← Back to Trade Talk Blog

One of the most interesting aspects of supporting a product like TT’s Autospreader® is the fact that users continue to find new ways to use it, especially as market conditions change. While it would be impossible for me to talk about the countless number of unique strategies that are created for specific markets, I can give you a good idea of how Autospreader can be applied by looking at how it’s used to execute some common arbitrage spreads.

My intention is not to portray these strategies as potential sources of profit, but to portray them as stepping stones to further innovation. I hope that these examples will “get your wheels turning.” Even if you’re already familiar with these spreads, this blog can serve as a good review of Autospreader.

Continue Reading →

Tags: Algos & Spread Trading

With a few blogs already posted on using Autospreader, I thought it would be good to take a step back, look at the basic functionality of TT’s Autospreader and provide some insight on how it works.

In my former life as a market maker at the Chicago Board Options Exchange (CBOE), it was instilled in me very early on that no trade should occur without knowing ahead of time how that trade would be offset or hedged with another trade. I won’t get into the details of options trading and all the potential strategies here, but there are numerous ways to hedge trades and create a position that could make a profit or incur a loss based on many different factors.

Every trade that involves another trade against it in another contract to create a position could be referred to as a spread. At the most basic level, spread trading involves buying one contract and selling another contract at the same time. The basic premise behind spread trading is that you can profit from the changes in the pricing relationships of two or more contracts or products.

The mindset and habits I learned from trading options and taking advantage of price discrepancies involving multiple products carried over to the futures world, where spread trading has been around since the inception of futures products and contracts.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

Global capital markets have been in flux over the past few months, to say the least. In early April, Japanese Prime Minister Shinzo Abe launched the second arrow of “Abenomics.” After 15 years of chronic deflation, the Bank of Japan set an inflation target of 2 percent and announced a plan to buy $75 billion a month of Japanese government bonds. This led to the Nikkei index to run up by roughly 30 percent through mid-May.

Much of the money that flooded into Japan was pulled out of emerging markets. Brazil in particular reacted to try and lure foreign capital back into the country. Years ago, while the U.S. and European economies were mired in recession, Brazil put in place capital controls in the form of the IOF tax to prevent hot money inflows from strengthening the real against the dollar. Since then, the Brazilian economy has stalled, and in mid-June the Brazilian government removed most of the IOF taxes, including the 1 percent tax on derivatives.

Thus far, we have only received hints of the biggest development yet to come. Starting in April, the U.S. Federal Reserve began hinting that it would likely wind down QE3 and begin tapering its purchase of bonds later this year. Although the talk of tapering being imminent has been put to rest for now, it is only a matter of time until the Fed begins to wind down its $85 billion a month purchase of bonds. In a preview of the eventual effect tapering will have, yields on benchmark 10-year U.S. Treasuries were up more than 80 basis points from the beginning of May through the end of June.

|

10-Year U.S. Treasury Yield

Source: Yahoo! Finance |

Taking a View Using the Swap Spread

The swap spread is a useful tool to speculate or hedge against changes in the supply and demand of the U.S. Treasury market, changes in the federal government deficit or responses to the expectation of increasing interest rates. A swap spread consists of a Treasury bond leg and an interest rate swap leg, with each leg acting as a proxy for the perceived riskiness of government debt and bank debt respectively.

When concerns arise regarding the creditworthiness of the banking system, the resulting flight to quality in Treasuries leads to a rise in the yield of interest rate swaps relative to government debt, and a widening swap spread. Conversely, if investors and credit rating agencies become concerned about the creditworthiness of government debt (not that that would ever happen…), people may pull money out of Treasuries, leading to a rise in the yield of government debt relative to bank debt and a narrowing swap spread.

Supply and demand mechanics of the Treasury market can also influence the swap spread. When a persistent federal deficit is expected, and with it the expectation of an ample supply of Treasuries, Treasury yields rise relative to swap yields and the swap spread narrows. When deficit projections decrease, expectations of a shrinking supply of Treasuries will cause spreads to widen.

|

U.S. Dollar 10-Year Swap Spread

Source: Bloomberg |

Perhaps one of the biggest influences on the swap spread is mortgage convexity hedging. When interest rates rise, the likelihood of homeowners refinancing decreases and the duration of outstanding loans increases. In response to the increase in duration and an increase in the amount of interest they can expect to earn from mortgages, investors will look to sell long-dated assets. The effects of this hedging are more pronounced in the swaps market than the Treasury market, usually leading to a widening of swap spreads. When interest rates fall, investors will look to buy swaps, often leading to a narrowing of the swap spread.

