← Back to Trade Talk Blog

I recently ran across an interesting post on EliteTrader. The author was looking for software capable of charting synthetic spreads with more than two legs such as the bund-bobl-schatz fly or crack spread. I shared my thoughts on the topic in the EliteTrader forum, but I thought the topic was compelling enough to address here on Trade Talk.

As was mentioned on EliteTrader by another member, charting a synthetic spread created from the underlying legs is not as simple as comparing the last traded price of one leg to the others or using one-minute bar data to compute the spread prices. To prevent from “charting a mirage” as the member stated in the post, we have gone out of our way to provide a better spread chart here at TT. We capture all best bid-ask market moves and traded prices, such that we look at one leg’s best bid or ask price when a trade occurs on the other leg’s bid or ask.

The above method creates an excellent synthetic spread chart, and we support up to 10 legs in a spread. The nice thing about TT is once you create the spread for trading, there is no additional work to create the spread chart. You can request the synthetic instrument and add studies and drawing tools just like a regular instrument in the chart.

Our bid-to-bid/ask-to-ask spread charts will calculate a spread price whenever there is a trade on one leg. If the trade occurs on the bid of leg one, then we will look at the bid of the other legs if they are required to sell and the ask if they are required to buy to determine the spread price. This effectively acts as getting edge on one leg with a limit fill, and the other legs going to market to complete the spread.

|

Synthetic spread charts (L) will have more data and provide more information

about how a spread moves compared to exchange traded spread charts (R). |

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

Today’s financial markets generate a volume of data barely dreamed about in the early days of electronic trading. Every year, exchanges create a record-breaking amount of transactions, and we know that somewhere within all of that data there lies a digital treasure chest. Finding a way to analyze and deliver this valuable data is a multi-headed problem, roughly broken down between charting, historical trade display and research scenarios.

In my role as an engineering manager at TT, I’m part of a team that’s been working to solve this problem in the new TT platform. We think we’ve found the answer by leveraging cutting-edge technologies, Node.js and Amazon Web Services (AWS). I’m excited about our solution, which is now automatically available to all TT platform users. Read on to learn more about our approach and how it can help you overcome the multi-faceted big-data challenges we all encounter today.

Node.js

Node.js is a run-time environment built on the same technologies that power the web, namely JavaScript. It was built around a few simple ideas and has rapidly grown out of its San Francisco hacker origins into enterprise software used by huge firms like Walmart and PayPal. If you have ever worked at a large enterprise with existing legacy architecture(s), you probably know how hard it is to turn an organization of that size onto a brand-new, relatively unknown technology platform. The answer in the case of Node.js is, surprisingly, very simple. Node.js is arguably the best web service platform available today, even though it hasn’t even hit the 1.0 version mark yet. Coding is simple, performance can be faster than Java/C++ web server(s) and the platform is easily scalable with features like the Node.js Cluster API.

One of the new technologies that makes the TT platform possible is WebSockets, which we use to deliver real-time data to both our mobile and desktop users around the world. Writing a WebSocket server with Node.js is as simple as writing just a few lines of code. Check out this example from the popular Node.js “ws” package. This is literally all you need to run a WebSocket server in Node.js:

Continue Reading →

Continue Reading →

Tags: Charting, Trade Execution

It started innocently enough last summer. A consecutive string of down days, followed by a bounce.

The bounce low was quickly taken out with price pushing below $100, and then stabilized for a few days. No one really noticed, nor were there major concerns. “Crude’s back in the $90s, this is great! Gotta go fill up the SUV!”

And then a steady downward drift lower continued into autumn. The move to lower prices was relentless and morphed into a steep cascade down to below $50. Check out this price chart of the front month WTI crude oil futures over the past two years:

The remarkable downward price slide in the price of crude and its related impacts are now front-page news. I’ll let the experts debate the reasons why prices have been cut in half in just a few short months, and let others prognosticate on when it will stabilize. What I would like to do here is comment on some interesting phenomena that have occurred and a few reasons why all this is good for the futures industry.

Continue Reading →

Tags: Charting

|

| Figure 1: TT Analytics in ADL. |

With the release of X_TRADER® 7.17.40, TT introduced a new feature in ADL® named TT Analytics. This feature uses a single block that brings a historical data solution to ADL along with a suite of technical indicators. It provides almost every value found in an X_STUDY® chart to your server-side algo. In this blog post, I will introduce the block while demonstrating how to find some important trading reference points.

The TT Analytics Block can be found under Misc. Blocks on the left side of the ADL Designer Window. You simply drag this block onto the canvas and double click it to expose the properties page. If you’re an X_STUDY user, the properties page will look familiar to you. Here you can add technical indicators and expose bar values such as open, high, low and close.

Figure 1 above shows the block with open, high, low, close and VWAP for the current daily bar of the December ES market. It also shows the Bollinger Bands technical indicator added to the block.

Next, you add an Instrument block to the TT Analytics Block from within the properties page and define the type of bar data you want returned. Once this is complete, you can go in either of two different directions: you can add a technical indicator to the block or expose more bar data.

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

Have you ever wanted to buy something in one location to sell it in another location at a higher price? Imagine buying gold on CME only to turn around and sell it on TOCOM at a higher price. This type of trade is known as geographical arbitrage.

While there is risk in every trade, geographical arbitrage is relatively low risk. The faster you can execute and the more alike the underlying products, the better the arb. Gold as an underlying makes for an almost perfect hedge, as the gold quality is identical. This is not true for most other commodities.

One major factor here is the two products are priced in different currencies. A currency conversion is required, and this conversion value is not static like some other conversion factors used for spreading. For example, in this spread, I will use a static conversion of 1 kilogram equal to approximately 32.15 troy ounces. This value will not change during my arb, but the dollar-to-yen ratio will.

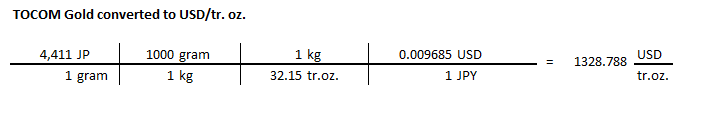

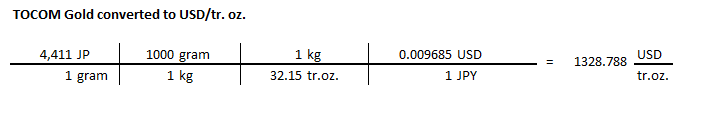

Let’s begin by calculating how to set up this trade. I will convert the yen-to-dollar using 6J on CME and grams to troy ounces. Below is a table that shows this conversion to get TOCOM gold priced in U.S. dollars and troy ounces.

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution