When a large tier-one bank with operations around the world realized that their legacy trade surveillance system not only failed to detect patterns of potential spoofing activity, but also generated too many false positive alerts, their compliance staff knew they needed to make a change.

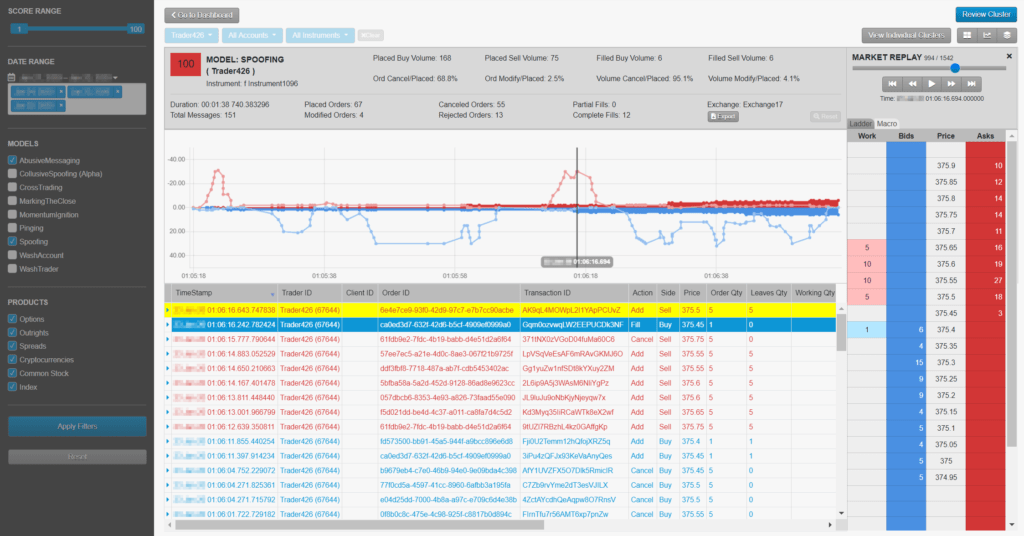

This bank, a long-time Trading Technologies client, had already migrated hundreds of users from their legacy trading platforms to TT. The TT platform includes a fully integrated solution for trade surveillance and compliance, TT Trade Surveillance. This unique offering leverages machine learning to identify trading behavior, such as spoofing, that may prompt regulatory inquiries. The bank’s desire to bolster their existing legacy system with a machine-learning-powered Spoofing model sparked their interest in TT Trade Surveillance.

The bank’s initial deployment of TT Trade Surveillance was on a large internal trading desk, which was up and running within a week. The initial results were positive, but the team wanted to take a deeper dive into the efficacy of the machine-learning technology. They decided to upload a month of historical trade data for analysis to see if TT Trade Surveillance could accurately identify activity that had drawn regulatory attention—activity that their existing legacy system failed to detect—while also avoiding the generation of too many false positives.

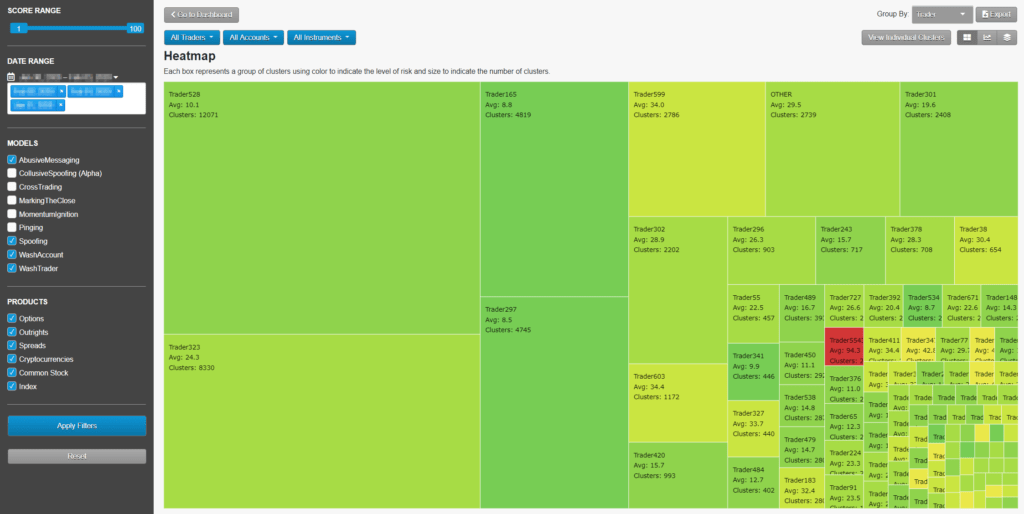

TT Trade Surveillance accurately identified the activity of interest, and also applied “risk scores” for the activity that were in line with the compliance officer’s expectations. Because TT Trade Surveillance was able to identify the “needle in the haystack” without generating a large number of false positive alerts, the bank committed to deploy TT Trade Surveillance at a broader level.

The TT Onboarding team provided the bank with access to all internal trading activity on approximately a dozen futures markets around the globe on TT Trade Surveillance within one week. The bank now has a customized setup on TT Trade Surveillance where each line of business can have access to TT Trade Surveillance to supervise their own trading activity, then generate periodic compliance reports for that business unit based upon surveillance results. The bank has also leveraged TT Trade Surveillance’s domain experts for user training and interpretation of results.

The bank’s ultimate goal is to streamline their compliance and risk reviews by identifying, prioritizing and addressing higher-risk activity sooner and more efficiently across all internal users and external customers. To learn more about TT Trade Surveillance and see how it can benefit your operations, contact your TT Customer Success representative or fill out our online inquiry form.