This is one of the many examples of how we work with a variety of clients to develop holistic enterprise end-to-end solutions. Contact us to find out more about how we can transform your business, maximize the value of enterprise workflow and optimize costs.

Case Study: Commodity Firm

TT® Enterprise Solutions

TT’s architecture and delivery model make it easier and faster for us to build solutions that meet our clients’ demands. Not only can we bring new features to market faster, but our open and extendable architecture allows us to deliver broad and deep end-to-end solutions for all client types. Read on to learn how a global commodity trading firm addressed their unique challenges with TT.

Situation and Needs

One of our customers is a leading global commodities trading firm with nearly 100 traders in multiple offices around the world. In addition to Trading Technologies, they used Fidessa, CQG, WebICE and LMESelect, and they have four FCM relationships to trade primarily crude and metals products on CME, ICE, LME, SGX, TOCOM and other derivatives exchanges. This trading firm had two primary goals. First, they wanted to reduce the complexity and cost of their IT infrastructure by consolidating trading platforms. Second, they wanted to improve the quality of their executions by centralizing order flow through execution desks, allowing execution specialists to fulfill orders, while at the same time minimizing execution fees.

Solutions and Benefits

Single Trading Screen

We proposed TT as a replacement for all of the trading platforms utilized and maintained by this global trading firm. The single platform greatly reduced the IT complexity and cost to the firm. Delivered on a SaaS model, TT is a completely hosted solution that requires no software installations or upgrades. With a single FIX drop copy feed, back office integration is straightforward and greatly simplified. Since all of their traders around the world are now using the same interface, internal trade support is much easier. The platform consolidation has allowed the firm to reduce a great deal of expenses, not only on external spending, but also on internal IT costs.

