . Once testing is complete , TT will announce the date for launching these products to UAT for customers to test.

Euronext: Introduction of Power Derivatives

February 2

Euronext, together with Nord Pool, will launch a new Euronext Nord Pool Power Futures market on the Euronext Optiq trading platform on 2 Feb 2026.

All the supported contracts are available for testing in the TT UAT environment.

Implied Prices are currently not supported by TT on Euronext, and the support for this will be deployed to TT UAT in a later release.

Note that 2 Feb is the date the power contracts will become tradable on Euronext, but the open interest migration from Nasdaq to Euronext will happen on 14 Mar.

Additional Resources

JPX: Introduction of Regular Contracts on TOPIX Banks Index options and TSE REIT Index options

April 2026

Currently, JPX supports flexible contracts only for TOPIX Banks Index Options and TSE REIT Index options. In April 2026, JPX will introduce regular contracts on these products.

TT plans to support these contracts from Day 1, and further details on this will be announced in subsequent system news.