Critical Updates

This Weekend: CME SOFR Options Tick Changes

September 21

This weekend, the CME will modify the Quarter tick eligibility for options on the following products.

- SR3

- 1YH

- 1YM

- 1YU

- 1YZ

- 2YH

- 2YM

- 2YU

- 2YZ

See here for details from the CME:

https://www.cmegroup.com/notices/electronic-trading/2025/09/20250915.html#ctsoqte

Customers who trade these Options via TTW must refresh their workspace after 15:30 CDT on Sunday, September 21, in order for the tick changes to take effect.

Customers trading via FIX should ensure that their weekly security definition download occurs after 15:30 CDT on Sunday, September 21.

If you need any assistance please reach out to TT Support.

Introducing the New TT Customer Portal

September

The TT Customer Portal will launch in September with a modern and intuitive experience that will allow you to access essential TT applications, support tools, documentation and training resources from a single, centralized location.

Access to the TT Customer Portal in UAT will be available starting July 24, followed by a tiered rollout to Production environments during August and September.

TT Live: TT Customer Portal Walkthrough

To help you navigate the new portal and maximize your experience, watch our short guided video walkthrough.

You will learn how to:

- Navigate the portal and access individual applications in new tabs

- Utilize the Help Library, “My open tickets,” Security Center, Status page and TT Learning tabs to track and manage Support interactions, monitor TT system status and leverage self-guided learning resources

- Access applications such as Trade, ADL®, Monitor, Setup, Workspace Management and more

Watch the video now.

For more information about the TT Customer Portal, please contact your TT representative.

B3: Binary Protocol

B3 has rolled out new low latency binary protocols for market data via the Binary Unified Market Data Feed (UMDF) and for Order entry (Simple Binary Encoding (SBE).

TT has already migrated its Market Data to the binary UMDF protocol and, for order entry, currently supports both the legacy FIX API and the new binary API.

Please note that B3 continues to support the legacy protocols in parallel with the new Binary offering, and the TT migration will follow a phased approach:

- Phase 1- Completed: TT upgraded its Market Data feed to use the new Binary UMDF protocol.

- Phase 2- In Progress: Customers can continue using their existing FIX order connections while also having the option to configure new binary API connections.

- Phase 3- Future: TT will discontinue support for the legacy FIX order entry API, requiring all customers to use the Binary Order Entry API connections. Any GTC/GTDate orders resting on legacy FIX connections will be canceled when the cut-off occurs.

NOTE: B3 has set the length of the “Entering Trader” value to five on the Binary Order Entry API.

TT will announce the deprecation date for the FIX order entry API later in 2025.

SGX_GIFT: Trading System Password Policy

September 22

SGX_GIFT will revise the number of allowed invalid user logins to the NNF API and NEAT GUI. The following shows the change which will be effective from September 22:

Current password policy: User ID is locked after 5 invalid login attempts

Proposed password policy: User ID shall be locked after 3 invalid login attempts

This exchange password policy change is also applicable to Gift Connect FIX logins and Gift Connect TCS Bancs PTRC and Drop Copy GUI).

Additional Information:

LSEG: Eurex – RIC rename for 2 digit year code

October 6

In October of this year, Refinitiv (LSEG) will rename Eurex RICs representing Futures and Spread contracts both on Real-time and Reference Data Products to support two-digit year codes. Underlying Futures contracts for Options on Futures will be displayed with a 2 digit year code. This change will also be applicable for Market by Price data, Level 2 RICs and delayed data.

TT will deploy the required changes to Production before the Refinitiv planned changes in production. These changes are now available for testing in UAT.

All currently deployed versions of TT FIX services are compatible with this change. TT customers using RICs for FIX Order Routing, Drop Copy or Market Data are encouraged to test their FIX applications in UAT prior to go-live.

