With a few blogs already posted on using Autospreader, I thought it would be good to take a step back, look at the basic functionality of TT’s Autospreader and provide some insight on how it works.

In my former life as a market maker at the Chicago Board Options Exchange (CBOE), it was instilled in me very early on that no trade should occur without knowing ahead of time how that trade would be offset or hedged with another trade. I won’t get into the details of options trading and all the potential strategies here, but there are numerous ways to hedge trades and create a position that could make a profit or incur a loss based on many different factors.

Every trade that involves another trade against it in another contract to create a position could be referred to as a spread. At the most basic level, spread trading involves buying one contract and selling another contract at the same time. The basic premise behind spread trading is that you can profit from the changes in the pricing relationships of two or more contracts or products.

The mindset and habits I learned from trading options and taking advantage of price discrepancies involving multiple products carried over to the futures world, where spread trading has been around since the inception of futures products and contracts.

Evolution of Futures Spread Trading

As futures markets began to move rapidly to electronic trading and screen-based trading became the norm, spread traders acquired the ability to watch two or more futures markets and pounce when the opportunity presented itself to put on a spread trade. Of course, market participants were often competing for trades as they tracked the same conditions and attempted to put on the same spread trade.

Early on, screen-based spread trading was done manually. In some cases, the manual method of spread trading futures didn’t work so well if the hedge market moved before the trader was able to execute the hedge trade.

Such volatile hedge markets often presented challenges to locking in the desired price differential. Basically, spread traders looking for a specific spread price were attempting to trade two or more markets at the same time.

This required a good set of mouse skills as the trader needed to work an order at some price level based on where the market was trading in another contract. Once the market conditions changed, the trader needed to manually change the price of the working order. This process would continue over and over until the order was filled, and then it was a race to get the hedge trade executed. Those with superior mouse skills were able to execute the offsetting hedge fast enough and complete the entire spread trade, and then start the process all over again in an attempt to profit.

So Came Autospreader®…

For the reasons described above, it was apparent that there was a need for an automated method to spread trade futures. Autospreader is a tool that provides traders with an automated means of quoting and executing spread orders, which consist of two or more contract legs. It is Autospreader’s number one job to watch prices and volume in multiple markets and make very quick decisions on where to place orders to get you the spread.

Based on user-defined parameters and the outright market prices for the spread legs, Autospreader calculates and displays a spread market where traders can submit spread orders at the desired spread price.

|

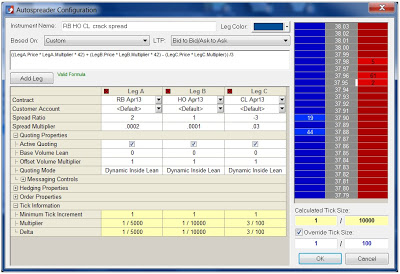

| The Autospreader® Configuration window as displayed in the upcoming release of X_TRADER, version 7.17.1 |

When you first look at the Autospreader configuration window and all the parameter settings, it may seem like a lot of information to put on a spread trade, but at the basic core of Autospreader is the engine that is designed to automatically work the legs in the outright markets to achieve the desired spread price. Specifically, when a spread order is entered at a spread price using Autospreader, buy and sell orders are automatically entered in the underlying legs. This is where the fun really begins.

Autospreader works these bids and offers dynamically in the spread legs to maintain the desired spread price, which is the differential between the prices of the legs. As the outright markets change in the legs of the spread, Autospreader automatically manages the orders it has working in the market to maintain the desired spread price. When one side of the leg is executed, Autospreader will automatically send an offsetting order into the other leg(s) to complete the spread.

At its core, Autospreader manages these outright orders that make up the spread from the moment the spread order is placed until the spread order is filled or deleted.

To better facilitate this core behavior, TT has incorporated the Autospreader Strategy Engine (Autospreader SE), which combines Autospreader’s spread trading flexibility with ultra-low latency proximity execution. When spreads are traded on an Autospreader SE located thousands of miles away, you can be in London spread trading ICE products as if you’re trading in Chicago eating deep dish pizza looking out over Lake Michigan.

Once you understand the basic core behavior of Autospreader, you can understand all the features and settings that make up the configuration—including when and where to quote and what price level to send the hedge order.

Conclusion

I hope this gives you some insight into the inner workings of Autospreader and how it functions. With more than a decade of history behind it, Autospreader has evolved and will continue to evolve with user-driven innovation. Above all, however, the core function of Autospreader as described above is the most important feature, and we will continue to strive to make Autospreader the best tool for spread trading.

To learn more, please see the TT website and the dedicated page for Autospreader, where you will find a wealth of information on both basic functionality and more advanced features.

Please feel free to share your thoughts, and stay tuned for more insight on Autospreader in future blogs.