HKEX: Market Rehearsals for Compression Mechanism

October 22 & January 2023

HKEX has announced the introduction of a new compression mechanism to be implemented on Datafeed and Retransmission for OMD D-Lite and OMD DS Market Data.

Since the new compression feature is to be initially used only on HKEX’s OMD D-Lite and OMD DS Market Data systems, the TT platform is unaffected by the change and therefore will not participate in the October 22, October 29, November or January Market Rehearsals.

CME: FX Instrument Migration and Market Data Channel Consolidation

October 30

On Sunday, October 30 (trade date Monday, October 31), to streamline the dissemination of CME FX market data offerings, CME FX futures and options instruments will be migrated onto distinct existing market segments and their MDP 3.0 market data channels consolidated on CME Globex as follows:

- Migrate all CME FX futures and FX Link instruments to a single market segment (MDP 3.0: Tag 1300-MarketSegmentID=88) from the current two market segments.

- Migrate all CME FX options instruments to a single existing market segment (MDP 3.0: Tag 1300-MarketSegmentID=52) from the current two market segments.

- Consolidate the CME FX futures market data channels to a single market data channel (MDP 3.0: TAG ApplID-1180=314) from the current two market data channels

- Consolidate the CME FX Options market data channels to a single market data channel (MDP 3.0: TAG ApplID-1180=321) from the current two market data channels

Customers must cancel any GTC/GTD orders (including User-defined Spreads on Options) on existing segments 52 and 88 before the close on Friday, October 28th. CME will be canceling/deleting GTC/GTD orders for UDS on options, market segment 88, however all other GTC/GTD orders on the two segments will become unmanaged on the TT platform if not canceled.

These changes will be available in the UAT environment on Monday, October 3rd.

Additional information

With this update the IP configuration for MSGW iLink and Drop Copy sessions will be updated. iLink and Drop Copy Convenience Gateway (CGW) network configurations will not be impacted.

Source IP information for configured firewall or network devices will not be impacted by these changes. These changes will not impact data licensing and entitlement requirements. The updated MDP 3.0 channel config file will reflect the new CME FX futures and options product mapping.

TFEX: New Currency Futures

October 31

TFEX has announced the introduction of two new Currency Futures with a tentative launch date of October 31, 2022. The Product Codes will be listed as follows:

- EUR/USD Futures – “EURUSD”

- USD/JPY Futures – “USDJPY”

The products are available for testing in UAT now. Brokers should complete their verification in UAT and submit their readiness survey to the exchange.

SGX: Mysteel Shanghai Rebar Futures

October 31

SGX has announced the introduction of SGX Mysteel Shanghai Rebar (USD) Futures with a launch date of October 31, 2022. The Product Code is RBF and the product is available for testing in UAT now.

SGX: Industry-wide Data Corruption, Reconciliation and Recovery Exercise

November 4

SGX has announced participation in the Derivatives Trading and Clearing Industry-wide Data Corruption, Reconciliation and Recovery Exercise (“DRE”) to take place starting October 10 and ending on November 4, 2022. Please note that TT will forego participation in these exercises.

EEX: Introduction of 2-Factor-Authentication for EEX TT Screen

November 7

Mandatory 2FA will be enabled on November 7th. The 2FA will be based on an e-mail passcode. Upon login, the user will be asked to enter a code in order to proceed. This will be sent to the e-mail address which has been registered for that respective account.

Please note, 2FA is already available on a voluntary basis. To be prepared, it is recommended to activate the 2FA via e-mail within your own TT settings before 7th of November. From that date on, a login without an activated 2FA via e-mail will not be possible. Respective login attempts will be automatically redirected to the settings section where the 2FA can be activated.

Additional Resources

TT Help Library: Configuring Two Factor Authentication

TFEX: New Trading System IWT

Ongoing until November 18

TFEX has announced the start of IWT for their next generation trading system. IWT for the TFEX Derivatives market started on August 8, and ends on November 16 18, 2022. Participation is mandatory for all brokers.

Access to the IWT Testing system is available via the TT UAT test environment. Details about how to prepare for IWT and access the environment are provided in the TFEX Trading System Upgrade Migration Guide.

All customers participating in IWT should contact the exchange Member Readiness Team ([email protected]) directly to make arrangements.