The Invoice Spread

A swap spread trade is typically constructed by buying (or selling) a Treasury bond and paying (or receiving) the fixed rate of an interest rate swap with an identical maturity. The same trade, known as an invoice spread, can be built using Treasury futures and Eris Exchange interest rate swap futures. Using an invoice spread can result in significant margin savings of up to 75 percent compared to a swap spread using the cash products.

Eris Exchange actually lists a flex contract specifically designed to lend itself to constructing an invoice spread. The Eris invoice spread leg contract has the same maturity as the cheapest to deliver Treasury underlying the 10-year U.S. Treasury future available on either the Chicago Board of Trade (CBOT) or NYSE Liffe U.S.

Even though Eris contracts are futures, they match the cash flows of a typical over-the-counter (OTC) interest rate swap. As a result, an Eris product offers the best of both worlds: like an OTC swap, it can serve as a proxy for corporate credit risk, while also offering the capital efficiencies of a futures product.

|

| Trade the Eris Exchange invoice spread with TT’s X_TRADER®. |

The Right Tools Make All the Difference

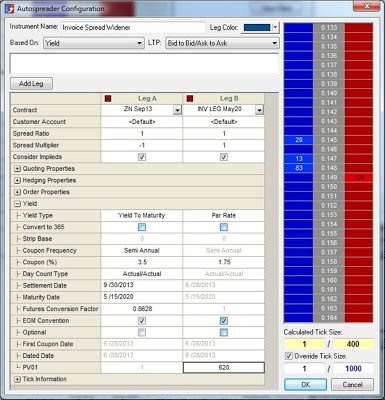

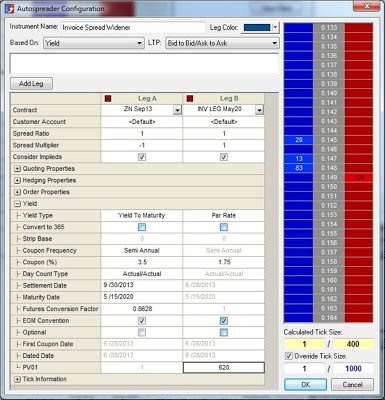

X_TRADER® 7.17 adds functionality that will make it easy to trade the invoice spread. X_TRADER and Autospreader® have long allowed the trader to convert quotes for fixed income products—whether they be Eurodollars, Treasury futures or cash Treasuries—to an implied yield.

The Eris invoice spread leg contract has a fixed coupon, and is quoted in net present value (NPV) terms. X_TRADER 7.17 will allow you to convert this NPV-quoted price to an implied yield. The only parameter the trader needs to supply is the PV01 value for the swap, or the price sensitivity of the swap to a one-basis-point change in yield. The PV01 value for a given swap is available through many market data services.

|

| Configuring the Eris Exchange invoice spread in TT’s Autospreader®. |

Both the CBOT Treasury futures leg and the Eris swap futures leg can be converted to an implied yield, making it simple to set up the spread between the two contracts. Additional information regarding how to set up an invoice spread is available on our website. With our new functionality and our newly available access to Eris Exchange, traders looking to stay ahead of the Fed have yet another tool in their arsenal.

Tags: Algos & Spread Trading, Market Access, Trade Execution

When considering what to cover in my first blog post, I kept coming back to topics related to spread trading. As a former full-time trader who made a living formulating and executing spread strategies, and as the person who leads the product management function for proprietary trading at TT, which includes automated trading, I think a lot about themes related to spreading.

TT’s Autospreader is one of the most widely used spread tools largely because it delivers sophisticated functionality and extreme performance in a very user-friendly package. I decided to write about dynamic hedging because I believe it’s an important concept for spread traders to understand and apply. Furthermore, I believe the way Autospreader addresses dynamic hedging with the Hedge Rule Builder tool is pretty powerful.

In this post, I’ll walk through some examples to illustrate how Hedge Rule Builder can be used to apply Pre Hedge and Post Hedge rules. But before I start on that topic, I’ll back up a bit for the benefit of readers who haven’t yet taken a deep dive into spread trading and hedging.

Spread Trading, Autospreader® and Hedge Rule Builder

The basic function of any spread trading tool, including TT’s Autospreader, is to execute orders to buy and sell a synthetic instrument composed of at least two exchange-listed securities, or “legs”. A spreader actively quotes at least one leg. When it accumulates inventory, it “hedges” by sending orders in the other leg in an attempt to buy or sell the synthetic instrument at the desired price.