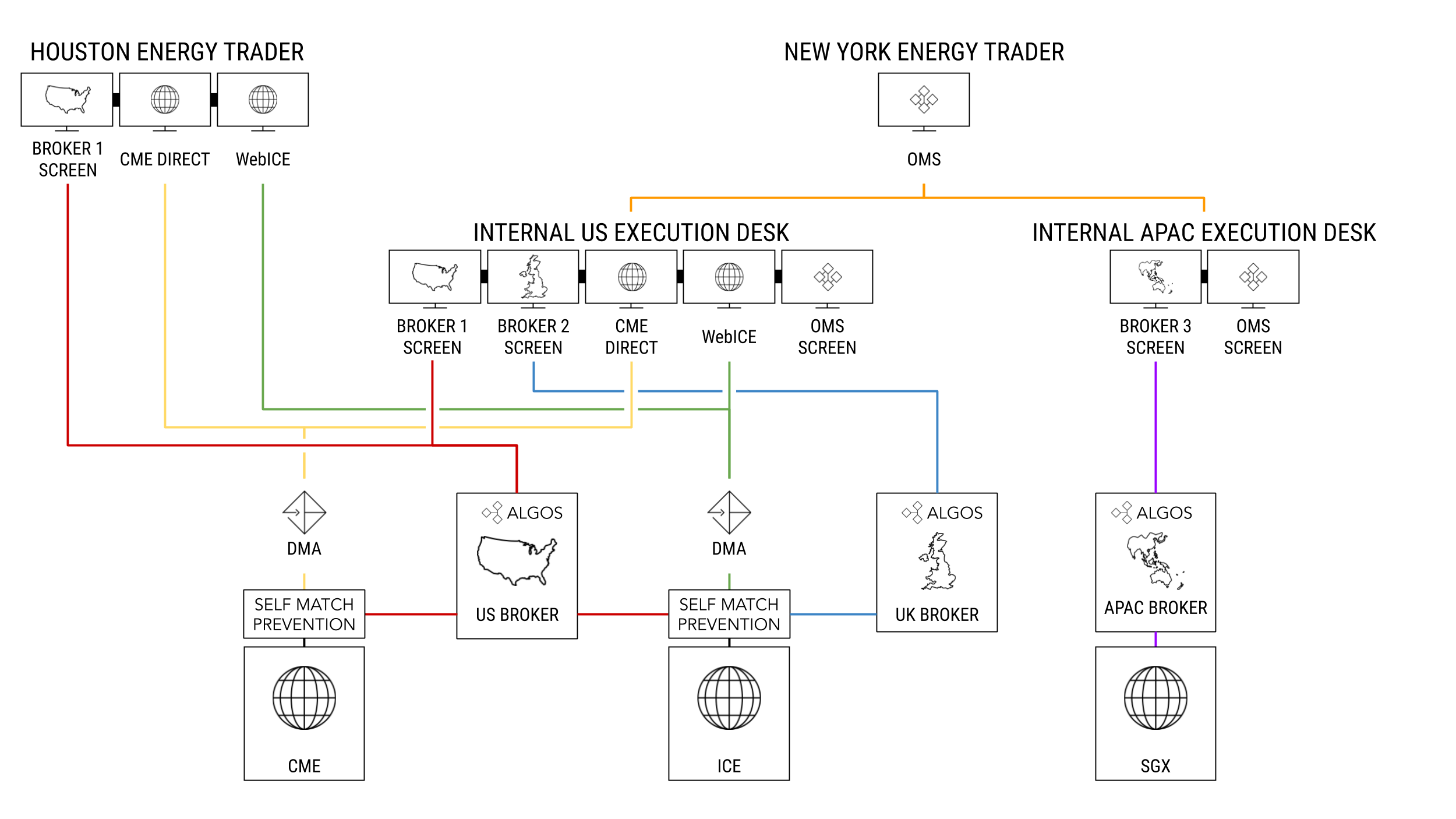

Broker-Neutral Screen

TT is supported by most of the largest FCMs in the world, including all four of the FCMs used by this trading firm. As such, traders can use a single TT screen to simultaneously access markets through multiple brokers. This single screen reduces clutter on the trader’s desk, improves the trader’s efficiencies by requiring them to be proficient with only one platform, and gives the trader choice and flexibility when it comes to execution. Additionally, some of these brokers offer execution algos, and they can be integrated directly into the TT screen for a seamless user experience. When one of the bank algos is used, the order is routed to the broker for algo execution, with fills automatically flowing back to the trader.

