← Back to Trade Talk Blog

Yesterday, The Wall Street Journal published an article titled “Algorithmic Trading: The Play-at-Home Version” highlighting the growth of a new crop of DIY tools that allow retail traders to easily automate their trading strategies. The users quoted in the article expressed excitement about having the ability to quickly build and deploy their own strategies, but they lamented that unforeseen issues in their algorithms led to sizable losses.

Since 1994, TT has been building tools to allow professional derivatives traders to automate their strategies. It’s encouraging to see the DIY algo programming trend start to migrate to retail traders, but the potential for loss with some of these systems is a detriment. To that end, allow me to point out a few differences between our approach and the others.

ADL® (Algo Design Lab)

Our ADL visual programming platform represented a major breakthrough in algorithmic trading when it was first brought to market in 2009. Using drag-and-drop actions to assemble building blocks, traders and programmers alike can rapidly design, test and deploy automated trading strategies without writing a single line of code. With ADL, users can generate executable strategies in hours to seize and act on fleeting market opportunities in timeframes that were difficult or even impossible to achieve previously.

|

| With ADL, users drag and drop blocks containing pre-tested code onto a canvas to create automated trading programs. |

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

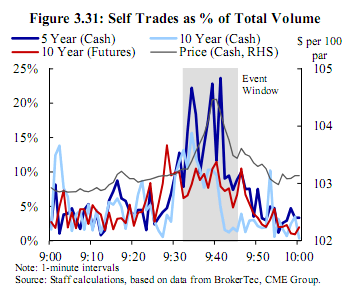

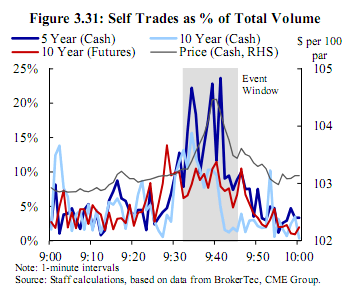

Last week the CFTC issued a report detailing the flash crash experienced in the U.S. Treasury cash and futures markets on October 15. The report highlighted the lack of a “smoking gun” culprit as the cause of the sudden and dramatic price swing witnessed in these markets. Instead, it pointed the finger at a culmination of many factors, including downward pressure on yields leading up to the event combined with an economic data release which contradicted the market’s expectations of a rate increase. It also highlighted another phenomenon prevalent in today’s highly automated markets: self trading.

Technology to Blame

According to the CFTC report, nearly 15% of all transactions were “wash trades” during the period in question, meaning the same person—or two people trading the same account—represented both the buyer and seller on a trade. While this is an incredibly high percentage, what is more troubling is the fact that the average daily percentage of self trading on the cash Treasury markets is nearly 6% of all volume according to the agency’s report. Even though wash trading is typically forbidden in futures markets, it is nevertheless a common occurrence as trading systems and strategies grow in complexity and capabilities.

|

| Source: Nanex |

Many exchanges have built self-match prevention measures into their matching engines, but they are an “opt-in” feature and are largely considered a blunt instrument trying to solve a more nuanced problem. Self-match prevention is also increasingly under the regulatory microscope due to its role in facilitating spoofing: the assumption goes that if a spoofer is really looking to sell, he or she can put a large bid into the market to encourage other buyers to join and then sell through the level he or she was bidding. This has the effect of creating the necessary size into which the trader can sell while relying on the exchange to safely cancel the resting bid when self-match prevention is enabled.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

I recently ran across an interesting post on EliteTrader. The author was looking for software capable of charting synthetic spreads with more than two legs such as the bund-bobl-schatz fly or crack spread. I shared my thoughts on the topic in the EliteTrader forum, but I thought the topic was compelling enough to address here on Trade Talk.

As was mentioned on EliteTrader by another member, charting a synthetic spread created from the underlying legs is not as simple as comparing the last traded price of one leg to the others or using one-minute bar data to compute the spread prices. To prevent from “charting a mirage” as the member stated in the post, we have gone out of our way to provide a better spread chart here at TT. We capture all best bid-ask market moves and traded prices, such that we look at one leg’s best bid or ask price when a trade occurs on the other leg’s bid or ask.