CME: Changes to BTIC on Yen Denominated TOPIX Futures and Yen Denominated Topics Futures – Resting Order Eliminations

November 20

Effective Sunday, November 20 (trade date Monday, November 21), the following changes will be implemented to BTIC on Yen Denominated TOPIX (TPB) futures and Yen Denominated TOPIX futures (TPY) as follows:

- The minimum price increment tag 969-MinPriceIncrement will be amended for the BTIC on Yen Denominated TOPIX futures to 25.000000000 from the current value of 10.000000000.

- The decimal price locator tag 9787-DisplayFactor for the Yen Denominated TOPIX futures and BTIC on Yen Denominated TOPIX calendar spreads will be amended to 0.001000000 from the current value of 0.010000000.

The daily settlement and clearing price increment for the Yen Denominated TOPIX futures published on the Market Data Incremental Refresh (tag 35-MsgType=X) messages will remain unchanged.

To facilitate this change, customers will be asked to cancel all Good ‘Till Cancel (GTC) and Good ‘Till Date (GTD) orders for existing futures, by the close on Friday, November 18. After 16:00 CT on Friday, November 18, any remaining GTC/GTD orders on these markets will be removed by CME.

Eurex: T7 11.0 Upgrade

November 21

Eurex will be upgrading T7 to version 11.0 on November 21, 2022. More details will be provided in upcoming System News and Updates. Eurex will upgrade the simulation environment on September 12. TT’s UAT environment will be available shortly after the 12th, date TBC.

TT will be supporting the following functional enhancements:

- Monday and Wednesday Weekly Option Contracts will be introduced to supplement the existing Friday Weekly Options contracts introduced by the Next Generation ETD Contracts Initiative.

- Tag 1031 ‘custOrderHandlingInst’ will become mandatory for all agency trading. Order entries and modifications without a submitted ‘custOrderHandlingInst’ when the Trading Capacity Agency is used will be rejected.

HKEX: Change of Trading Hours for Selected MSCI & Currency Products

November 21

HKEX has announced plans to revise the T Session closing hour and T+1 opening hour (“Late Close”) for selected MSCI Price Return, MSCI Net Total Return (“NTR”) and Foreign Exchange Futures and Options (altogether “Late Close Contracts”) starting from November 21, 2022.

No changes are required for supporting the change of trading hours.

TT Platform Impact

None.

Additional Resources

Exchange Circular MO/DT/231/22

Euronext: Change of format for Trading Venue Transaction ID (TVTIC) for Euronext Markets

November 28

A new field, Trade Unique Identifier (TUI) will be disseminated within the Order Entry Gateway, Market Data Gateway and Drop Copy and will be used as the new TVTIC (Trading Venue Transaction Identification Code) across all Euronext markets to uniquely identify a trade. TVTIC used for TRS22 purposes will have a new format. TT will implement the new field/format on November 28, 2022. This change will be available for testing in UAT on October 5, 2022.

MX: API Upgrade

Mid-November 2022 for UAT and mid-December 2022 for production

The Montreal Exchange is upgrading its Order Entry (B3), Market data (D7) and Drop copy protocols.

- The exchange go-live date for the new protocol is November 14, 2022. TT will launch shortly after. TT will continue to support trading using the old protocol until then

- Current API will be active in GTE1 so UAT will still be available

The TT dates for the SAIL B3 Orders API upgrade are mid-November 2022 for UAT and mid-December 2022 for production.

The HSVF D7 price new protocol in this API upgrade is expected to go into UAT and Production in February 2023.

CME: Change to Bursa Malaysia Derivatives (BMD) Extended Night Trading Session

December 2022

In December 2022 and pending final regulatory approval, Bursa Malaysia Derivatives (BMD) will extend its night trading session for selected products on CME. Due to the time difference between Malaysian Time and Central Time, the extended night trading session activities will begin the business day prior to actual trade date in Malaysian time. The new extended night trading session will be open for trading Monday – Thursday.