Basically, a spreader performs two functions: it assumes risk, then reduces it as the spread order gets closer to completion. It provides liquidity, then seeks liquidity.

When trading a spread, hedging entails sending orders in legs as a reaction to an execution in an actively quoted leg. This is liquidity-seeking behavior, and therefore has a cost, which is mostly the price of crossing the bid-ask spread. While the main point of hedging is to reduce risk, a close second is to minimize the costs of reducing that risk.

How can we try to reduce our costs of seeking liquidity? One possibility is to vary our aggressiveness based on market conditions.

Autospreader’s Hedge Rule Builder offers two powerful ways to customize hedging behavior and aggressiveness: the Pre Hedge Rule and the Post Hedge Rule. The Pre Hedge Rule is evaluated after a quote fill but before any hedge orders are sent; the Post Hedge Rule is evaluated after hedge orders have been sent and acknowledged by the exchange. In other words, the Post Hedge Rule is only evaluated when there are “resting” hedge orders. Used together, these rules give us the opportunity to reduce liquidity costs, boosting bottom-line results.

Let’s walk through a few specific liquidity-seeking techniques to illustrate the concept.

Pre Hedge Rule

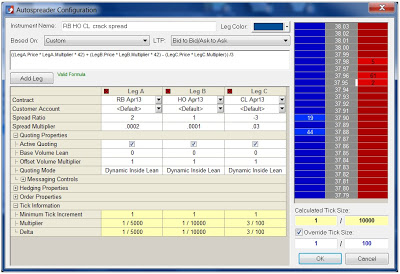

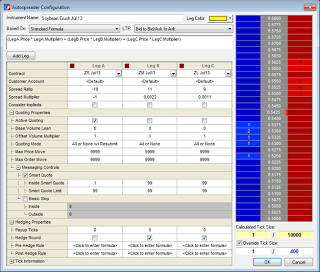

We’ll use the soybean crush for our examples. This is a common strategy where a position in soybean futures is offset by equivalent positions in soybean meal and soybean oil. We’ll define our spread as follows (using the soon-to-be-released X_TRADER® 7.17), with Hedge Round enabled to round hedging quantities rather than truncate them:

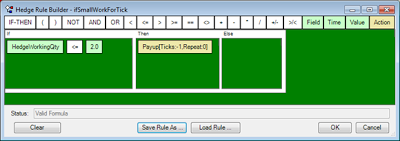

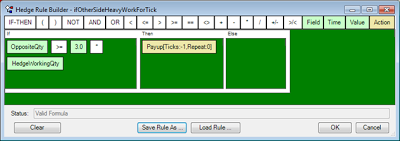

When we get a small fill on our quoting leg, we may decide to be less aggressive (where “aggressive” is defined as being less willing to cross the market) in pricing our hedge orders and making one-lots and two-lots “work for better” by applying a negative payup tick. Note that in this context, HedgeWorkingQty is the quantity Autospreader is about to submit:

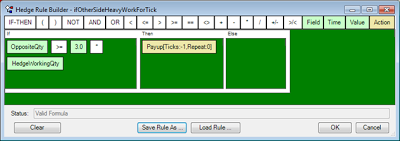

Even if our hedge need is relatively large, we can be less aggressive if the opposite side bid/offer is strong:

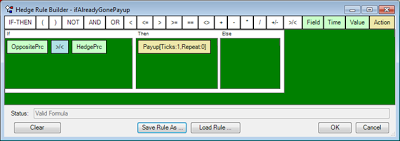

In other cases, by detecting that the market has moved away from us, we can be more aggressive. Note that at the time of the Pre Hedge Rule’s evaluation, HedgePrc is the price Autospreader will submit before including payup ticks:

Post Hedge Rule

After hedge orders have been sent, Autospreader can monitor market conditions and react based on user-defined logic. This allows us to continue to adjust our aggressiveness in seeking liquidity based on new information. Remember that when configuring a Post Hedge Rule, we need to provide a “repeat value” if we want the behavior to be dynamic—that is, performed more than once as conditions change.