Euronext: Optional order field for Liquidity Provider ID

October

In October of this year, Euronext will add support for an optional field of Liquidity Provider ID on the order messages. This field will be available for configuration on TTUS under account settings.

FIX users can use FIX parties block Tag 448 for specifying this ID, with Tag 452 = 35.

Note that the existing field of LP Role will be set as 1 (Liquidity Provider and Market Maker) by TT, when the Account Type is specified as Market Maker, as that is the only value allowed by Euronext on the derivatives market. No value needs to be specified by customers for the LP Role field.

The Liquidity Provider ID field is now available in the TT UAT environment for customer testing.

FMX and FMX_USTF: Optional order fields for Clearing Firm and Position Account

November 3

FMX has added support for specifying the clearing firm and the position account on the orders sent to the exchange. TT plans to add support for these fields on 3 November. These fields will be available as configurable fields under account settings on the TT User Setup. FIX users can use FIX party blocks with party role 4 and 38 for the clearing firm and position account respectively.

These fields are expected to be available in the TT UAT environment for customer testing from 24 Oct.

Eurex/EEX/NODAL : T7 14.0 Upgrade

November 10

Deutsche Börse will release T7 14.0 to Production on November 10, 2025 across Eurex, EEX and NODAL. Simulation access for T7 Release 14.0 will be available from the exchange on September 1, and TT plans to provide access in UAT as soon as possible once internal testing is complete.

Additional information from the exchange (including System documentation, circulars and timelines) is available on the T7 14.0 initiative page via the following link: www.eurex.com > Support > Initiatives & Releases > T7 Release 14.0

The following are the anticipated milestones for this project:

| Milestone | Expected Date | Delivered Date |

| Exchange Upgrade Announcement | 6/13/2025 | 5/5/2025 |

| Exchange Preliminary Release Notes | 7/13/2025 | 7/01/2025 |

| Exchange Preliminary Specifications | 7/28/2025 | 7/01/2025 |

| Exchange Simulation Available | 9/01/2025 | 9/01/2025 |

| TT Deployment to UAT | 9/05/2025 | 9/08/2025 |

| TT Impact Analysis | 9/19/2025 | 9/19/2025 |

| TT Delivery of Go-Live Plan | 9/19/2025 | 9/19/2025 |

| Customer UAT Completion Target | 10/25/2025 | |

| Exchange Connectivity Test | 11/08/2025 | |

| Exchange Go-Live | 11/10/2025 |

TT Impact Analysis and Go-Live Plan:

No customer action is required for this release. TT will conduct template upgrades the weekend before November 10th and participate in exchange connection testing during the go-live weekend. We will closely monitor all services at startup on Monday, November 10th, and address any issues that may arise.

Eurex is implementing an enhancement for SMP with T7 14.0. TT is currently reviewing these requirements and plans to support these SMP enhancements; a due date will be announced soon.

TT will submit its Readiness Statement to the exchange once testing is complete.

WSE: API Upgrade

November 10

On November 10, WSE will upgrade their trading system APIs for both market data and order entry. As of this date, the current API will be decommissioned and the market will be fully migrated to the new versions.

- No functional changes are being implemented on the market data feed for display on TT

- New OTDs of Account Type and Trading Capacity will be introduced, which can be appropriately configured on TT

- TT will support the Self Match Prevention feature introduced as part of this upgrade

- Customers are strongly advised to cancel any pending GTC/GTD/GTT orders before close of trading on November 7

Further details regarding availability of TT UAT for testing will be updated in subsequent system news.

Exchange has scheduled 2 mock testing sessions in the production environment for this change on 4 and 25 Oct, and TT plans to participate in both these sessions.

MIAX: API Upgrade and Minneapolis Hard Red Spring Wheat Options Support

November

MIAX Futures has published updated Interface Specifications for the MIAX Futures Onyx trading platform to support enhancements expected to be implemented into production in Q4 2025.

TT plans to support the options contracts on Minneapolis Hard Red Spring Wheat Futures along with this upgrade.