There will be no Friday night trading session. There is no impact to the current Monday – Friday day trading sessions.

| Current Time | New Time |

| 21:00:00 – 23:30:00 (Malaysia Time) | 21:00:00 – 02:30:00 (Malaysia Time) |

| Product | Symbol |

| FTSE Kuala Lumpur Composite Index Futures | FKLI |

| Gold Futures | FGLD |

| MINI FTSE BURSE MALAYSIA MID 70 IDX | FM70 |

| FTSE Kuala Lumpur Composite Index Options | OKLI |

| BMD Tin Futures | FTIN |

| 3 Month Kuala Lumpur Interbank Offered Rate Futures | FKB3 |

ICE: Mandatory Migration from LMA to IM-SMA

December 31

ICE has started the process of phasing out Locally Managed Accounts (LMAs) by introducing a new set-up feature, called Independently-Managed System Managed Account (IM SMA) in the ICE Clearing Admin tool which is designed to replace LMAs. The timeline for the migration has been set to year-end.

The new ICE IM SMA feature is available within the SMA functionality and is replacing the legacy LMA, which will be phased out completely by December 31, 2022. The new IM SMA feature offers Clearing Members more control over accounts than is available with LMA.

With IM SMA set-up, it is mandatory to send in tags 439 (Clearing Firm) and 440 (Clearing Account) to the exchange. The customer could continue using tag 9207 (CustAccountRefID field) as an optional field to distinguish the customer business. ICE is targeting December 31, 2022, as the end date for LMA access. In line with this milestone, ICE will not support the creation of any new LMA access starting August 1, 2022.

The TT platform already supports the required tags for IM SMA as required by ICE. Below are the mappings between the required tags and the respective fields in the TT user setup.

- Tag 439 – Clearing Firm ID

- Tag 440 – Exchange Account

Customers are requested to get in touch with TT onboarding team in case any assistance is needed for setup.

TFEX: New Trading System Market Rehearsal

January 14

TFEX has announced the start of Market Rehearsals (MR) for their next generation trading system. Market Rehearsals are scheduled Saturdays beginning on January 14, 2023 and ending on January 28, 2023.

Each Broker is required to Pass 2 of the 3 rounds of MR Testing provided by the Exchange.

KRX: Market Data System Upgrade

January 23, 2023

KRX has announced the launch of a new Market Data System (“New MDDS”) scheduled to go into production on January 23, 2023. Updated information will be provided in System News and Updates as it becomes available.

TT Platform Impact

For Users of the TT Platform there will be no observable impact to trading. All users can expect a seamless transition from the current system to the KRX “New MDDS” with no interruptions.

Eurex: Next Generation ETD Contracts

February 6, 2023

Eurex is aiming to introduce a more flexible set-up of Exchange Traded Derivatives (ETD) products by implementing an enhanced contract identification concept in February 2023 allowing more than one expiration per month on product level (sub-monthly contracts).

New features, changes and improvements:

- Integration of Weekly Expiring Instruments on Product Level

- Volatility Strategies in Single Stock Options

- Market-On-Close Futures T+X (Basis Trading in Equity Index Futures)

Weekly contracts will follow the new format of DDMMYYYY (current format: MMYYY), and will be listed under the same Product symbol as the Monthly contracts.

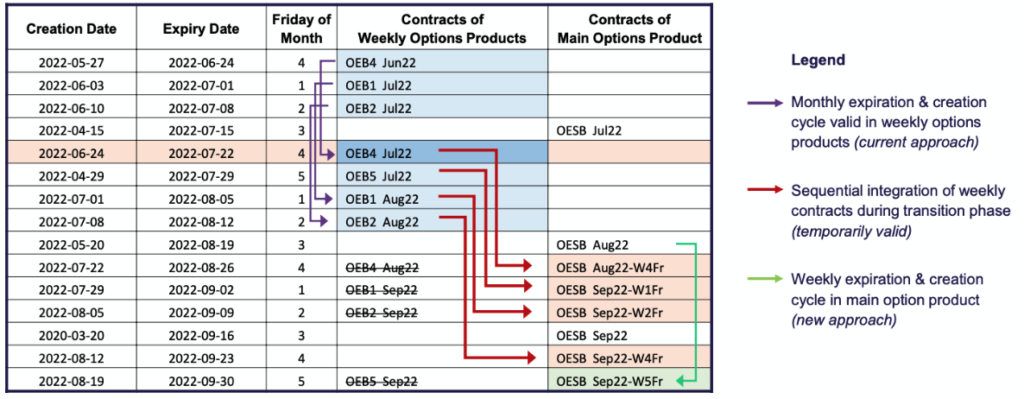

Example: OEB1, OEB2, OEB4, OEB5 will be listed under the OESB Product Symbol, and will be sequentially integrated into the following month as they expire.

