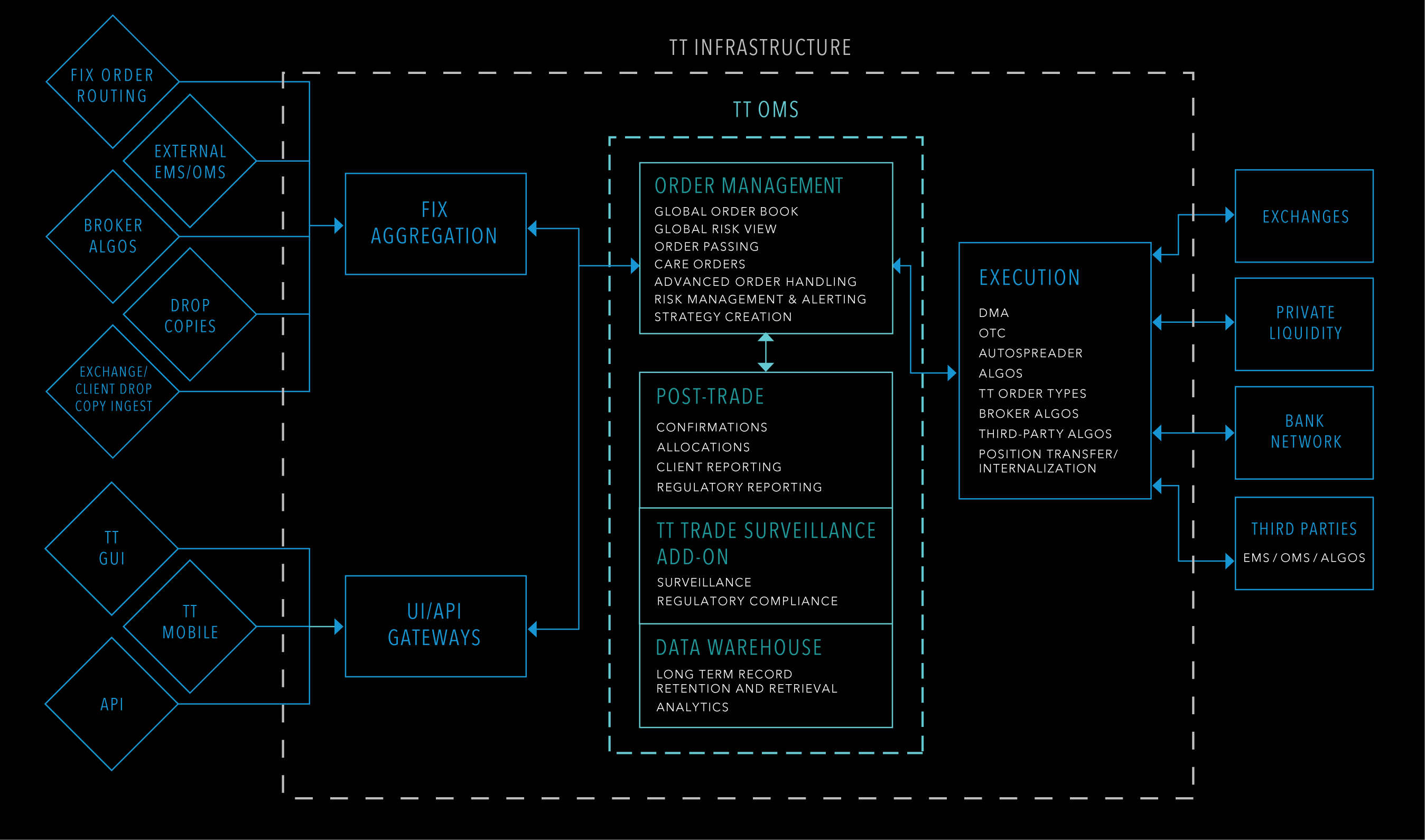

TT® OMS

The most advanced trading tools delivering a more cost-effective order management system.

Benefits

Open Platform

Accept order flow from any EMS, OMS or algo provider via FIX.

Global Order Book

Control the visibility of customer orders and pass ownership to another user, group or desk.

High-Touch Workflows

Accept, manage and execute orders and conduct post-trade confirmations and allocations.

Execution Tools

Leverage ADL®, Autospreader®, TT Order Types, broker algos and third-party algos for superior execution on dozens of colocated exchanges worldwide.

FIX Routing

Route orders via TT FIX Gateway to any number of destinations, including bank networks, private liquidity pools and third-party systems.

Internalization

Take advantage of Position Transfer or private matching engines to improve executions and avoid crossing.

Highlights

- Dramatically improved transparency and accountability from consolidating all order management and execution on one platform.

- Open architecture provides 100% seamless OMS integration with your existing trading operations.

- Accounts and account hierarchy can be imported from your back office.

- Receive alerts upon order rejects, unsolicited cancels, wash trades and more.

- Automatically generate and send reports to customers on a schedule.

- Generate compliance reports for various regulatory needs.

Care Orders

Separate the trading decision from the mechanics of execution.

Stage

Submit care orders via your FIX client or TT screen to your broker or internal desk for execution.

Claim

Take ownership of care orders that your customer staged and work according to parameters and instructions.

Execute

Use your expertise and all of the tools available, including DMA, OTC trades, execution algos and more, to fill your customers’ care orders.

Internalize

Fill internal care orders out of the firm’s position or inventory with manual fills and internally match offsetting orders with Position Transfer.

Advanced Order Handling

Combine orders into spreads for more efficient executions.

Stitching

Combine buy orders for one expiry with sell orders for another expiry and execute as an exchange-listed spread.

Splitting

Split orders apart and stitch together with orders of equal quantity to execute as spreads. Then execute the leftover contracts as outrights.

Lock and Release

Completely fill a customer’s order before releasing fills and execution reports.

Bulk Orders

Optimize executions by grouping orders together.

Bulking

Combine multiple care orders with the same instrument, side and price into a single order for more efficient execution.

Allocations

Assign bulk order fills to the appropriate accounts using the desired allocation algorithm.

TEO

Manage post-trade allocations and client confirmations with TT’s comprehensive electronic blotter.

Complete Global Blotter

Combine multiple care orders with the same instrument, side and price into a single order for more efficient execution.

Efficient Allocations

Assign bulk order fills to the appropriate accounts using the desired allocation algorithm.

Sophisticated Confirmations

Deliver client confirmations through customer-specific or industry-standard systems, such as Bloomberg VCON or Traiana.