Have you ever wanted to buy something in one location to sell it in another location at a higher price? Imagine buying gold on CME only to turn around and sell it on TOCOM at a higher price. This type of trade is known as geographical arbitrage.

While there is risk in every trade, geographical arbitrage is relatively low risk. The faster you can execute and the more alike the underlying products, the better the arb. Gold as an underlying makes for an almost perfect hedge, as the gold quality is identical. This is not true for most other commodities.

One major factor here is the two products are priced in different currencies. A currency conversion is required, and this conversion value is not static like some other conversion factors used for spreading. For example, in this spread, I will use a static conversion of 1 kilogram equal to approximately 32.15 troy ounces. This value will not change during my arb, but the dollar-to-yen ratio will.

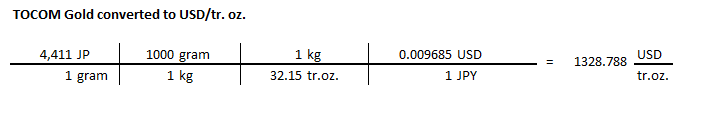

Let’s begin by calculating how to set up this trade. I will convert the yen-to-dollar using 6J on CME and grams to troy ounces. Below is a table that shows this conversion to get TOCOM gold priced in U.S. dollars and troy ounces.