Along with the support for options, MIAX has also introduced a change on their order gateway, wherein any modification to the Time In Force of the original order will be rejected by MIAX.

The exact date for this release will be confirmed once the date is announced by MIAX.

JPX : Tick Change for Nikkei Options

November 17

The tick size table for the Nikkei Options on JPX will be updated on November 17.

| Current | To Be |

| Tick Size = 1, for prices 0 to 100Tick Size = 5, for prices above 100 | Tick Size = 1, for prices 0 to 300Tick Size = 5, for prices above 300 |

This change will be applicable for both – regular Nikkei 225 Options (Product Symbol = 225), as well as Nikkei 225 Mini Options (Product Symbol = 225M).

This change is now available in the TT UAT environment for customer testing..

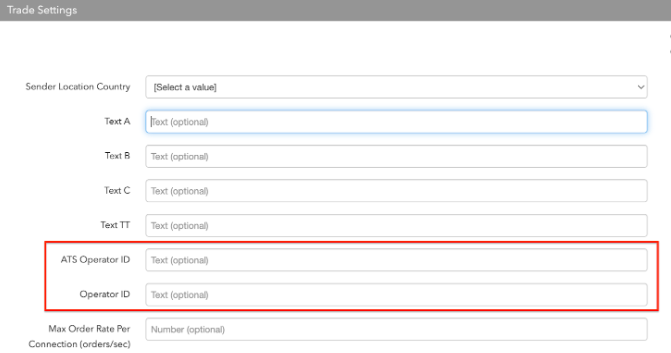

CFE: Upcoming ATS Operator ID Enforcement

Q4, 2025

To ensure compliance with CFE Rules 403(b) and 303A, TT will update system behavior related to the handling of Operator IDs (OEOID – FIX Tag 25004) for manual and automated orders.

As part of this update, TT will:

- No longer substitute the Manual Operator ID when the ATS Operator ID is not configured

- Omit Tag 25004 if the applicable Operator ID is missing, which will result in order rejection by CFE

TT plans to deploy this update in Q4 2025. The tentative effective date is November 15, 2025.

Required Action in TT Setup

To ensure compliance with CFE rules, and to avoid order rejections once software changes are implemented later this year, customers should review the User configuration in TT Setup and verify that the following fields are populated as needed:

- Manual Operator ID: Used for manual order entry

- ATS Operator ID: Used for orders submitted via automated trading systems

These are separate fields and must be configured independently.

Order behavior is as follows, based on the TT Setup configuration:

- If only the Manual Operator ID is configured:

- Manual orders will be accepted

- Automated orders will be rejected by CFE (Tag 25004 not sent)

- If only the ATS Operator ID is configured:

- Manual orders will be rejected by CFE (Tag 25004 not sent)

- Automated orders will be accepted

- If both Manual and ATS Operator IDs are configured:

- Manual orders will be accepted

- Automated orders will be accepted

- If neither field is configured:

- All orders (manual and automated) will be rejected by CFE

If you are unsure of your current Operator ID configuration or need assistance updating Setup, please contact your TT Onboarding representative or TT Support.

SGX : Liquidity Switch from PV to PW Contracts

January 16 , 2026

Singapore Exchange (“SGX”) will carry out a liquidity switch service (“Liquidity Switch”) to migrate all open interest in the SGX Baltic Panamax Time Charter Average (4 Routes) Futures (“PV Contracts”) to SGX Baltic Panamax Time Charter Average (5 Routes) Futures (“PW Contracts”).

All open positions in PV Contracts on 16 January 2026, Friday after the end of the T session, which are not netted off in post-trade activities, will be automatically migrated by SGX to PW Contracts with clearing date 19 January 2026, Monday.

The PV Contracts will be suspended from trading after the end of the T session on 16 January 2026.

