This is one of the many examples of how we work with a variety of clients to develop holistic enterprise end-to-end solutions. Contact us to find out more about how we can transform your business, maximize the value of enterprise workflow and optimize costs.

Case Study: Global Bank

TT® Enterprise Solutions

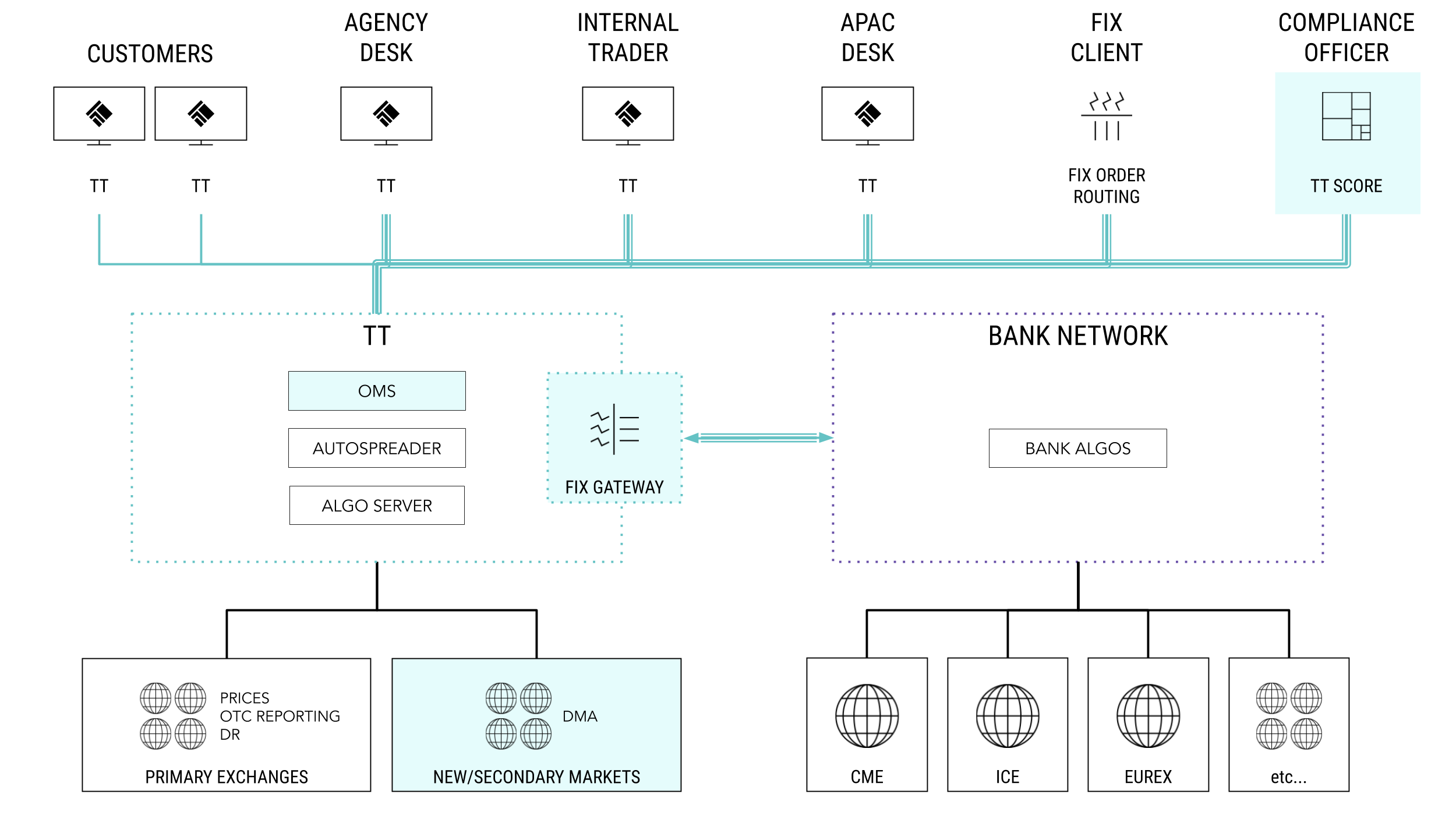

TT’s architecture and delivery model make it easier and faster for us to build solutions that meet our clients’ demands. Not only can we bring new features to market faster, but our open and extendable architecture allows us to deliver broad and deep end-to-end solutions for all client types. Read on to learn how a major global bank addressed their unique challenges with TT.