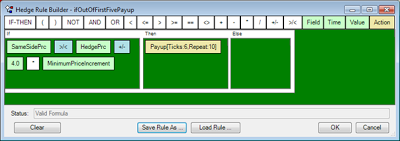

One way to keep a hedge order “competitive” is to track its price against the best price in the market. It’s easy to write a rule such that if a hedge order “falls out” of the first five price levels, we get more aggressive by attempting to cross an assumed one-tick-wide market at the new level:

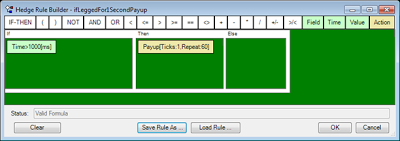

We can also base our behavior on time. We can improve our price one level once a second for the first minute of being “hung”:

Conclusion

As someone who still dabbles in trading, I really appreciate the fact that the Pre Hedge and Post Hedge rules allow the user to tweak Autospreader functionality. These logic “hooks” give the trader the needed flexibility to maximize opportunity and minimize costs.

These techniques are just a few examples of what is possible, and they can even be combined into more complex behaviors.

If you’d like to explore some of the more sophisticated applications of Pre Hedge and Post Hedge rules, feel free to submit a comment on this blog post. Or, you can consult the Online Help module on our website.

Tags: Algos & Spread Trading

|

|

Tulane Algorithmic Trading Club members Willow Zhang (1st

Place) and Yuki Yang (2nd Place) used X_TRADER® to out-

perform the competition in the club’s first official trading contest.

|

Tulane University is one of Trading Technologies’ most active University Program partners. At Tulane, our X_TRADER® software is used in classroom instruction, and it’s installed at the A.B. Freeman Trading Center laboratory. The lab is accessible to all students, including members of the Tulane Algorithmic Trading Club (TATC).

The club supports research, facilitates discussions and encourages hands-on development of automated trading strategies. As a student organization, membership is open to all interested Tulane students.

TATC members gain real-world skills by writing and developing trading algorithms while learning from collaborations with their peers and faculty advisors. The students are challenged to trade in simulation mode against live market data using industry-standard technologies, including X_TRADER and TT’s application programming interfaces (APIs). The algorithms that they develop are deployed in simulation against real-market data, and the strategies are ranked in terms of profit to identify the students who’ve best met the challenge.

Recently, the club held its first official trading competition. Entry was open to all Tulane students. Participants were encouraged to be creative in their use of information and technology when they developed their automated strategies, which ranged from high-frequency styles that monitored market liquidity and took advantage of arbitrage opportunities to those that were a bit more long-term in nature and driven by technical indicators.

And the Winner Is…

After the contest concluded, TATC President Zachary Poche and Secretary Geoffrey Lewis reported: “…the Tulane Algorithmic Trading Club held its first trading competition. Algorithms were pitted against one another in a battle of mathematical wits and technical savvy. The competitors met in the trading laboratory at 12:00 PM, and, after a quick fine tuning of Trading Technologies by our resident tech wizard Kevin Ammentorp, trading began promptly at 12:15. After 45 minutes of trading, the best algorithm was evident and club member Willow walked away with the top prize, our respect and adoration, with an overall profit of $55,000. The first runner up was Yuki with a profit of $8,000.”

Willow’s winning strategy utilized the Average Directional Index (ADX) and the Commodity Channel Index (CCI), while Yuki’s runner-up strategy was a Moving Average (MA) indicator built entirely in ADL™, TT’s visual programming platform.

The students who participated in the contest said they appreciated the opportunity to apply what they learned in class using real-world tools in a real-world setting—to get real-world results.

Of particular interest to me is how enthusiastically the students employed ADL. It enabled them to design, test and deploy their trading algorithms in C# without writing a single line of code. Geoff and Zack told me that one of the biggest advantages to using ADL was the speed at which the students were able to generate, test and deploy their strategies once they were defined. These students haven’t graduated yet, but they know that in the marketplace, “speed to market” is vital, and they leveraged ADL to obtain a speed advantage.

Clubs like Tulane’s Algorithmic Trading Club highlight the collaboration of university, students and business. As a voluntary endeavor, the students display an entrepreneurial spirit with faculty guiding that spirit. I’d like to think companies like ours, that provide the technology and training, give them the tools to empower that spirit and bring their ideas to life. That’s a winning strategy for everyone.

ACKNOWLEDGEMENT: The Tulane Algorithmic Trading Club is steered by Zachary Poche (President), Joshua Aiken (Vice President) and Geoffrey Lewis (secretary). Professors Joe LeBlanc and Geoffrey Parker are the faculty advisors.

Tags: Algos & Spread Trading, Trade Execution, TT CampusConnect