Eurex: TLS Upgrade 1.3

Q1, 2026

Eurex launched support for TLS 1.3 in October 2023 and has continued to support TLS 1.2 and TLS 1.3 in parallel. Support for TLS 1.2 will be decommissioned in Q1, 2026.

Currently, TT supports TLS 1.2 and will upgrade to TLS 1.3 in advance of the decommission date.

Customer Impact: There will be no impact on the customer experience, and no action is needed from customers.

Disaster Recovery and Mock Testing

MEFF: Data Centre Migration Failover Test

September 21

On September 21, MEFF will migrate its secondary data center from Plaza de la Lealtad to the Equinix MD6 building in Alcobendas. A failover test is scheduled for September 21 to validate business continuity processes by confirming seamless failover from the primary site (Las Rozas) to the new secondary site (Alcobendas).

TT will participate in this connectivity test, and no customer action is required.

Nasdaq Nordic Equity Derivatives: Verification of Failover Functionality

September 27

On Saturday, September 27, Nasdaq will perform verification tests of the site failover functionality in the Genium INET Production and Nasdaq Equity Derivatives Trading Production (NDTS) environments. The systems will be available for Nasdaq Exchange and Clearing members for login and standard reference data, and business queries. No other type of business functionality will be enabled.

TT will participate in this connectivity testing, and no customer action is required.

Additional Resources:

NASDAQ_TEST_TECHNICAL_DETAILS.pdf

Registration and Report Sept 2025.pdf

TFEX: Order Gateway Rebalance Q4

October 4

On October 4, TFEX will conduct its quarterly order gateway rebalance. Impacted customers will be notified by the exchange during the week of September 8th – 12th should changes to their connections be required.

Affected customers should contact their TT Service Managers or Onboarding representative in order to confirm their participation in this connectivity test..

FIA: Industry-Wide Testing

October 25

The Futures Industry Association will sponsor its annual Industry-Wide Disaster Recovery Testing (IWT) on Saturday, October 25. We will facilitate customer participation for registered TT platform customers.

Testing will be available on the following exchanges:

- CDE

- CFE

- CME

- EEX

- Eurex

- Euronext

- FMX

- ICE

- MIAX

- Nodal

- Montréal Exchange

- Nodal

Additional details are available from the FIA here:

https://www.fia.org/fia/events/2025-fia-disaster-recovery-exercise

Customers who plan to participate in the FIA IWT should contact their Onboarding Manager to register for testing and provide exchanges that will be tested along with Connection IDs that will be used during the test.

Ping/telnet tests for relevant exchanges will be completed by TT staff as required.

New Markets

NZX: NZX 20 Index Futures Relaunch Project

Q4, 2025

In Q4, NZX will move forward with its S&P/NZX 20 Index Futures Relaunch Project which will be supported on the TT platform as a new market, NZX. NZX20 index futures and spreads will be supported.

NZX is now available for testing in UAT. Interested customers should reach out to their Onboarding representative to gain access to the market.

More Information about the NZX20 Index products can be found here.

For all inquiries related to NZX20, please email [email protected].

New Products

Please Note: Trading Technologies’ default approach is to support every new product listed, on the product’s first day of trading, for all markets available on the TT trading platform. If a new product listing receives high-profile attention or is of significant industry importance, TT may announce support for it below. For all other new products announced by exchanges but not listed below, users should expect that TT provides support unless otherwise noted.

HKEX: Introduction of 10-Year China Ministry of Finance Treasury Bond Futures

TBD

HKEX has announced the long-awaited introduction of 10-year China Ministry of Finance Treasury Bond Futures to its product line-up. The product launch will be announced when the preparatory work is completed on the exchange side.

Changes to the TT platform are not needed for support of the new product. The product symbol is HTT, and it is available now for testing in the UAT Environment.