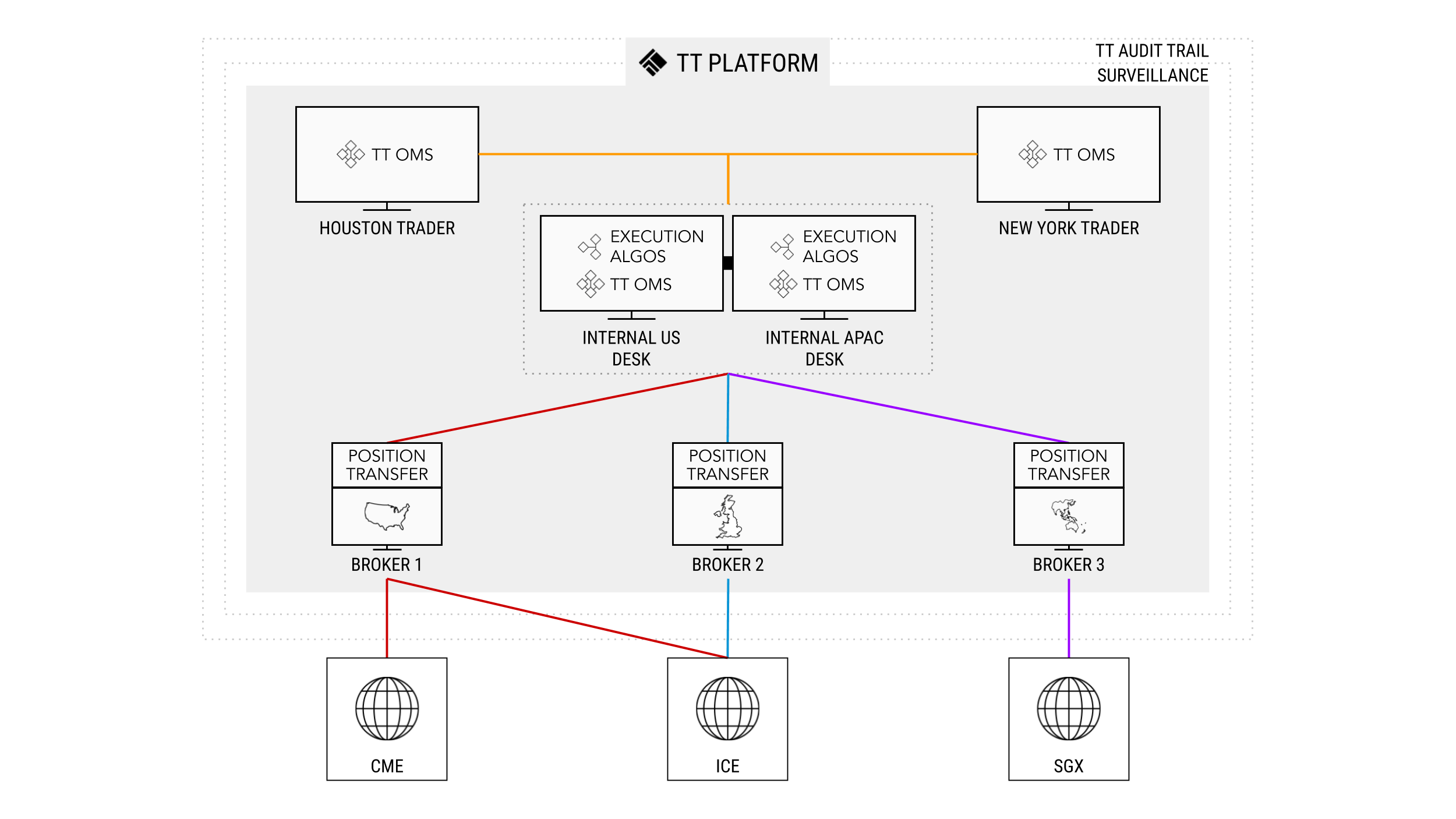

OMS

With TT OMS, which is completely integrated with the TT platform, traders have the flexibility to submit orders directly into the market or stage care orders to their broker or execution specialists. The trading firm decided to leverage TT OMS and centralize execution through two desks—one in the U.S. and one in Europe. Traders submit care orders from their screens, and specialists on the desk claim the orders and execute as they see fit, using the abundance of order management and order execution functionality at their disposal. They can manually fill a trader’s order out of the firm’s inventory, offset an order with one from another trader, combine orders from multiple traders for more efficient execution or use any of TT’s advanced tools to complete the order. All workflows are streamlined on TT, fills are reported back to the trader, and all order actions are recorded and stored for compliance purposes.

Execution Tools

We are known for our execution tools, and they fit perfectly into this trading firm’s style of trading. They execute a lot of spread trades, including calendar spreads, inter-product spreads on an exchange and inter-exchange spreads. Autospreader® gives traders the ability to define spread relationships, submit orders at a desired spread price, automatically quote one or more instruments based on the market in other instruments and complete the spread with an automatic hedge if a quote order is filled. This allows their traders and execution specialists to focus on the market and leverage TT to improve their trade executions.

Position Transfer

With 100 traders around the world trading energy and metals, it’s not uncommon for traders at the firm to submit orders that may potentially match with each other. In many cases, this order crossing is forbidden and can result in fines from exchanges and regulatory bodies. TT provides Avoid Orders That Cross (AOTC) functionality that prevents traders at a firm from trading with each other. One of the methods that AOTC uses is called Position Transfer. Instead of rejecting or canceling orders that might cross, Position Transfer essentially matches those trades internally, which for a commodity trading firm is perfectly legal. This not only avoids potential illegal activity, but can also improve executions for both traders involved and reduce execution fees.