The IDEM market of Borsa Italiana expands trading hours and continues on its growth path.

IDEM, the Italian Derivatives Market of Borsa Italiana and part of London Stock Exchange Group, was one of the fastest growing equity derivatives markets last year in Europe, trading nearly 49 million lots. This performance was led by FTSE MIB futures and FTSE MIB options, with both experiencing double-digit growth in 2016. The IDEM market has also seen record liquidity thanks to the support of 24 global market-making firms and the significant contribution of the online trading community–heralded by IDEM as a unique situation in Europe. We spoke with Massimo Giorgini, Head of Equity and Derivatives Markets Business Development at Borsa Italiana – London Stock Exchange Group, about recent developments at IDEM.

IDEM, the Italian Derivatives Market of Borsa Italiana and part of London Stock Exchange Group, was one of the fastest growing equity derivatives markets last year in Europe, trading nearly 49 million lots. This performance was led by FTSE MIB futures and FTSE MIB options, with both experiencing double-digit growth in 2016. The IDEM market has also seen record liquidity thanks to the support of 24 global market-making firms and the significant contribution of the online trading community–heralded by IDEM as a unique situation in Europe. We spoke with Massimo Giorgini, Head of Equity and Derivatives Markets Business Development at Borsa Italiana – London Stock Exchange Group, about recent developments at IDEM.

Continue Reading →

Tags: 5 Questions / Interviews

Lisa Ward has more than six year’s experience working in finance and banking in a range of roles including operations, customer relations, project management, accounts and Treasuries. Her drive and enthusiasm for learning new things led her to discover a passion for markets—specifically for the oil industry. As a result of her love of oil, she co-founded an online community known as The Organization of the Oil-Trading Tweeters, or #OOTT on Twitter, which has grown to include several million members. Lisa and her co-founder, Samir Madani, also developed a way to track global maritime oil movements and created the TankerTrackers website. Follow her on Twitter at @Lisa_Ward1990.

Lisa Ward has more than six year’s experience working in finance and banking in a range of roles including operations, customer relations, project management, accounts and Treasuries. Her drive and enthusiasm for learning new things led her to discover a passion for markets—specifically for the oil industry. As a result of her love of oil, she co-founded an online community known as The Organization of the Oil-Trading Tweeters, or #OOTT on Twitter, which has grown to include several million members. Lisa and her co-founder, Samir Madani, also developed a way to track global maritime oil movements and created the TankerTrackers website. Follow her on Twitter at @Lisa_Ward1990.

Continue Reading →

Tags: 5 Questions / Interviews

The following is a guest post by Christopher Rodriguez, chief marketing and relationship management officer of Eris Exchange, and Geoffrey Sharp, Eris’ managing director and head of sales. Eris is a U.S. futures exchange that offers listed interest rate swap futures. Trading Technologies offers connectivity to Eris through both the TT® and X_TRADER® platforms.

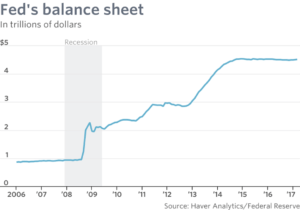

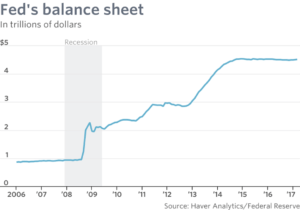

The last 30 years of monetary policy have been dominated by control of short rates. But with an unprecedented buildup of central bank balance sheets since the global financial crisis, central banks now have another lever, and their impact on long rates cannot be ignored. Specifically, the Fed has started to signal a desire to reduce the size of its balance sheet, which could commence later this year. There is little doubt that we are in uncharted territory, with limited precedent or standard to follow, and this normalization needs to be balanced against the impact of further rate hikes and the recent apparent softening of U.S. economic data.

The last 30 years of monetary policy have been dominated by control of short rates. But with an unprecedented buildup of central bank balance sheets since the global financial crisis, central banks now have another lever, and their impact on long rates cannot be ignored. Specifically, the Fed has started to signal a desire to reduce the size of its balance sheet, which could commence later this year. There is little doubt that we are in uncharted territory, with limited precedent or standard to follow, and this normalization needs to be balanced against the impact of further rate hikes and the recent apparent softening of U.S. economic data.

Continue Reading →

As the industry has been preparing for the implementation of MiFID II (Markets in Financial Instruments Directive II) in 2018, so too has Trading Technologies been working closely with our clients on planning and executing compliance solutions. Over the next few months, I will be sharing my thoughts and TT’s point of view on MiFID II and industry implications. We begin the first in a series of blog posts with what is MiFID, how did we get here and what does it all mean?

MiFID II is a consequential and reactionary financial regulation born from MiFID I and the same G20 Pittsburgh meeting in 2009 that instigated the blueprints of its older siblings, Dodd-Frank, EMIR, REITS and, recently, the seemingly stalled Regulation Automated Trading (Reg AT), post the 2008 financial crash.

Continue Reading →

David Stendahl is founder and president of Signal Trading Group, an international speaker and the author of four books. He has designed trend, pattern and momentum-style trading systems for more than 20 years. As a Commodity Trading Advisor (CTA), he traded 40 individual futures markets across eight different sectors. He currently focuses on trading the global futures markets, following a systematic, low-leveraged, highly diversified trading regiment. Follow him on Twitter at @David_Stendahl.

Continue Reading →

Tags: 5 Questions / Interviews

IDEM, the Italian Derivatives Market of Borsa Italiana and part of London Stock Exchange Group, was one of the fastest growing equity derivatives markets last year in Europe, trading nearly 49 million lots. This performance was led by FTSE MIB futures and FTSE MIB options, with both experiencing double-digit growth in 2016. The IDEM market has also seen record liquidity thanks to the support of 24 global market-making firms and the significant contribution of the online trading community–heralded by IDEM as a unique situation in Europe. We spoke with Massimo Giorgini, Head of Equity and Derivatives Markets Business Development at Borsa Italiana – London Stock Exchange Group, about recent developments at IDEM.

IDEM, the Italian Derivatives Market of Borsa Italiana and part of London Stock Exchange Group, was one of the fastest growing equity derivatives markets last year in Europe, trading nearly 49 million lots. This performance was led by FTSE MIB futures and FTSE MIB options, with both experiencing double-digit growth in 2016. The IDEM market has also seen record liquidity thanks to the support of 24 global market-making firms and the significant contribution of the online trading community–heralded by IDEM as a unique situation in Europe. We spoke with Massimo Giorgini, Head of Equity and Derivatives Markets Business Development at Borsa Italiana – London Stock Exchange Group, about recent developments at IDEM.

Lisa Ward has more than six year’s experience working in finance and banking in a range of roles including operations, customer relations, project management, accounts and Treasuries. Her drive and enthusiasm for learning new things led her to discover a passion for markets—specifically for the oil industry. As a result of her love of oil, she co-founded an online community known as The Organization of the Oil-Trading Tweeters, or

Lisa Ward has more than six year’s experience working in finance and banking in a range of roles including operations, customer relations, project management, accounts and Treasuries. Her drive and enthusiasm for learning new things led her to discover a passion for markets—specifically for the oil industry. As a result of her love of oil, she co-founded an online community known as The Organization of the Oil-Trading Tweeters, or