The above method creates an excellent synthetic spread chart, and we support up to 10 legs in a spread. The nice thing about TT is once you create the spread for trading, there is no additional work to create the spread chart. You can request the synthetic instrument and add studies and drawing tools just like a regular instrument in the chart.

Our bid-to-bid/ask-to-ask spread charts will calculate a spread price whenever there is a trade on one leg. If the trade occurs on the bid of leg one, then we will look at the bid of the other legs if they are required to sell and the ask if they are required to buy to determine the spread price. This effectively acts as getting edge on one leg with a limit fill, and the other legs going to market to complete the spread.

|

Synthetic spread charts (L) will have more data and provide more information

about how a spread moves compared to exchange traded spread charts (R). |

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

Rob Wherry, MBA student, and Michelle Golojuch, finance and accountancy major, track a stock on a Bloomberg terminal in DePaul’s Finance Lab. The virtual trading room contains the latest in high-tech trading, investing and finance software.

The statement from the Federal Open Market Committee (FOMC) meeting in January had barely been made public before DePaul University finance student Arman Hodzic saw the reaction in the markets. Hodzic watched in real time as the Standard & Poor’s 500 Index and the yield on the 10-year Treasury reacted to the news.

Traders and investors were responding to the Federal Reserve’s statements on monetary policy. Prior to the announcement, Hodzic and his partners, fellow undergraduate students Alex Netzel, Dhruvish Shah and Brendan Newell, used Trading Technologies ADL® (Algo Design Lab) to create an algorithm that would take long positions on the market and hopefully earn them virtual profits.

Hodzic and his team used specially engineered keyboard terminals created by Bloomberg L.P. to access real-time market data to see the pendulum-swinging Treasury yields and the S&P in vivid charts, graphs and numbers.

They waited patiently, watching the “iceberg” algorithm they created execute automatic trading actions. At the end of their trading they had a simulated $33,000 profit.

“The market was acting really wildly and we profited off that,” says Hodzic. He was one of about 40 students enrolled in a “Money and Banking” course who participated in the simulated trading event at DePaul on Jan. 28. They experienced firsthand how announcements by the FOMC, a Federal Reserve committee charged with setting monetary policy, can precipitate a flurry of investment and trading activity.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution, TT CampusConnect

The March-June 2015 CBOT Treasury bond futures roll is generating a lot of buzz. Most people are used to trading the Treasury calendar spreads 1:1, and the current roll is trading 3:2. How is this possible? The 1:1 was so easy to calculate in your head, and now they say you have to trade it 3:2?

The five-year gap

Between early 2001 and early 2006, the U.S. Treasury did not issue any Treasury bonds. Nine years later, that gap comes into play because now there is a single issuance, stranded at the front-end of the delivery basket, that would have been eligible for delivery. In December 2013, CME Group announced that it would exclude the 5-⅜ percent of February 2031 U.S. Treasury bond from the contract grade for the delivery months June 2015, September 2015 and December 2015.

So what does that have to do with the 1:1 calendar spread? The removal of the single issuance makes June’s delivery basket, on average, five years longer in maturity than March’s. More importantly, the dollar value of a basis point (DV01) for the June contract is roughly 50 percent larger than that of March’s. In other words, for every two-tick move in the March contract, the June contract will move approximately three ticks. In order to compensate for that difference in value, one should only buy two June contracts for every three March contracts that he/she sells.

Price can be very misleading

In addition to the yield of a bond, the coupon rate and time to maturity are the biggest factors that determine price and hedge ratios. While yield relationships are relatively stable, the coupon and maturity can vary greatly from instrument to instrument. Even if the proper ratio for a bond spread was 1:1 (and that’s a big if because the ratio is not static and rarely even), the price difference is just a number. A decent sized move in both contracts could easily result in the same yield spread we started with, but a wildly different price spread. When dealing with weighted spreads like the 3:2 March-June bond spread, keeping track of the weighted price differential while trying to stay properly hedged can be an arduous task. (Note the current ratio of the March-June spread is actually 305:200 at present, making this even more difficult.)

In just the last six weeks, the “properly” weighted March-June bond spread has had a price differential with a range of 3-½ bond points or 112 ticks.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution