← Back to Trade Talk Blog

TT received multiple awards last week in New York, including

the HFM award for “Best Trading and Execution Technology.”

Well no, TT did not win anything at the Grammys. We did, however, take home both “Best Trading and Execution Technology” at the HFM U.S. Technology Awards and “Best Overall Technology” at the CTA U.S. Services Awards.

The CTA Intelligence Services Awards honor firms that have provided outstanding support and services to the North American managed futures industry, while the HFM U.S. Technology Awards recognize hedge fund technology providers that have demonstrated exceptional customer service and innovative product development.

“Given the strength of the contestants, it is quite an accomplishment for Trading Technologies to earn honors in both the HFM and CTA awards. With unique features like MultiBroker, order passing and ADL, TT’s X_TRADER platform gives traders a combination of flexibility and power that makes it a top technology offering for both CTAs and hedge fund managers,” said Matt Smith, head of content for CTA Intelligence. This sentiment was echoed by Chris Matthews, HFMWeek technology correspondent.

It’s great to know that hedge funds and CTAs find our X_TRADER® trading solution to be so compelling, but what’s coming with our next-generation TT platform is even more exciting.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

|

| Figure 1: TT Analytics in ADL. |

With the release of X_TRADER® 7.17.40, TT introduced a new feature in ADL® named TT Analytics. This feature uses a single block that brings a historical data solution to ADL along with a suite of technical indicators. It provides almost every value found in an X_STUDY® chart to your server-side algo. In this blog post, I will introduce the block while demonstrating how to find some important trading reference points.

The TT Analytics Block can be found under Misc. Blocks on the left side of the ADL Designer Window. You simply drag this block onto the canvas and double click it to expose the properties page. If you’re an X_STUDY user, the properties page will look familiar to you. Here you can add technical indicators and expose bar values such as open, high, low and close.

Figure 1 above shows the block with open, high, low, close and VWAP for the current daily bar of the December ES market. It also shows the Bollinger Bands technical indicator added to the block.

Next, you add an Instrument block to the TT Analytics Block from within the properties page and define the type of bar data you want returned. Once this is complete, you can go in either of two different directions: you can add a technical indicator to the block or expose more bar data.

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

|

Look for the hashtag #TTturns20 on Twitter

for more about our milestone anniversary. |

Today, as we celebrate 20 years of building trading software for our customers, I thought it was worth a look back at how the industry, and subsequently TT, has evolved over the past two decades and take a look at what’s ahead for our customers and TT.

On this date 20 years ago, we were founded in Frankfurt, Germany when nearly all trading on futures markets was conducted via open outcry. Access was extremely limited, and the ability for people to realize the benefits of listed futures, namely accurate price discovery and risk management, was limited to a select few.

When TT made Chicago its home a few years later, the floors of the Chicago Board of Trade and Chicago Mercantile Exchange roared. But as the trading community got comfortable with the concept of electronic trading, volume began to gradually migrate to the screen. A product we released in those early days, MD Trader®, had a huge impact because it was a radically different way to interface with the electronic market. It gave traders the ability to see and interact with the market with a level of confidence they hadn’t seen before and, in many ways, went hand-in-hand with the dramatic migration of volume to “the screens.”

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution, TT CampusConnect

Have you ever wanted to buy something in one location to sell it in another location at a higher price? Imagine buying gold on CME only to turn around and sell it on TOCOM at a higher price. This type of trade is known as geographical arbitrage.

While there is risk in every trade, geographical arbitrage is relatively low risk. The faster you can execute and the more alike the underlying products, the better the arb. Gold as an underlying makes for an almost perfect hedge, as the gold quality is identical. This is not true for most other commodities.

One major factor here is the two products are priced in different currencies. A currency conversion is required, and this conversion value is not static like some other conversion factors used for spreading. For example, in this spread, I will use a static conversion of 1 kilogram equal to approximately 32.15 troy ounces. This value will not change during my arb, but the dollar-to-yen ratio will.

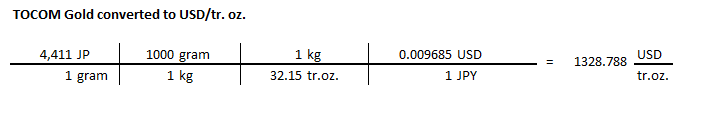

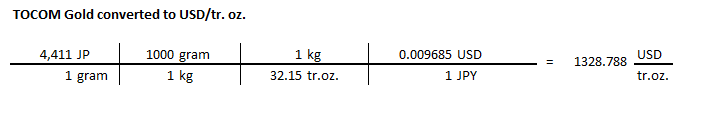

Let’s begin by calculating how to set up this trade. I will convert the yen-to-dollar using 6J on CME and grams to troy ounces. Below is a table that shows this conversion to get TOCOM gold priced in U.S. dollars and troy ounces.

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

I was amused by the recent flurry of media releases proclaiming the adoption of algorithmic trading in derivatives markets. Pay no attention to the man behind the curtain, could this be important new information that somehow leads us to enlightened trading? Or is it the case there is nothing more deceptive than an obvious fact? The latter are the words of one well-known sleuth, whose Watson would likely retort, “No kidding, Sherlock,” or something roughly comparable.

|

| The infamous Sherlock Holmes |

Avoiding the temptation to offer my own breaking insights, such as The Internet is here to stay! and Mobile communications expected to take off!, I will instead stay the high road, eschewing mirthful gratification for the sake of propriety. As our sleuth would advise, if you eliminate all other factors, the one which remains must be the truth: while other vendors are merely talking about algo trading in derivatives, Trading Technologies has been delivering for several years. I am therefore tickled pink that other vendors are now “discovering” this space. The algos are not missing, they are here. In production. Today.

One of TT’s first algorithmic solutions was our hosted Autospreader® Strategy Engine (SE), which is a very-low-latency computational server for executing synthetic spread algorithms such as calendar rolls, synthetic strips, butterflies and condors. Recent enhancements to this system include intuitive rule building for customized handling of pre- and post-trade hedging, as well as conditional participation and synthetic sniper spreads.

The Autospreader SE product is complemented by TT’s Synthetic Strategy Engine, another proximity-hosted server that provides a suite of algorithmic order types, including synthetic icebergs, TWAP, POV and triggered algos such as stops and if-touched orders.

Continue Reading →

Tags: Algos & Spread Trading, APIs, Trade Execution