Currently, the Weekly options are:

OEB1

OEB2

OEB4

OEB5

Current Monthly Option:

OESB Oct22

At the end of the integration process, the October contracts will be the following:

OESB Oct22-W1Fr

OESB Oct22-W2Fr

OESB Oct22

OESB Oct22-W4Fr

OESB Oct22-W5Fr

It is important to note that the Weekly Options will sequentially migrate after each weekly option expires.

For example, in the third week in October, OEB1 and OEB2 have already migrated to their OESB November Week 1 and Week November 2 display names, while weeks 4 and 5 have not migrated yet.

Here is another example with a visual aid:

Market on Close T+X will be eligible for MSCI Futures. An example is the following:

On T, Client trades the calendar between the daily future (T+1) and the standard future. After the T+1 session, the index close of T+1 is published by MSCI. On T+2, the T+1 index close is entered as the Final Settlement Price for the daily future. At the end, the Client has paid basis + index close for the standard future.

Eurex Next Generation ETD contracts are now available in UAT for customer testing. The following products are now available, please see the product symbols below and use those for testing purposes:

Active as of July 2022:

T+X MSCI Futures and Spreads (FMEA, FMWN)

Integration of sub-monthly options (NOA3, OGBL, AXA, BAY, CSGN, ROG, ODAX (including end of month contracts), OSMI)

Daily expiring single stock futures (AXAP, BAYP, NO3P, ROGP)

Activation Date in Simulation: September 23, 2022 (integration period until October 18, 2022):

Starting 23 September 2022, Eurex will gradually integrate all weekly expiring contracts OES1/OES2/OES4/OMSX into the standard option OESX. Please find below the detailed migration schedule:

Activation Date September 30, 2022:

Daily expiring contracts in MSCI Futures FMWO, FMJP, FMEF

Activation Date October 6, 2022:

Daily expiring contracts in single stock futures in ADSP, BMWP, UBSP

Please refer to the attached Eurex Simulation Calendar, as the 3-day rolling contracts will follow the Business Day rather than Calendar day.

Additional Resources

ICE: Exchanges Datacenter Migration

March 4, 2023

In March of 2023, ICE will migrate to a new datacenter. Additional information on the move is available from the exchange here.

Key Dates:

- October 3, 2022 – Telnet testing begins

- November 5-6, 2022 – Weekend Login and Heartbeat testing prior to Mock Trading Session #1

- November 10-11, 2022 – Weekend Login and Heartbeat testing prior to Mock Trading Session #2

- November 12, 2022 – Mock Trading Session #1 (Production Site)

- December 3, 2022 – Mock Trading Session #2 (Disaster Recovery Site)

- January 21, 2023 – Mock Trading Session #3 (Production Site)

- February 4, 2023 – Mock Trading Session #4 (Disaster Recovery Site)

- March 4, 2023 – LIFFE Markets Data Center Migration

- March 18, 2023 – ICE and Endex Markets Data Center Migration

TT will advise on its plans for weekend testing in the near future.

CME: DR Datacenter Migration and Test Postponed

March 2023

The mock disaster recovery test previously scheduled for September 10 has been postponed to early March 2023. Additional details, test scripts, and registration information will be announced in future CME Globex Notices.

TFX: Three-month TONA Futures & Options

March 2023

TFX has announced the introduction of Three-month TONA (Tokyo Overnight Average) Futures & Options with a launch date in late March 2023. The new products will be available for testing in UAT prior to product launch. Updated information will be relayed here in System News and Updates whenever it becomes available from the exchange.

Additional Resources

JPX: Three-month TONA Futures

May 29, 2023

JPX has announced the introduction of Three-month TONA (Tokyo Overnight Average) Futures with a launch date of May 29, 2023. The new products will be available for testing in UAT prior to product launch. Updated information will be relayed here in System News and Updates whenever it becomes available from the exchange.

Additional Resources

IDEM: Migration to Euronext

End of Q2/2023

IDEM products will be migrating to Euronext at the end of Q2/2023. Further details will be provided as the date approaches.