Additional Resources

Exchange Circular EBF/FIC/004/24

CDE: Launch of Mag7 + Crypto Equity Index Futures

September 21

Coinbase Derivatives is launching Mag7 plus Crypto Equity Index Futures (symbol: MC) on Sunday, September 21, 2025, at 17:00 CT. Trading hours will run Sunday 17:00 CT – Friday 16:00 CT with a daily break from 16:00 -17:00 CT.

Euronext: Introduction of Fixed Income Derivatives

September 22

As part of the Fixed Income Derivatives initiative, Euronext will introduce a set of futures on main European government bonds (10yr BTP, OAT, BUND, BONO and 30yr BTP) on the Euronext Derivatives Milan market on September 22.

These products are now available in TT UAT, and any trader who has access to the Euronext IDEM instruments on TT may trade them. The details of these product symbols are as follows:

| Contract Name | TT Symbol |

| BONO mini-futures 10 yr | tMBON |

| BTP mini-futures 10 yr | tMBTP |

| BTP mini-futures 30 yr | tMBTX |

| BUND mini-futures 10 yr | tMBUN |

| OAT mini-futures 10 yr | tMOAT |

Strategy Creation on the Inter Contract Spreads on these products is not currently supported via TT, however support will be added in a future release.

Additional Resources

EEX : Fiscal Year Future for Japanese Power Markets

October 14

The European Energy Exchange (EEX) will expand its Japanese power derivatives offering with the launch of EEX Japanese Power Fiscal Year Futures for the Tokyo and Kansai market areas with effect from Tuesday, 14 October 2025.

| Contract Name | TT Symbol |

| EEX Japanese Power Tokyo Area Base Fiscal Year Future | FOBF |

| EEX Japanese Power Tokyo Area Peak Fiscal Year Future | FOPF |

| EEX Japanese Power Kansai Area Base Fiscal Year Future | FQBF |

| EEX Japanese Power Kansai Area Peak Fiscal Year Future | FQPF |

The upcoming EEX Japanese Fiscal Year Futures will replace the existing EEX Japanese Year Futures for the Tokyo and Kansai areas. EEX intends to discontinue the existing Year Futures (subject to Exchange Council approval) once the EEX Japanese Fiscal Year Futures are introduced. In scope for the delisting are the EEX Japanese Power Tokyo & Kansai Area Base & Peak Year Futures (FOBY/FOPY/FQBY/FQPY)

Additional Resources

CFE: Launch of continuous Bitcoin and Ether Futures

November 10

Cboe Futures Exchange (CFE) will launch new continuous futures contracts effective November 10, 2025.

- PBT: Cboe Bitcoin Continuous Futures

- PET: Cboe Ether Continuous Futures

These contracts are long dated (10-year expiry), cash-settled, and provide continuous exposure without the need for regular rolls.

Please note that funding-related information for these products will not be supported on TT at this time.

Additional Resources

SGX: Introduction of Perpetual Futures

Q4 2025

In Q4, SGX plans to launch perpetual futures contracts, subject to due regulatory process. Perpetual futures differ from regular futures in that they do not have an expiration date.

SGX has launched a sample product in the simulation / UAT environment. TT users can find this product with the name ABCP. Note that this is a dummy product, and the actual products and their launch date will be announced by SGX in due time. Once these products are formally announced and supported in Simulation, TT will communicate future plans for support.

Euronext: Introduction of Power Derivatives

February 2

Euronext, together with Nord Pool, will launch a new Euronext Nord Pool Power Futures market on the Euronext Optiq trading platform on 2 Feb 2026.

The monthly contracts will be available for testing in the TT UAT environment from 24 Sep.

Additional features in support of the Power Derivatives market will be deployed to TT UAT in a later release, and further details will be announced in subsequent updates. This will include support for the below:

- Other types of contracts (Yearly, Quarterly, Weekly and Daily expiry contracts. Expected to be available in TT UAT by 23 Oct)

- Implied Prices

- Strategy Creation on Inter-Contract Spreads

Additional Resources