← Back to Trade Talk Blog

When we were in the early stages of developing the new TT platform, we were often asked if we thought our customers would resist moving to an HTML5-based trading system that leveraged the cloud. Given that the financial services industry has generally been slow to adopt multi-tenant cloud-based services, it seemed like a fair question—and one that we were prepared to address and overcome.

While we’ve certainly faced questions about the new system, we’ve seen almost no resistance to the technologies on which it is built. Our customers, including many global banks, recognize that the cloud along with the software-as-a-service (SaaS) delivery model will deliver faster client onboarding, reduced IT support requirements, lower costs and unprecedented ease of use along with low-latency execution via private, proximity-hosted data centers and co-located execution facilities.

We recently showed the TT platform to TABB Group’s Paul Rowady, who was enthusiastic about the hybrid architecture. He published his initial thoughts in “Next-Gen Cloud: Bifurcation Becomes Trifurcation,” asserting that “firms increasingly must adopt proprietary plus multi-tenancy infrastructure configurations, in which infrastructure includes not just internal and external (cloud) components, but further places assets in locations that match the desired performance.”

Continue Reading →

Tags: Trade Execution

|

| Figure 1: TT Analytics in ADL. |

With the release of X_TRADER® 7.17.40, TT introduced a new feature in ADL® named TT Analytics. This feature uses a single block that brings a historical data solution to ADL along with a suite of technical indicators. It provides almost every value found in an X_STUDY® chart to your server-side algo. In this blog post, I will introduce the block while demonstrating how to find some important trading reference points.

The TT Analytics Block can be found under Misc. Blocks on the left side of the ADL Designer Window. You simply drag this block onto the canvas and double click it to expose the properties page. If you’re an X_STUDY user, the properties page will look familiar to you. Here you can add technical indicators and expose bar values such as open, high, low and close.

Figure 1 above shows the block with open, high, low, close and VWAP for the current daily bar of the December ES market. It also shows the Bollinger Bands technical indicator added to the block.

Next, you add an Instrument block to the TT Analytics Block from within the properties page and define the type of bar data you want returned. Once this is complete, you can go in either of two different directions: you can add a technical indicator to the block or expose more bar data.

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

|

Look for the hashtag #TTturns20 on Twitter

for more about our milestone anniversary. |

Today, as we celebrate 20 years of building trading software for our customers, I thought it was worth a look back at how the industry, and subsequently TT, has evolved over the past two decades and take a look at what’s ahead for our customers and TT.

On this date 20 years ago, we were founded in Frankfurt, Germany when nearly all trading on futures markets was conducted via open outcry. Access was extremely limited, and the ability for people to realize the benefits of listed futures, namely accurate price discovery and risk management, was limited to a select few.

When TT made Chicago its home a few years later, the floors of the Chicago Board of Trade and Chicago Mercantile Exchange roared. But as the trading community got comfortable with the concept of electronic trading, volume began to gradually migrate to the screen. A product we released in those early days, MD Trader®, had a huge impact because it was a radically different way to interface with the electronic market. It gave traders the ability to see and interact with the market with a level of confidence they hadn’t seen before and, in many ways, went hand-in-hand with the dramatic migration of volume to “the screens.”

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution, TT CampusConnect

Have you ever wanted to buy something in one location to sell it in another location at a higher price? Imagine buying gold on CME only to turn around and sell it on TOCOM at a higher price. This type of trade is known as geographical arbitrage.

While there is risk in every trade, geographical arbitrage is relatively low risk. The faster you can execute and the more alike the underlying products, the better the arb. Gold as an underlying makes for an almost perfect hedge, as the gold quality is identical. This is not true for most other commodities.

One major factor here is the two products are priced in different currencies. A currency conversion is required, and this conversion value is not static like some other conversion factors used for spreading. For example, in this spread, I will use a static conversion of 1 kilogram equal to approximately 32.15 troy ounces. This value will not change during my arb, but the dollar-to-yen ratio will.

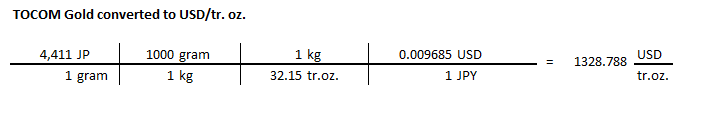

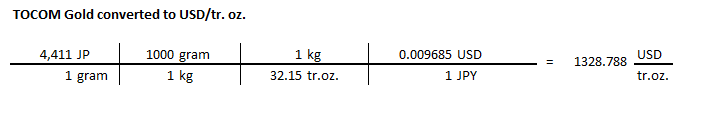

Let’s begin by calculating how to set up this trade. I will convert the yen-to-dollar using 6J on CME and grams to troy ounces. Below is a table that shows this conversion to get TOCOM gold priced in U.S. dollars and troy ounces.

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

As part of writing this blog describing TT’s new order passing functionality, I went to the Internet, curious to see how the trusty Merriam-Webster dictionary defines the word “pass.”

Not surprisingly, most of the definitions are unrelated to passing an order, and you have to go all the way down to the seventh entry to find a definition that even closely aligns with the trading world:

“Pass: (7) to go from the control, ownership, or possession of one person or group to that of another <the throne passed to the king’s son>…”

While passing an order to another user or execution desk does involve the concepts of ownership and control, for complete accuracy I have to admit (with tongue in cheek) that order passing is just slightly different from the succession process in a monarchy.

Continue Reading →

Tags: Trade Execution