Situation and Needs

One of our existing TTNET™ customers is a leading bank with operations around the world. They had over 250 X_TRADER® licenses for internal and external users plus three internal platforms totaling over 500 users. The internal platforms had reached end-of-life and would have required significant investment to continue using. However, the bank had recently built out native market access to the primary exchanges and wanted to continue leveraging that access along with their proprietary execution algo platform. As the bank migrated to the TT platform, they wanted to upgrade or replace their internal platforms and consolidate onto a single platform, all while continuing to utilize their own market access and execution algos.

Solutions and Benefits

Single Trading Screen

We proposed a single screen to replace the 250 X_TRADER screens and the 500 internal platform screens. This technology consolidation greatly reduced operational complexity and prevented the bank from having to invest significant time and resources upgrading, maintaining and supporting the internal systems. Furthermore, TT’s SaaS delivery greatly simplified the administration of users and accounts and the deployment of software to users.

Market Access

With our open architecture, we were able to offer a hybrid solution that leveraged the bank’s existing exchange connectivity and provided access to additional markets via our global network. Our FIX Order Gateway easily extends TT and seamlessly routes orders from our network using the bank’s native DMA. We also are able to offer OTC reporting and DR capabilities for those same markets using our market connectivity. We provide the market data for all markets so the bank only needs to maintain order connectivity on its end.

Bank Algo Integration

This bank has proprietary execution algos that run on servers in their network. This is an important differentiator for them, as their customers have access to these algos. We support this with our FIX Order Gateway and seamless integration of the algo order ticket on the TT GUI, which allows users to configure their orders and tweak parameters. When submitted, orders are sent to the bank’s algo servers, which manage the orders. This solution works for the bank’s native market access as well as markets for which TT provides access.

OMS

One of the bank’s in-house platforms is an OMS. It’s a separate system that the agency desk uses to manage orders, keep track of order status, perform post-trade actions, such as allocations, and report back to their customers. There’s no integration between the OMS and the execution platforms—orders need to be re-keyed into the execution screen. We’re able to offer an integrated solution with TT. The TT® OMS provides seamless integration and addresses critical sell-side workflows that improve executions, eliminate manual steps, reduce errors and improve efficiencies. Care orders can be submitted from either a TT screen or FIX-enabled system and claimed by brokers who can use our robust toolset to execute those orders.

Market Data Administration Service

Market data reporting was a big concern for this customer. They were spending over four million USD per year in market data fees, much of which was on behalf of clients that they weren’t re-billing. There’s also a lot of overhead associated with reporting and dealing with exchange audits. We now offer an optional service, where allowed by the applicable exchange, whereby we report exchange market data subscriptions and collect market data fees on behalf of our customers. Additionally, we assume the liability for properly reporting and paying those fees to the exchange.

Surveillance

TT® Score is our trade surveillance software that leverages machine learning to identify trading behavior, such as spoofing, that may prompt regulatory inquiries. TT Score is integrated with TT and can be instantly enabled. This bank plans to utilize TT Score to streamline its compliance and risk reviews by identifying, prioritizing and addressing higher-risk activity sooner and more efficiently across all internal users and external customers.

Private Liquidity

Similar to how we can support a firm’s native market access using the FIX Order Gateway, we can support trading on markets that we don’t offer. In addition to supporting order routing, firms can publish their own market data into TT using the FIX Price Gateway. This bank is considering making its fixed income liquidity pool available to its users via TT.